Exclusive FNG… FNG has learned through regulatory filings that FCA-licensed institutional broker YCM Invest has seen its Revenue fall by more than two-thirds in 2022 as the firm rebranded from Finotec to its new name, YCM Invest. (The group’s corporate name was similarly changed, from Finotec Trading UK Limited to YCM-Invest Ltd.)

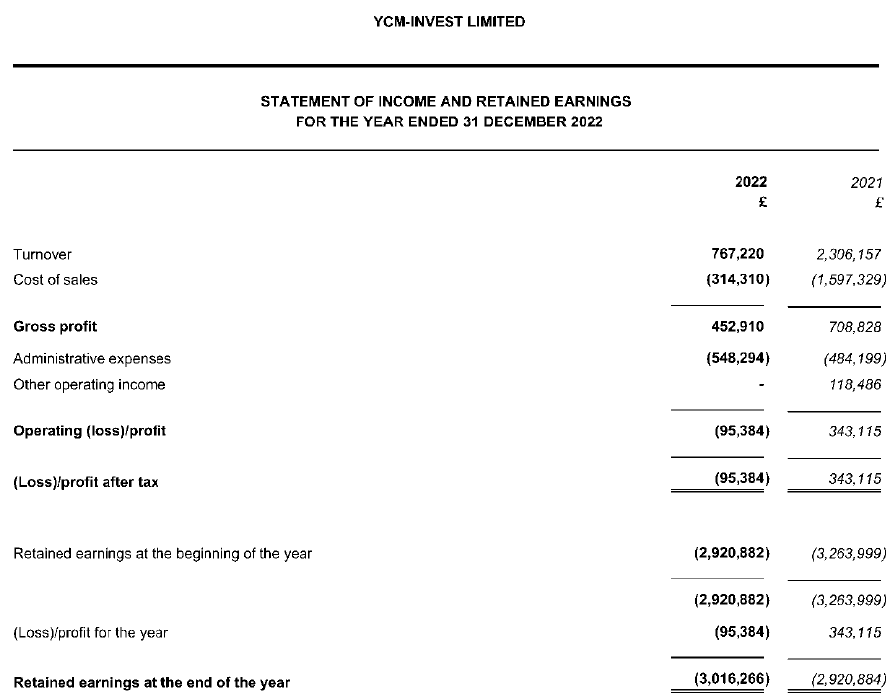

YCM Invest’s revenue was just £767,220 in 2022, down from £2.3m the year before, when the company was still known as Finotec. YCM Invest posted a Net Loss of £0.1M for 2022, compared to a Net Profit of £343K in 2021.

