FCA-licensed Retail FX and CFDs broker Hantec Markets Limited has announced its 2023 results, showing a healthy 24% rise in revenue as the firm continued to run near-split for the second consecutive year.

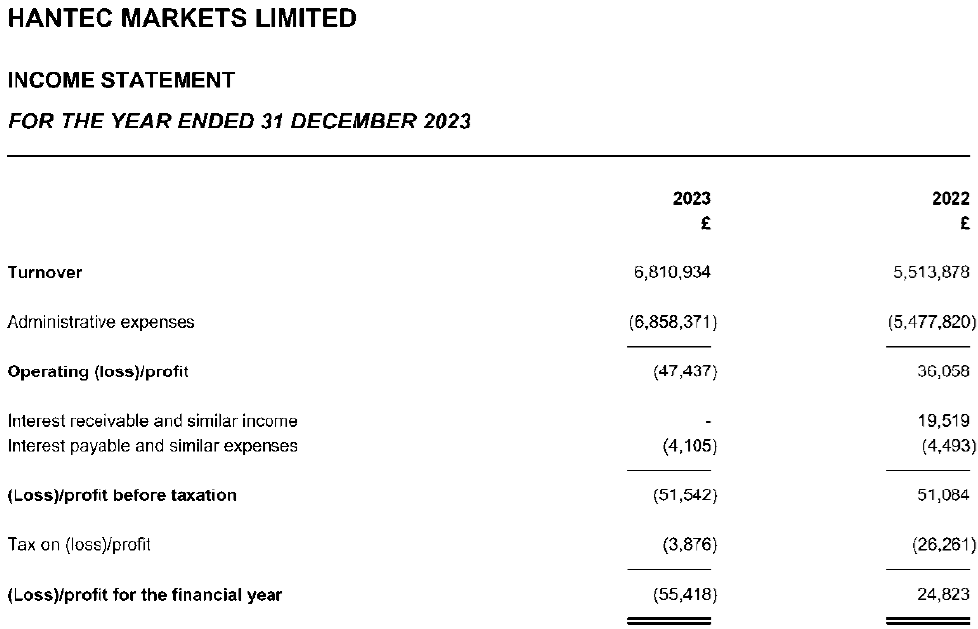

Hantec Markets UK’s revenue was £6.81M in 2023, up 24% from £5.51M in 2022. Overall, Hantec Markets UK made a slight net loss of £55K, against a profit of £25K the previous year.

Management noted that the company’s operations generally developed in line with the board’s expectations and the period’s results and financial position at the end of the period were deemed satisfactory, given the increasing competition and regulations in the industry. Hantec’s small operating loss was caused by additional IT costs incurred towards the end of the year due to the introduction of a new technology strategy. The company said it expects this investment in the development of new technologies to make a significant contribution to the future profitability of the business.

Directors expect the company’s financial results next year to return to profitability.

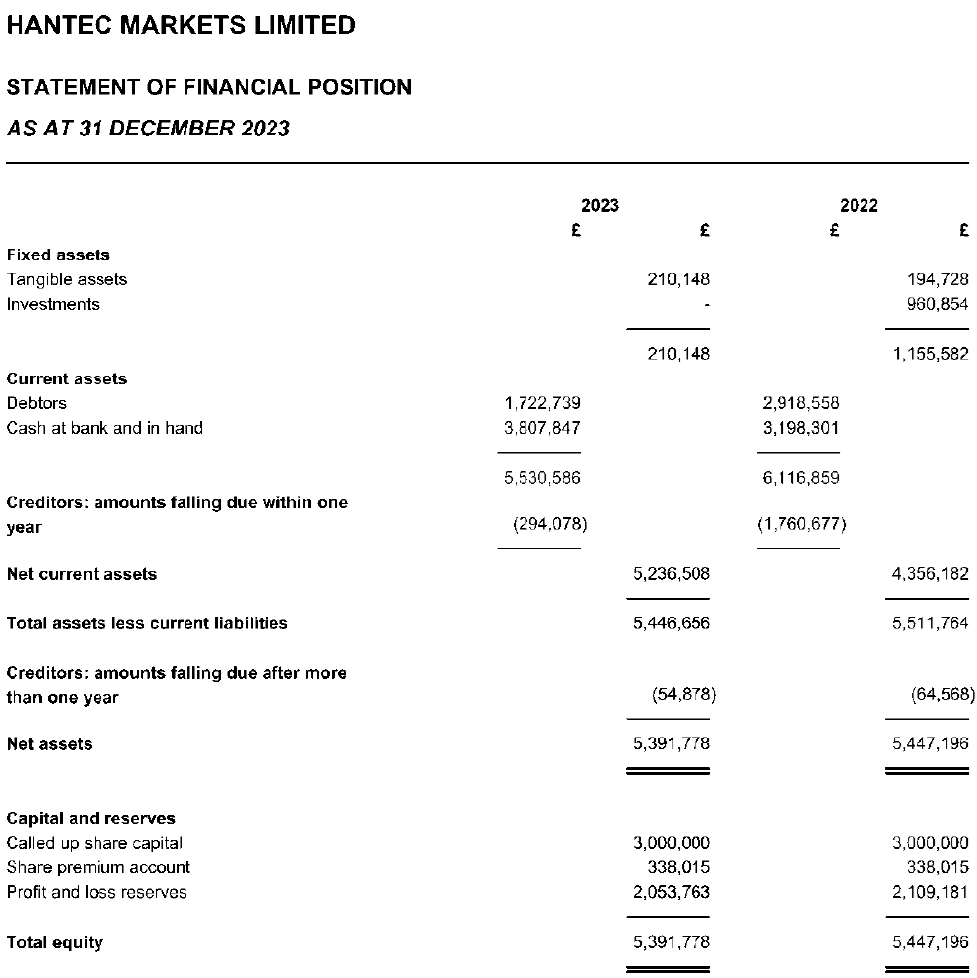

Hantec Markets UK saw a decrease in client money held at the firm in 2023, to £9.7m from £16.8m at the end of 2022.

Hantec Markets is controlled by former ODL Securities and Rosenthal Collins executive Bashir Nurmohamed. Mr Nurmohamed founded the broker in 2010 with the backing of Hong Kong-based Hantec Group founder Tang Yu Lap.

The income statement and balance sheet of Hantec Markets Limited for 2023 follows: