Exclusive FNG… After a stellar 2024 that saw a redefinition of professional customers, the FCA Redgaled Black Pearl Securities Limited, which takes advantage of the BP Prime Online Trading brand, has seen a great fate of Fy2025.

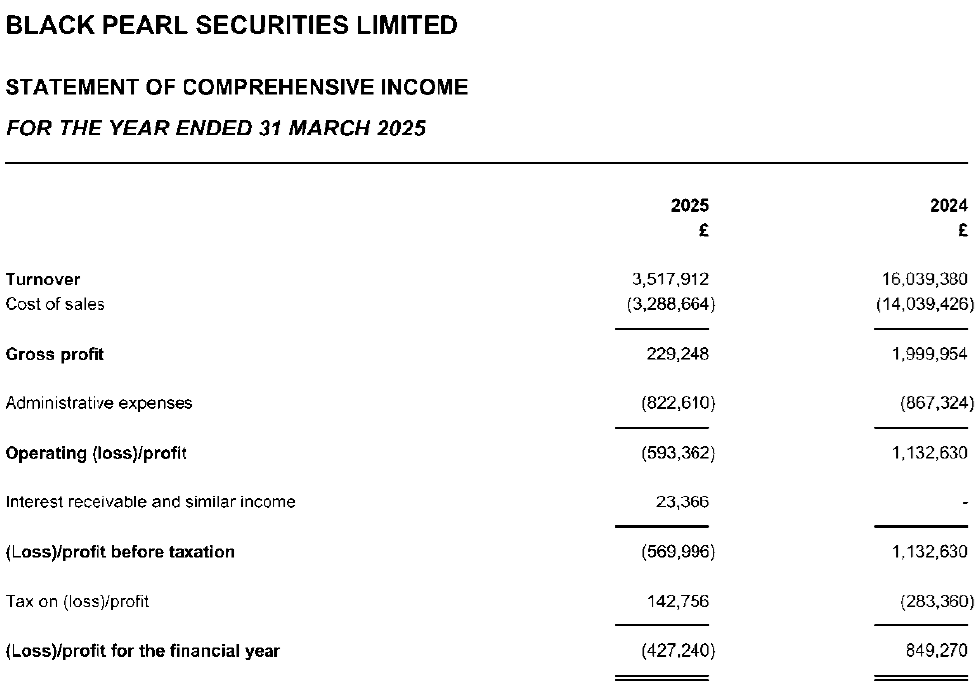

FNG has learned through regulatory deposits that BP Prime has dropped 78% on revenue in 2025 (year end on March 31), with BP Prime revenue entering £ 3.5 million, compared to £ 16.0 million last year. The net profit of FY2024 £ 849k turned into a net loss of £ 427k FY2025.

Explaining the change from 2024 to 2025, BP Prime said that the turnover was substantially reduced during the year due to the loss of several basic customers and led the company to cause damage. The retail product watched a reduction in account applications and the subsequent reduction in profit levy. CFD sectors, professionals and retail customers remain highly competitive in the market.

At the end of the year, the BP Prime had net assets of £ 1,827,010 (2024: £ 2,254.250).

BP Prime underwent a review in 2024, rejuvenating its logo and launching a new site (BPPRime.com).

During FY2025 BP Prime Managing Director Zuzana Hashemi resigned and abandoned the company, as reported exclusively at that time here at FNG. Zuzana is now chief executive of Goldstone Group, also owned by BP Prime Controlring shareholders Vladimir Gesperik, who takes advantage of several brands on the internet, including Goldstone, FXGSS and GS securities.

Black pearls and BP Prime are controlled by Vladimir Gesperik, a Slovak businessman who now lives in the UAE. Mr. Gesperik also operates offshore (Labuan) CFDS Golden Brokers.

The BP Prime Prime results account status is followed below.