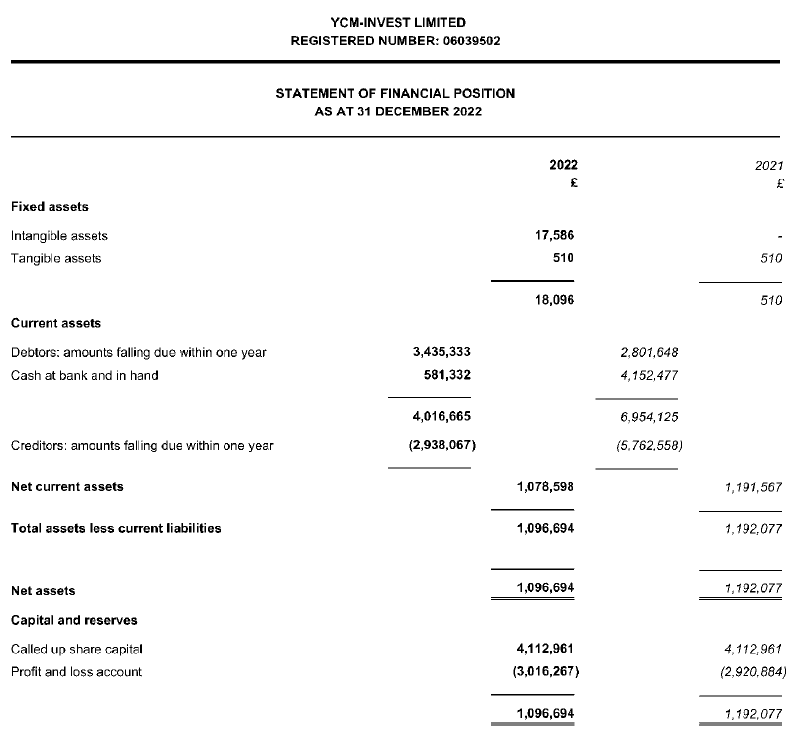

On a cash flow basis, YCM Invest recorded an Operating Activities cash outflow of £3.5m in 2022. As a result, the company’s cash levels fell from £4.15m at the end of 2021 to just £581,332 in 2022.

YCM Invest is controlled by its long-time managing director, Didier Essemini.

YCM Invest describes itself as a long-established financial services brokerage and investment management firm, operating an execution-only trading platform specializing in OTC trading venues and exchanges. The company’s target market is that of Professional Traders, Asset Managers and Hedge Fund Operators. Its service mainly consists of the integration of multiple sources of liquidity offered through API connections.

YCM Invest provides a wide range of personalized services to its clients, as well as the tools and systems required to set up and run an FX Business. Since 2008, YCM Invest has operated a Matched Principal business model, ensuring that its interests are always aligned with those of its clients. This decision was based on the realization that its own earning potential shares a strong correlation with the Lifetime Value of its customers. and to foster a strong sense of success from its customers, it should match its customers’ orders with the market, thereby eliminating any potential conflict of interest.

YCM Invest offers execution and settlement solutions, as well as ancillary technology and investment management solutions to professional Traders & Brokers, Investors, Asset Managers and Hedge Fund Operators. The company carries out clean services on board or serves retail customers.

The core of YCM Invest’s strategy is that it is a service-based, non-risk-taking business. As a liquidity consolidator, YCM Invest is able to eliminate one of the most important risks facing its business. providing connectivity from a wide selection of liquidity providers, rather than direct connection to a less wide selection.

This direction supports and facilitates:

- Confidence that customers can access the best available rates at all times.

- Continuity of service in the event of an interruption to any liquidity provider or connection.

YCM Invest said it mitigates the risk of being dependent on active clients by selectively negotiating minimum monthly volume fees, as well as monthly technology and/or service fees. These fees act as a source of fixed income for the Company and are generated regardless of whether the customer has been sufficiently active during a given period.

In addition, YCM Invest’s direct cost base is highly variable, which translates into a proportional reduction in cost base should the Company experience a decline in volume-based revenue, which it did during 2022. Fixed assets generally YCM Invest’s expenses are equally considered, with a relatively modest footprint for its size and scale, and in line with its position to avoid unnecessary risks.

On the investment management side, YCM Invest operates managed accounts, some of which trade using algorithms produced by its parent company, Yedidya Capital Markets, which is a private company incorporated in Israel. Yedidya Capital Markets continues to develop its risk management software with additional layers of artificial intelligence. The intention is to further improve the algorithm’s decision-based self-learning engine to better predict the impact of low volatility on the market.

YCM Invest now offers a new type of managed account for investors, where investors’ funds are allocated to the Portfolio Manager accounts of high-performing traders who trade using YCM Invest’s brokerage services. The company uses an IP that reproduces and calculates “live” historical, daily statistics of all traders trading on the YCM Invest platform, with a special focus on downside statistics to better assess the risk a particular trader is ready to take. receive in order to create performances.

The company’s IP is based on a level of Artificial Intelligence and then recognizes statistical development patterns that indicate the future probability that the trader will continue to perform successfully within an acceptable level of risk. According to traders’ scores, funds are allocated and then their Portfolio Manager account is monitored.

Traders who generate profits for investors using their trading strategies receive up to 15% of that profit. This agreement makes YCM Invest’s brokerage platform an even more attractive option for successful traders as it allows them to benefit more from the trading strategies they use in relation to the success of the trades they make.

YCM Invest’s view is to continue to build its base of successful traders on the platform, while at the same time growing AUM and thus generating profits for both its investors and traders.

Here is YCM Invest’s 2022 Income Statement and Balance Sheet.