The UK Financial Conduct Authority (FCA) has today published figures summarizing its work to tackle consumer harm in the investment market between 1 April 2022 and 31 March 2023.

During the relevant period, the FCA:

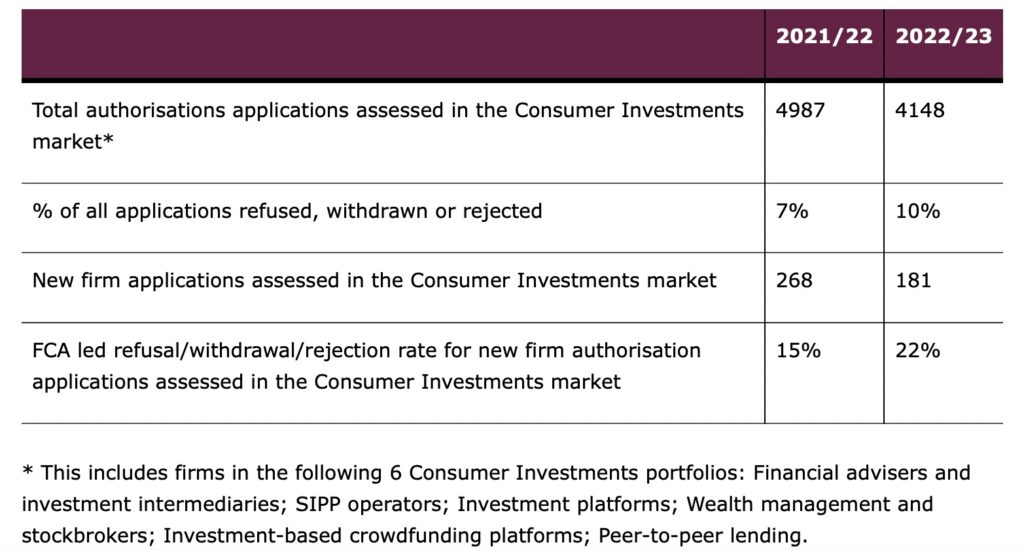

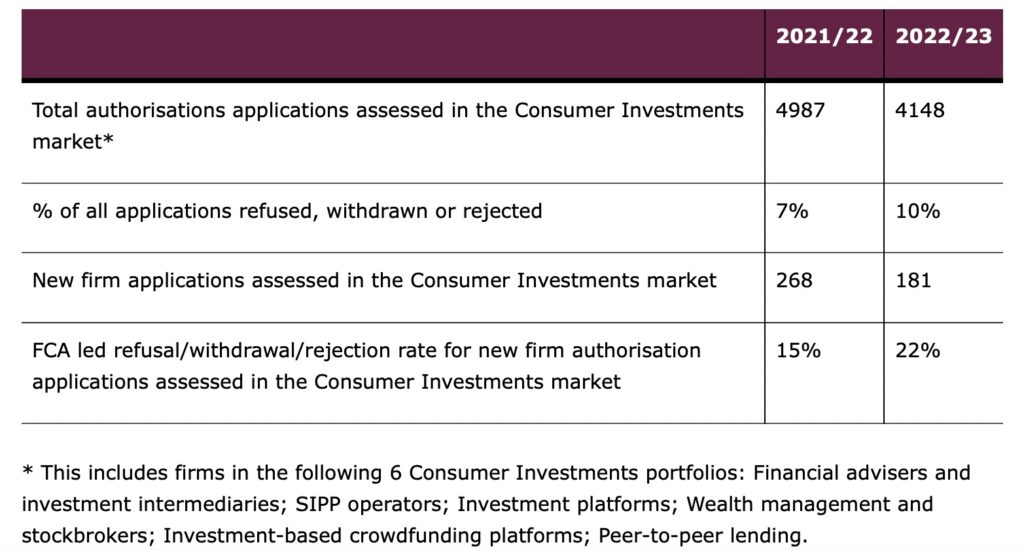

- Stopped 1 in 5 new consumer investment firms applying to enter the market;

- Posted 1,716 consumer alerts about unauthorized companies or individuals.

- secured £4.9m for consumer redress from unauthorized investment firm.

At the same time, the FCA’s work for consumers shows the challenges facing investors. Inquiries to the FCA’s consumer helpline about potential fraud have increased significantly since 2020 and this trend has continued in 2022/23 (12% annual increase).

The ScamSmart website also had 12% more visitors than last year. The FCA saw significant increases in inquiries about potential recovery room scams (21%), FCA impersonation scams (38%) and cryptocurrency scams (17%). While most consumers contact the FCA’s helpline about potential scams before investing, 80% of consumers who contacted the FCA about potential cryptocurrency scams did so after investing.

The FCA received more than 25,000 reports of potential unauthorized business activity between April 2022 and March 2023. Many of these reports are either already known to us or do not fall within the FCA’s remit. The regulator either records the remaining reports for information purposes or opens them as investigations for further review. Investigations may involve the FCA working to stop unauthorized business activity, such as issuing consumer alerts, taking steps to take down websites and working with companies to resolve a breach. The most serious cases become enforcement investigations into serious misconduct using the FCA’s formal powers.

The FCA currently has 48 enforcement investigations into 212 unauthorized firms and individuals.

Due to the large volume of reports and their complexity, their results may vary from year to year depending on many factors. These include the nature of the reports, the FCA’s approach to triaging cases and the resources it can devote to this work.

In previous periods the FCA has achieved significant redress for consumers in relation to unauthorized firms. The £4.9m for 2022/23 is a return to more typical levels.