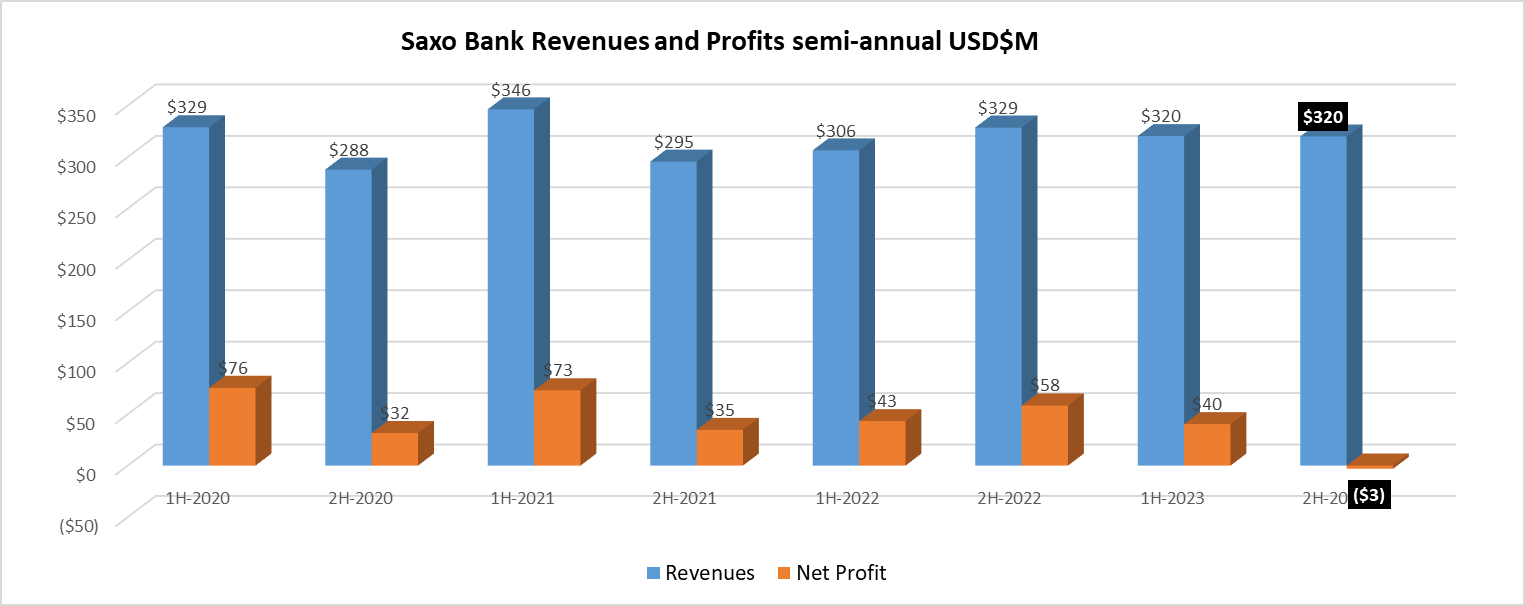

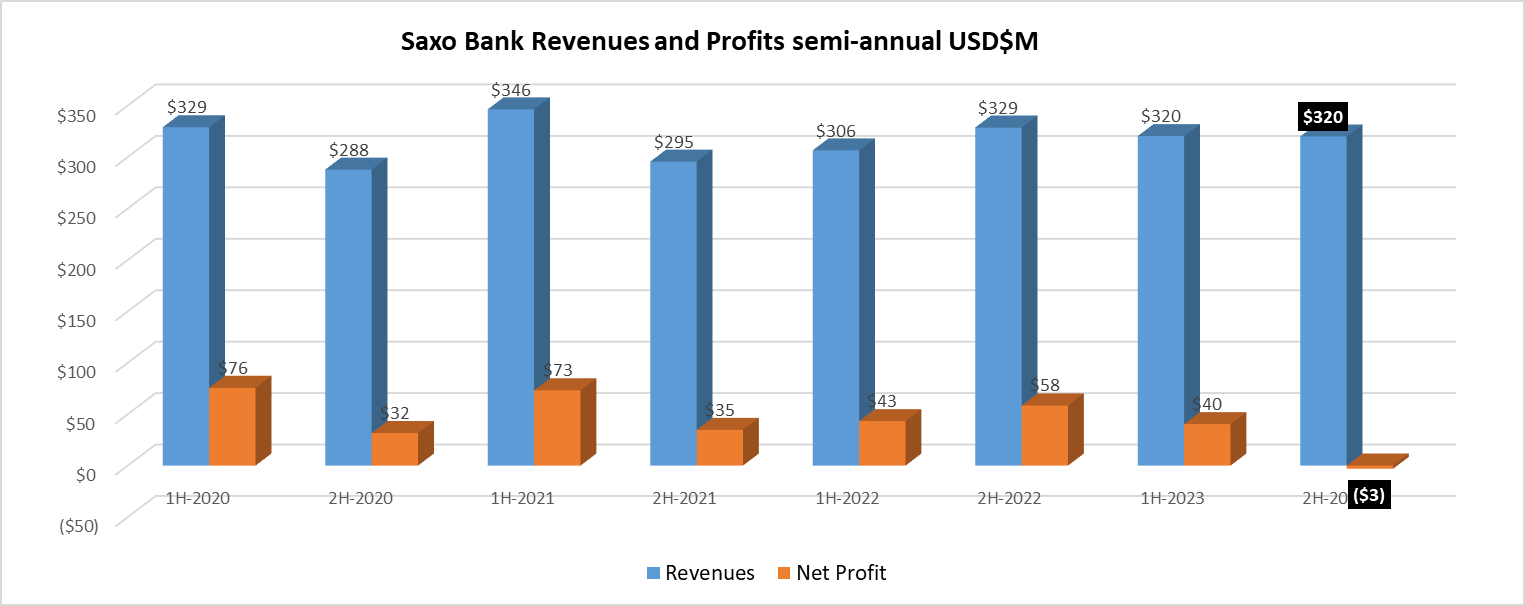

Copenhagen-based Retail FX and CFDs broker Saxo Bank has released its annual report for 2023, indicating fairly steady profitability in the second half of the year, but declining company profitability.

Saxo Bank’s revenue amounted to DKK 2.239 billion (USD 320 million) in the second half of 2023, almost the same as in the first half of the year (DKK 2.242 billion). However, on balance, Saxo posted a net loss of DKK 22 million ($3 million) in the July-December 2023 period, compared to a profit of DKK 282 million in the first half of the year. The loss was mainly due to a software write-off and a negative impact of DKK 94 million from the divestment of the joint venture Saxo Geely Tech Holding.

For the full year 2023, Saxo Bank’s revenue was DKK 4.481 billion ($640 million), up 1% from 2022, and the company posted a net profit of DKK 260 million ($37 million), down 63% from the last year.

Looking a little deeper into Saxo Bank’s numbers, the company’s results in 2023 were helped by the higher interest rate environment, with Net Interest Income of DKK 2.0 billion making up 45% of total income, compared to just 32% in 2022. Net Saxo commission and commission Its core trading revenue fell in 2023 to DKK 1.31 billion from DKK 1.55 billion the previous year, as client trading volume at Saxo Bank fell slightly in 2023 from 2022 levels.

Saxo Bank has abandoned its bid to go public in late 2022 via a merger with the Euronext Amsterdam-listed special purpose vehicle, which would have provided liquidity to the company’s two largest outside shareholders, China’s Geely Group (49.9 %) and the Finnish Sampo (19.8%).

Commenting on the results, Kim Fournais, CEO and founder of Saxo Bank, said:

“In 2023, we made further progress in building a more competitive, durable and relevant Saxo. We reached a record of more than 1.1 million end customers with assets exceeding DKK 745 billion. A key factor in attracting new customers and increasing customer assets was the introduction of our innovative interest rate model. This model allows customers to earn market-leading interest rates on their uninvested cash without the usual restrictions such as lock-in periods.

“2023 also marked Saxo Bank’s designation as a Systemically Important Financial Institution (SIFI). It’s a responsibility we embrace with humility and determination and underlines our commitment to being a reliable, prudent and compliant partner for our customers and partners, as well as the communities in which we operate.

“The strategic focus remains unchanged with a continued emphasis on growing the number of customers and customer assets and improving our product and platform offering for the benefit of our customers, as well as focusing on our core markets. Earlier this year, we announced significant price reductions across markets to improve competitiveness and enable investors to get more of their returns. “Decreasing prices and fees are making it increasingly simple and attractive to diversify across different asset classes, a key component of a strong and successful investment portfolio.”

Saxo Bank Annual Report 2023 you can download it here (pdf).