- Recovering Ethereum prices is ready to challenge a basic level of resistance to $ 3,740 amid the formation of a flag plan.

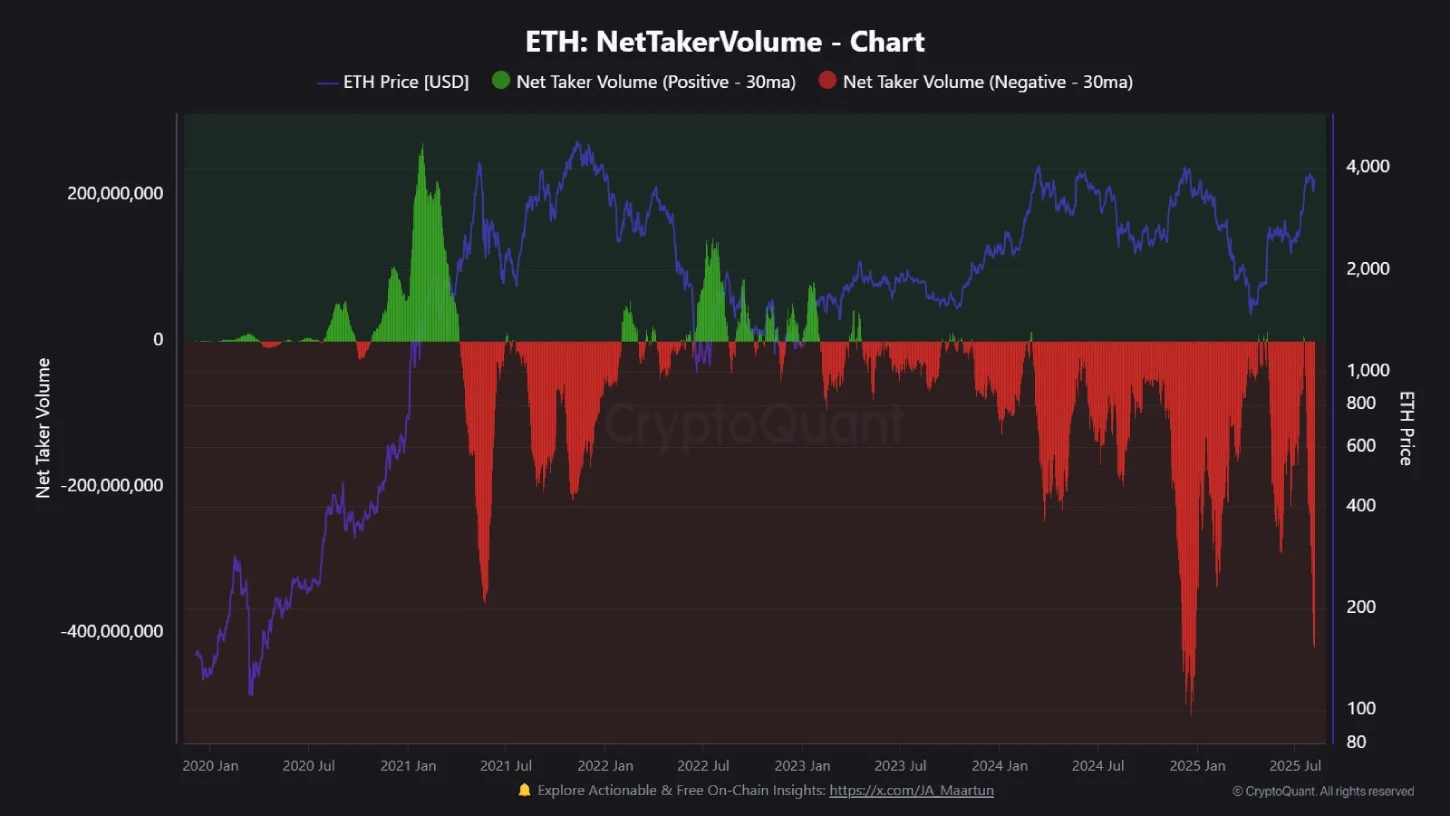

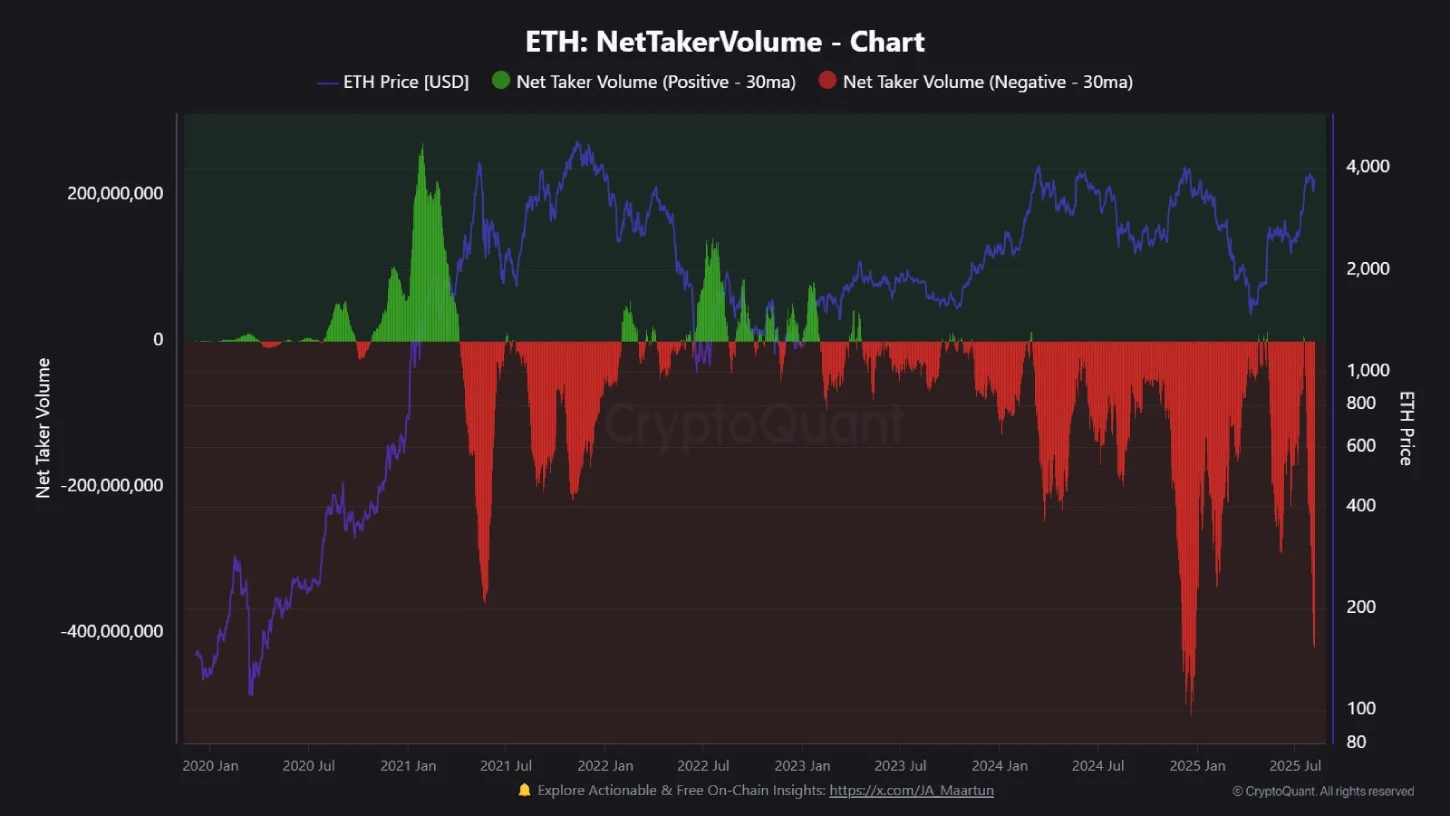

- The net volume of ETH’s ETH sank into the negative area, indicating the aggressive market pressure on the market.

