The pan-European market infrastructure Euronext today published its results for the fourth quarter and full year 2023.

Foreign exchange revenue was flat at €6.7 million in the final quarter of 2023, as higher volumes were offset by the impact of foreign exchange. On a constant currency basis, FX trading revenue was up 4.8% compared to Q4 2022.

Foreign exchange revenue was €25.6 million in 2023, down 10.0% compared to record performance in 2022. This decline reflects lower volatility in the first three quarters of the year and the negative impact of foreign exchange.

In constant currency, FX trading revenue fell 7.8% in 2023 compared to 2022.

In the 4th quarter of 2023, Euronext’s revenue and income reached €374.1 million, up 7.8% compared to the fourth quarter of 2022, driven by record performance in fixed income trading, strong results in non-volume businesses and the positive contribution of the European expansion of Euronext Clearing at the end of November 2023.

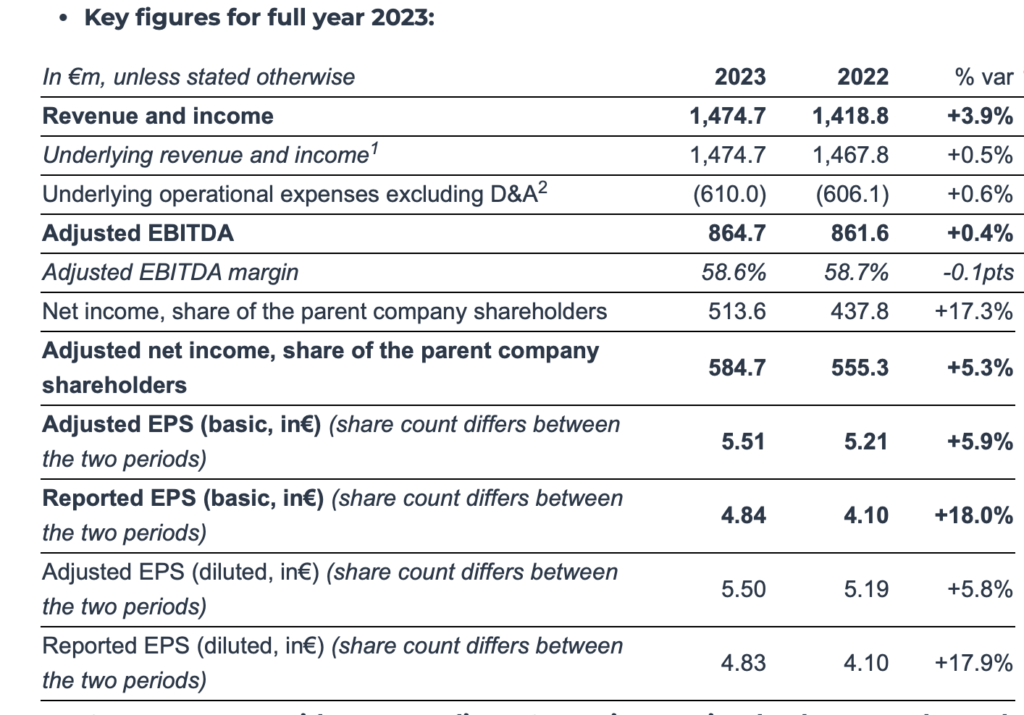

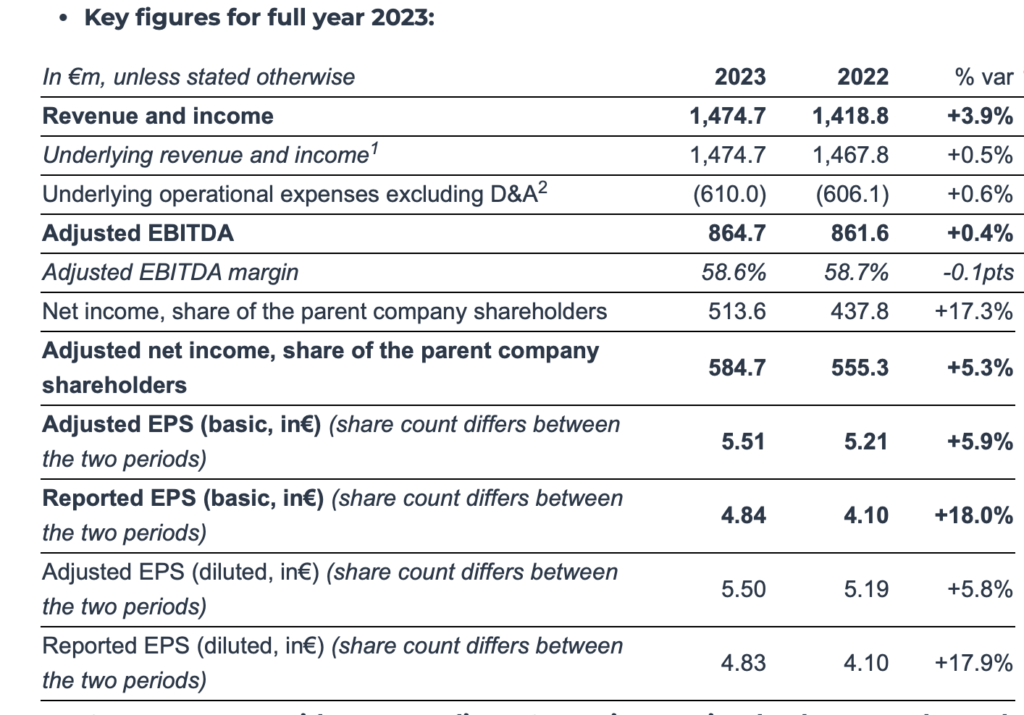

In 2023, Euronext’s underlying revenues and income were €1,474.7 million, up 0.5% compared to 2022, as a result of strong performance in non-volume activities, offsetting the softer trading environment in cash and negative effects from NOK depreciation during the year. Total 2023 revenue and income increased by 3.9%, reflecting the 3rd quarter 2022 one-off loss in net inventory income related to the partial disposal of the Euronext clearing portfolio.

On a like-for-like basis and in constant currencies, Euronext’s consolidated revenues and revenues increased by 1.6% in 2023 to €1,469.7 million, compared to 2022.

A dividend of €256.8 million will be proposed at the Annual General Meeting on May 15, 2024. This represents 50% of reported net income for 2023, in accordance with Euronext’s dividend policy. Based on the number of shares outstanding at the end of 2023, this represents a dividend of €2.48 per share, up 11.7% compared to 2022.