Closing in the first half of the trading in the FX institutional sphere, each of the leading EFX areas investigated by FNG reported a slight increase in trading volumes during Mau, but remained well below the logs earlier in a year.

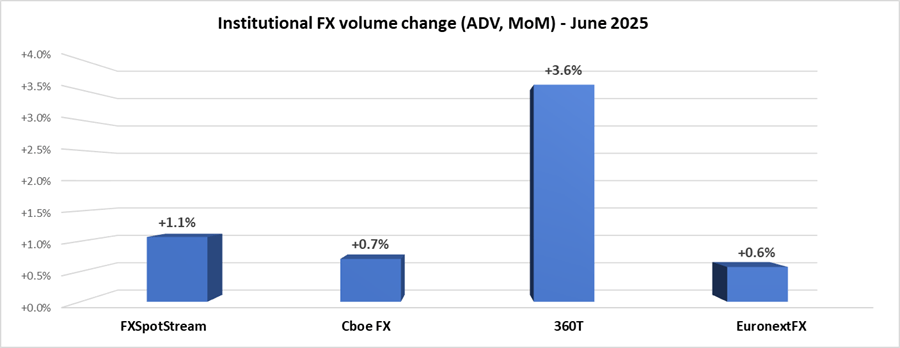

After seeing a 22% decrease in FX FX transactions in May, each of the FXSPotstream, CBOE FX, Euronextfx and Deutsche Borse 360T reported between 0.6% and 3.6% increases in June 2025, on average 1.5%. Better than May, but well below March and the April record they enjoyed when the coins’ volatility was on a perennial peak.

CBOE FX (formerly hotspotfx)

- June 2025 The average daily tumors were $ 48.31 billion, +0.7% of the $ 47.97 billion of May.

EuronextFX (formerly Fastmatch)

- June 2025 ADV $ 27.66 billion, +0.6% From the May $ 27.50 billion ADV.

Fxspotstream

- In June, the total ADV of FxSpotstream was USD99.792Billion an increase 1.07% mom. This consists of an ADV point of USD66.913Billion and USD32.878Billion in other products.

- Year to date, the total ADV of FXSPotstream (for the January-June 2025 period) increased by 28.45% compared to the same period last year.

- Details of June’s total volume can be found below:

- FXSPOTSREAM’s total ADV mom (Jun’25 vs May’25) increased by 1.07%

- FxSpotstream’s total Adv yoy (Jun’25 vs Jun’24) increased by 5.22%

- FxSpotstream’s Adv Mom point (Jun’25 vs May’25) decreased by 1.61%

- Today’s FxSpotstream Adv Yoy (Jun’25 vs Jun’24) decreased by 2.69%

- FXSPOTSREAM’s other Mom ADV (Jun’25 vs May’25) increased by 6.98%

- The other Adv Yoy (Jun’25 vs Jun’24) of FxSpotstream (Jun’25 vs Jun’24)

360T

- The average daily volumes (ADV) at 360T came to 33.89 billion $ In June 2025, up to 3.6% from $ 32.72 billion in May.