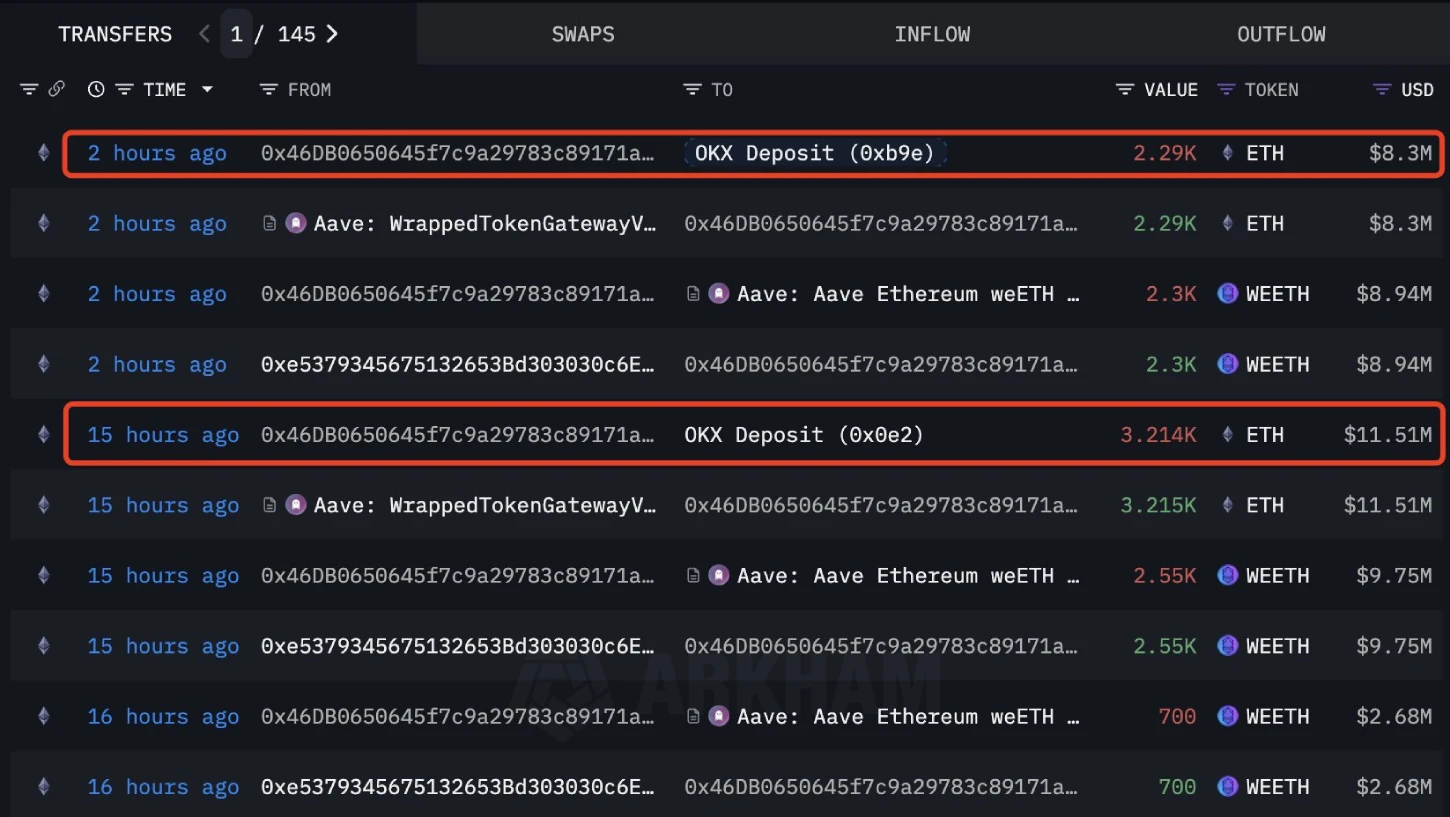

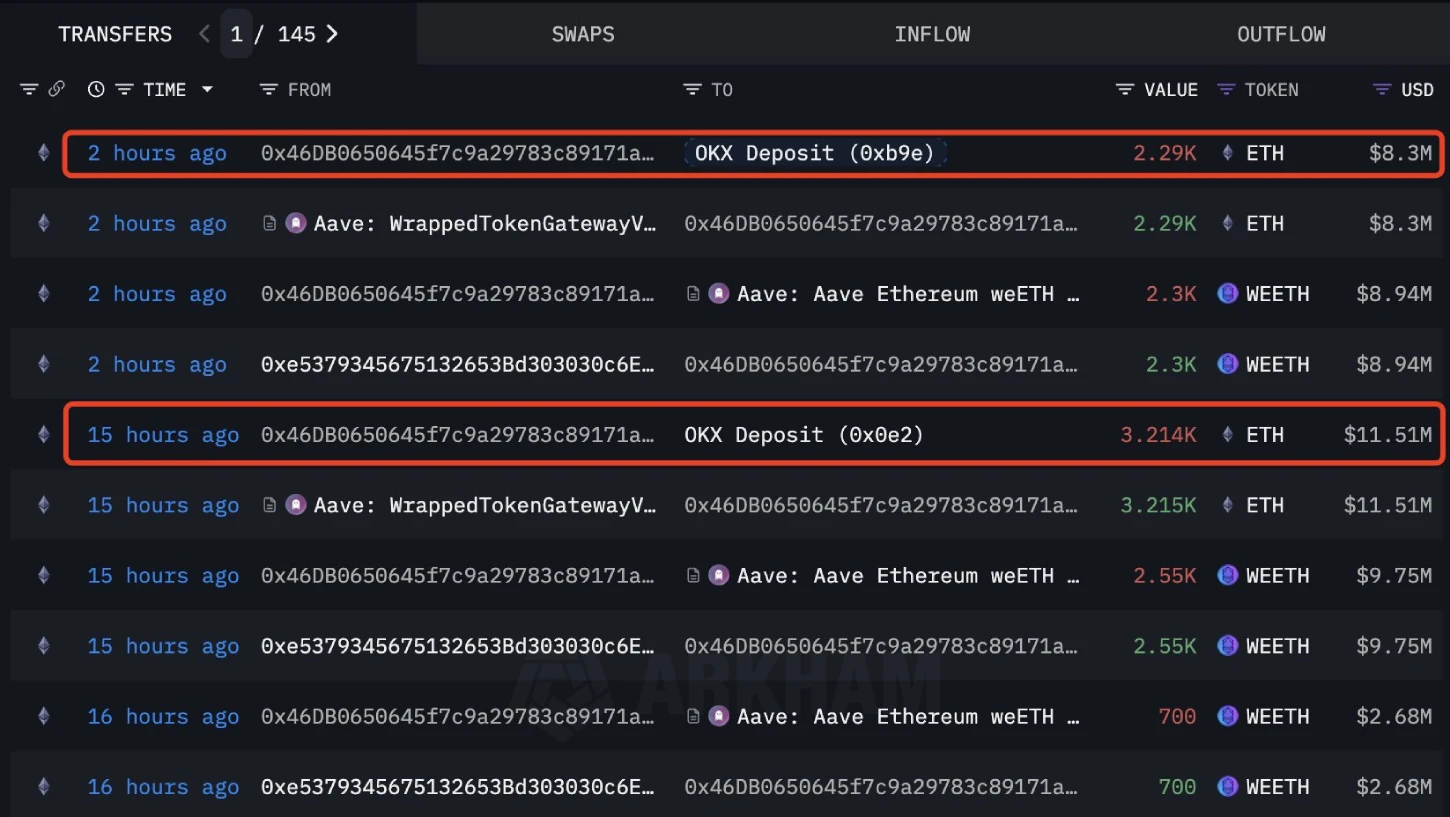

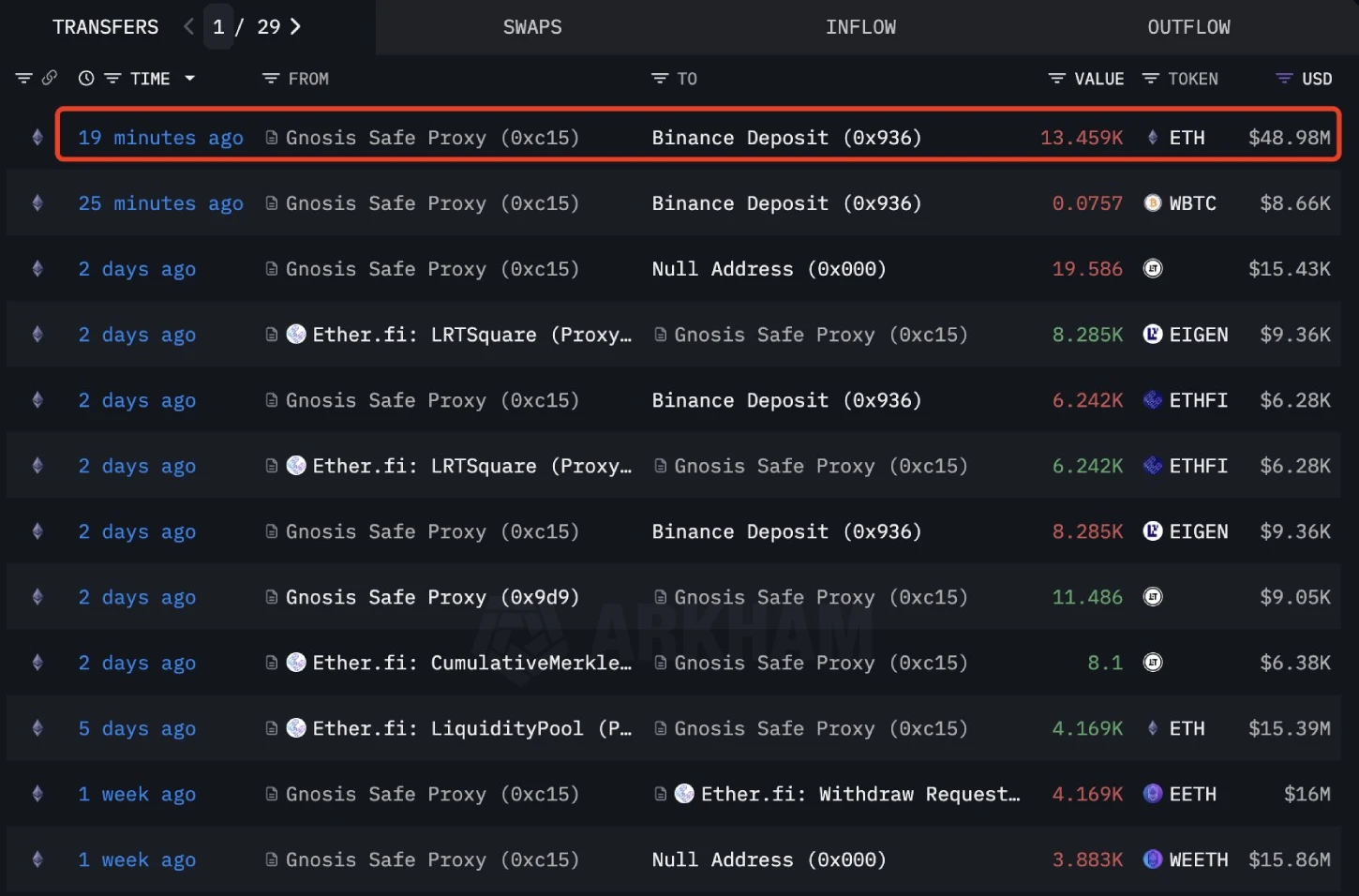

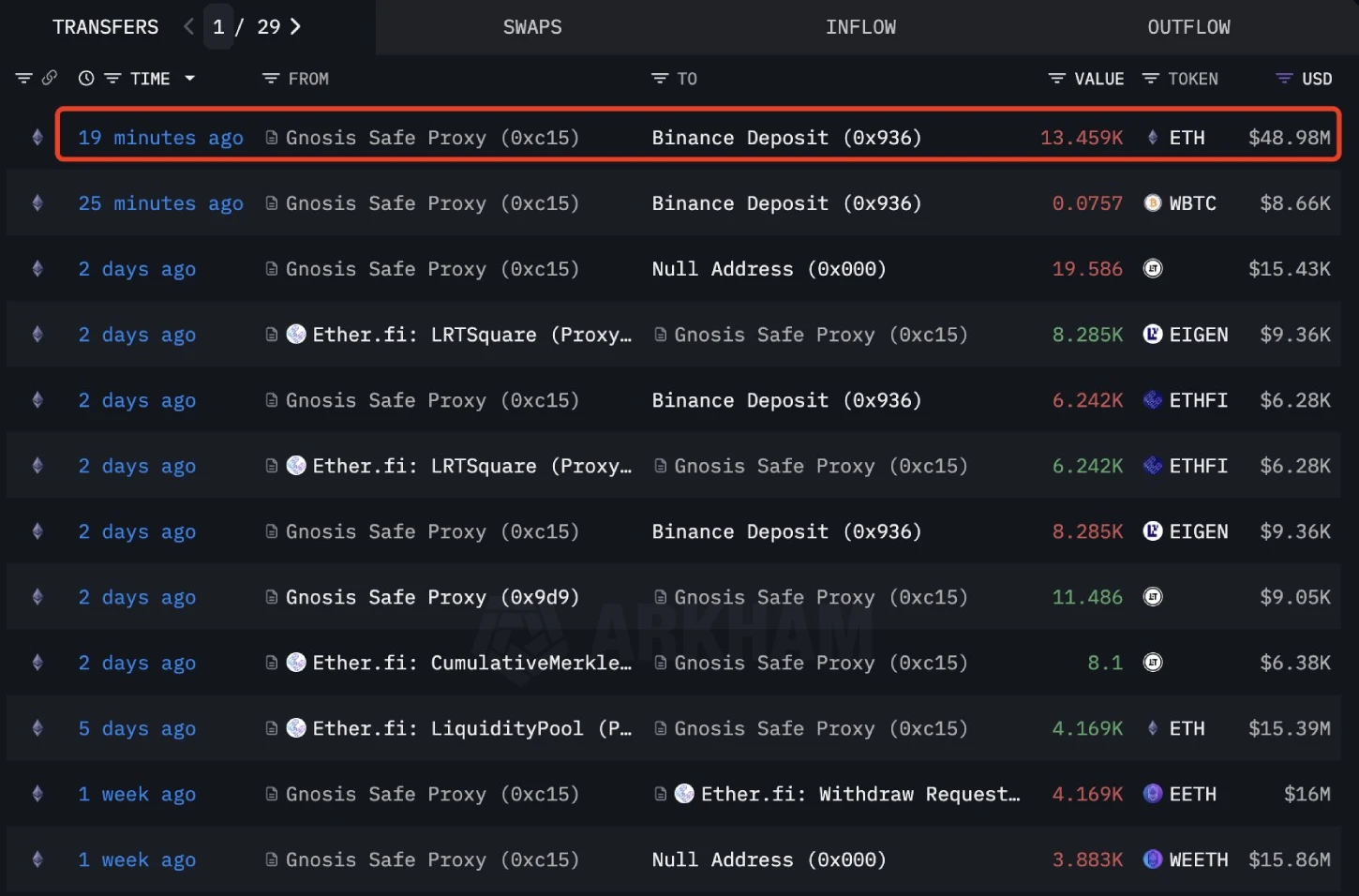

- Lookonchain data reveals that falain cryptographic wallets have carried the Ethereum worth millions of dollars to encryption exchanges.

ETH, the inherent encryption of the smart Giant Ethereum contract, records a 1.75% jump during US market hours. With the intra -business increase, the price of Ethereum is likely to challenge a basic resistance zone of $ 3,740, signaling a level of rotation for the asset to determine its next move. However, the data in the chain emphasizes that whales and retail traders are rushing to get out of the market, enhancing the price of sales in price. Is it a distribution under $ 3,500?

Negative volume and sale of pure recipient whales indicate deeper ETH correction

