Exclusive FNG… FNG has learned through regulatory filings that FCA regulator Black Pearl Securities Limited, which operates online trading brand BP Prime, has seen a huge, almost sevenfold increase in revenue in the 2024 financial year (year ending March 31 ), as the company rebranded and refocused on institutional and professional clients.

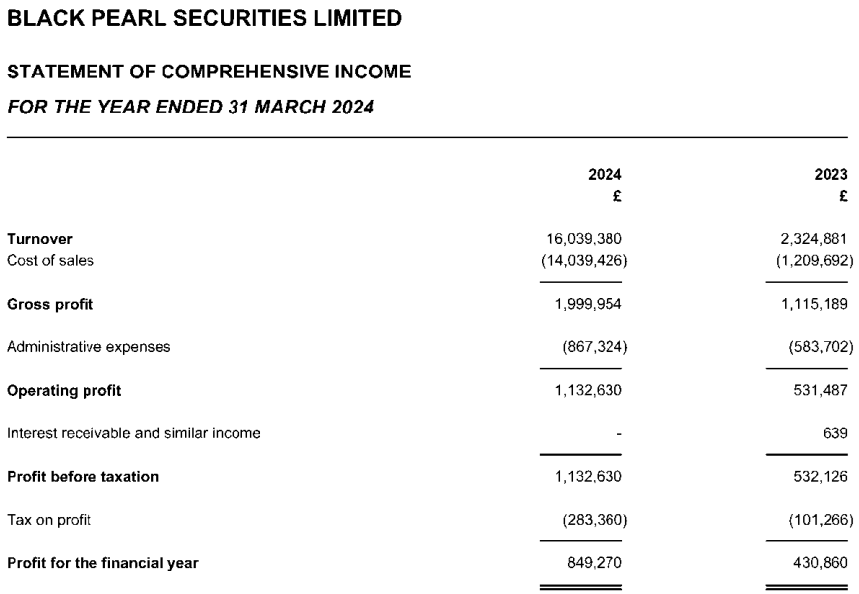

BP Prime revenue was £16.0m in 2024, up 590% from £2.3m. Net profit for 2024 was £849,000, roughly double 2023’s £430,000.

The company said its institutional product offering to regulated entities and professional clients was mainly responsible for the increase in income. The retail product saw a decline in account applications and a consequent decline in profit contribution. Both areas. professional and retail, remain highly competitive in the market. BP Prime underwent a rebrand during the year, revamping its logo and launching a new website (bpprime.com).

As for future developments, BP Prime said it continues to look for opportunities both in the UK and overseas. The company continues to market its core product to regulated institutional customers and is optimistic about success. The company is also looking to revitalize its retail product in China with the introduction of a new CRM, local website and region-specific payment gateways.

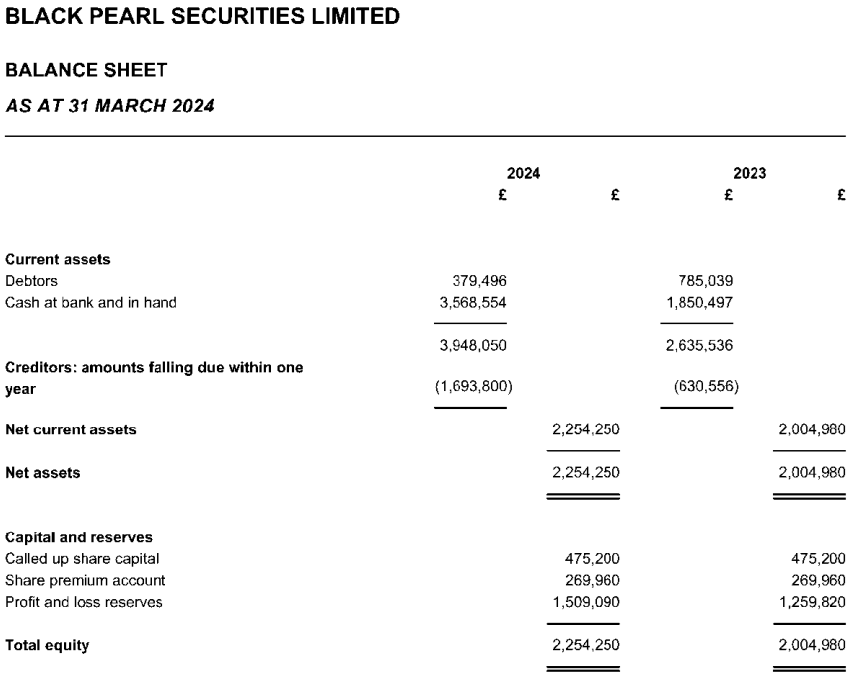

At 31 March 2024, the amounts held by the firm on behalf of clients under the Financial Conduct Authority’s Client Assets Rules amounted to £2,181,447 (2023: £1,651,589).

Black Pearl Securities and BP Prime are controlled by Vladimir Gesperik, a Slovakian businessman who now resides in the United Arab Emirates. Mr. Gesperik also operates offshore (Labuan) CFDs broker Golden Brokers.

Below is BP Prime’s income statement and balance sheet for the 2024 financial year.