Financial services is by far the most owned sector among retail investors, according to data from the latest Retail Investor Beat (RIB) from trading and investment platform eToro.

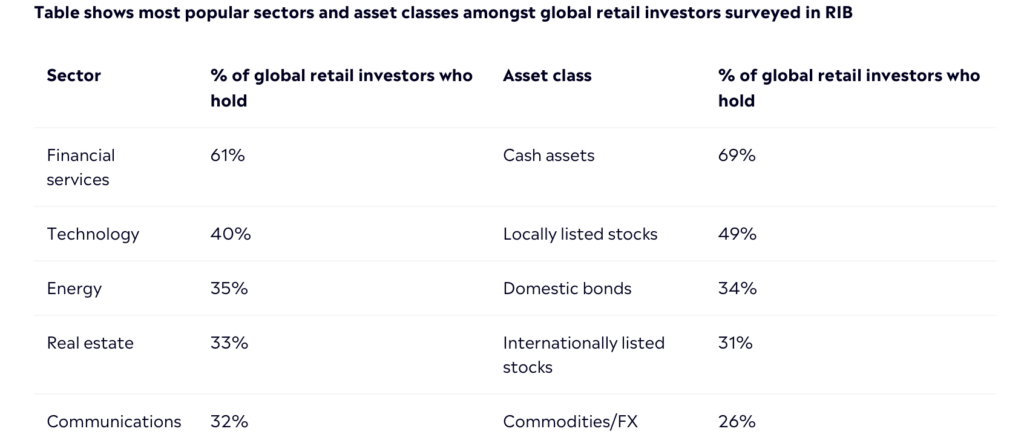

In the study of 10,000 retail investors in 12 countries, 61% say they own financial services stocks, with technology the second most-held sector at 40% and energy third at 35%. All three sectors have rallied over the past 18 months with energy and technology stocks outperforming and financial services stocks expected to gain momentum as the world’s second largest and one of the cheapest industries benefits from a combination of lower interest rates and stronger loan growth.

The average retail investor’s portfolio is also likely to include cash, with 69% of investors holding cash such as savings accounts, while stocks listed in an investor’s local market rank second (49%) among asset classes, followed by domestic bonds (34% ). The popularity of cash assets continued to grow this year according to RIB data, as high risk-free savings rates of 5% were widely available in many major economies.

When retail investors at the RIB were asked which sector they were most likely to increase their investment in, technology and financial services once again topped the list, chosen by 18% and 12% of respondents respectively, followed by a diversified mix of real estate (9%), healthcare (8%) and energy (8%).

Among asset classes, crypto is seen as the biggest opportunity, with 15% of investors saying they would prioritize the world’s top-performing asset class over others. This was followed by cash (14%), local stocks (13%), internationally listed stocks (9%), commodities (8%), domestic bonds (7%), foreign exchange (5%), alternative investments (4%) and foreign bonds (4%).

Commenting on the data, eToro analyst Sam North says:

“While markets have continued to deliver for investors in 2024, the widespread availability of highly attractive savings rates means that cash will remain the dominant asset class among global retail investors, at least for a few more months. However, with the ECB recently cutting interest rates and other major central banks expected to follow soon, the scales will soon tip more in favor of equities and other asset classes such as real estate.

“The average global retail investor is also well positioned for a potentially strong period for financial services companies, with this sector by far the most common feature of investor portfolios around the world. What the data also showed is that, despite the rapid globalization of financial markets in recent years, there is still a strong bias towards locally listed stocks.”

The data show a significant divergence of investment intentions when looking at private investors from different countries. In the UK, for example, one in four (25%) investors say they will prioritize cash over any other asset class in the coming months, ahead of crypto (11%), local shares (8%) and international stocks (10). %). A similar trend is evident in the US and France, while in Germany and Spain it is the opposite, with cryptocurrencies at the top and cash in third place in terms of investment intentions.

This trend strikes a chord with crypto ownership in these countries. In Spain and Germany, 38% and 32% of retail investors own crypto, respectively. This drops to 25% in the UK and 27% in the US.

North adds:

“We are seeing a real disparity globally in terms of the asset classes that investors plan to prioritize in the coming months. This may be partly due to the attractiveness of savings rates in different countries. In the UK and US, for example, where savers can still secure interest rates above 5%, this asset class remains the priority. However, in Germany and the Netherlands, where savers are unlikely to get as much as 4%, crypto and stocks are the focus.”

The latest Retail Investor Beat was based on a survey of 10,000 retail investors in 12 countries and 3 continents. The following countries had 1,000 respondents: UK, USA, Germany, France, Australia, Italy and Spain. The following countries had 600 respondents: the Netherlands, Denmark, Poland, Romania and the Czech Republic.

The survey was conducted from May 15 to June 5, 2024 and was conducted by research firm Opinium. Retail investors were defined as self-directed or advised and had to hold at least one investment product, including shares, bonds, funds, investment ISAs or equivalent. They didn’t have to be eToro users.