In the last two weeks, the price of Ethereum has shown a brief correction of $ 3,940 at the current $ 3,684 trading price, showing a loss of 6.5%. Pullback started with a broader market feeling for a Rall correction, but bears won additional impulse amidst aggressive sale from market participants.

In a recent post, market analyst Market He emphasized that the net volume of the ETH recipient is deeply submerged into negative territory, currently located at $ 418.8 million. This measurement highlights the inequality between aggressive buyers and sellers on the market, who prefer quick purchase orders for waiting for marginal orders.

When the net volume of the recipient observes negatively, it indicates that the sellers are currently the aggressive force in the markets, usually a precursor to the possible AA recession. According to encryption data, Taker sellers have unloaded 104.3k more ETH coins than buyers are willing to absorb.

Sudden inequality suggests that participants prioritize the speed of execution at proper prices exit, resembling panic sale. If the tendency persists, Ethereum’s short -term prospects will continue to remain under pressure, as the sellers’ influence is dominated.

Add to Bearish Note, Blockchain Tracker Look It reveals a remarkable sale pressure from high network investors in today’s market.

Earlier today, a 0x46dB encryption wallet deposited 5,504 ETH worth about $ 19.89 million in OKX exchange.

In addition, another wallet, 0xC156, deposited 13,459 ETH (worth about $ 49 million) in the binance exchange just 20 minutes before reporting.

Historically, a phase of distribution from cryptographic whales is often accompanied by a significant market correction and continues to correct the price.

Also read: Metamask, Stripe is preparing to start Stablecoin “MMUSD”

Ethereum’s price is at a shift level of a flag plan

The continued correction voltage at the price of Ethereum found temporary bottom at the level of $ 3,365 before driving a sharp invert. The upward trend has pushed 9.3% in the last 4 days to negotiate today at $ 3,673. If the renewed recovery insists, buyers could challenge a basic confluence of the horizontal level of resistance and the downsloping of the flag motif at $ 3,740.

A possible unblocking under this obstacle will accelerate market momentum and boost the price for an initial increase to $ 4,150.

On the contrary, the current market uncertainty and the increase in whales and retail traders signify the risk of possible reversal. If the currency price shows a renewed sale pressure of $ 3,740, sellers could push for a prolonged downward trend below $ 3,537 and $ 3,365 support.

Also Read: Solana Price Signals 7% More Pain as Bulls lose control of basic support