UK financial regulator The Financial Behavior Authority (FCA) has announced that it restricts UK Ltd (or short time) direct commercial technology from the conduct of regulated activities, preventing the execution of any regulated activities and restriction of access to its assets.

The regulatory authority said it has found that DTT fails or is likely to fail to meet the standards required by an authorized business.

Due to the restrictions implemented, the company is obliged to ensure that all open trading positions have been closed and investor money is intended for customers. The business can no longer provide adjustable services, including negotiation.

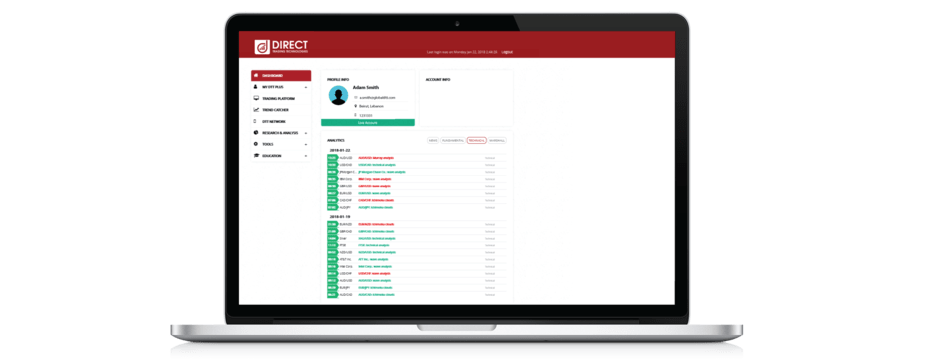

The Direct Trading Technologies UK Ltd is the British arm of Global DTT, a Arabic language market that focuses on FX and CFDS Broker, based mainly on Lebanon and Dubai. The company holds licenses in the UAE, Lithuania, Vanuatu and Panama, and in 2018 received FCA license in the United Kingdom for Direct Trading Technologies UK Limited, where it mainly serves professional customers. DTT is jointly controlled by Walid Ead’s long -term CEO and Saudi Arabic -based investor Khalid Al Makkawi.

Basic concerns found in DTT

Lack of systems and controls to prevent financial crime. Specifically, DTT systems and controls were not sufficient to detect or prevent a staff member by allegedly falsifying documents for business control.

Poor governance and supervision. DTT appears to have no effective procedures for identifying, managing, monitoring and reporting the risks that are or may be exposed or sufficient internal control mechanisms, including management and accounting procedures.

Failure. The DTT was not open and worked with FCA and failed to ensure that the information was properly disclosed. In addition, the information provided to the business controller appears to be incompatible with information provided separately by the company to FCA.

FCA First Supervisory Notice

FCA has issued a first supervisory notice, which explains the reasons for measures against DTT. Some excerpts from the first supervisory notice include:

On January 7, 2025, the Authority received a notice from the auditors … that during the recent audit of the company’s financial statements for the year ended December 31, 2023, the company had provided the auditors documentation which the auditors were reasonably considered to be constructed.

Given the nature of the company’s basic broker trading model, the Authority considers that the business does not have strong governance arrangements to ensure that those who have a management have effectively supervised its activities.

The Authority has serious concerns that the arrangements implemented by the company to deal with the accounting irregularities found during the audit have led to a substantial deficit in the company’s customer money account …

The company appears to have an inadequate framework for financial crime … The company’s recent control has found significant shortages in the procedures for controlling the financial crime of the business that led to a business employee allegedly falsifying a document used to support a significant payment.

The FCA restrictions imposed on DTT have abolished the company’s ability to conduct regulators and prevent it from reducing the value of its assets without our consent. Complete First supervisory notice Issued by FCA on DTT can be approached here (PDF).