Lithuania-based RegTech solutions provider iDenfy has announced the launch of a new facial authentication service. iDenfy, known for its variety of KYC tools, said the new cutting-edge technology is designed to detect fraudulent biometrics and add extra protection without unnecessary friction for the end user. Facial authentication enables online platforms to create a more secure network by flagging suspicious activity in real-time, helping to prevent fraud at every stage of the customer journey.

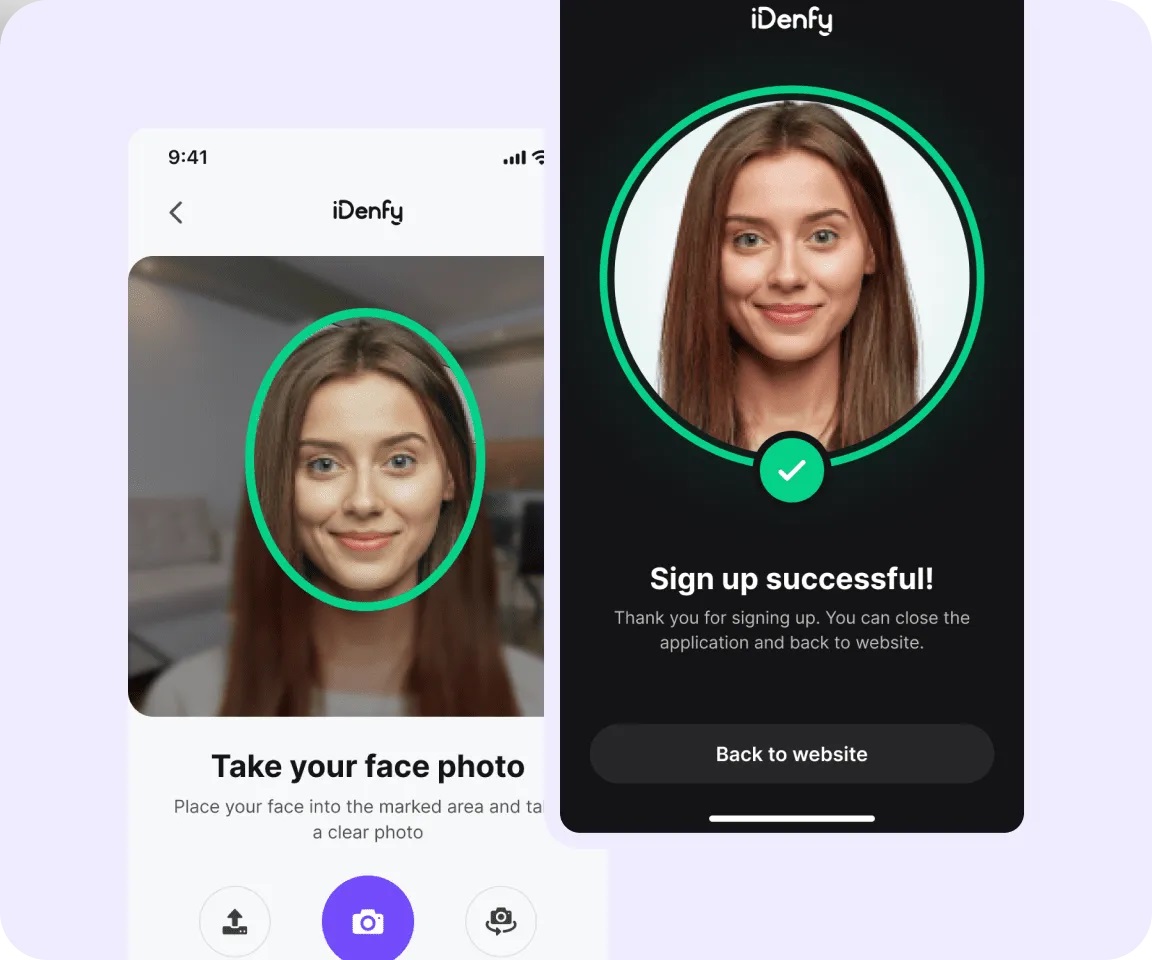

iDenfy’s Face Authentication service offers a seamless user experience by verifying identities in seconds. This innovative solution is set to transform the onboarding process, enabling businesses to onboard new customers quickly and securely. With verification times of up to 15 seconds, this service is not only efficient, but also ensures a high level of security, making it a must-have tool for businesses that prioritize compliance and user experience.

The fully automated solution works by comparing the customer’s live face to a reference image. This process involves extracting information based on artificial intelligence by reading the data from the customer’s identity document. The extracted information then verifies the authenticity of the face. Using iDenfy’s advanced facial recognition technology, the customer’s live face is automatically analyzed and matched to the photo on their ID document, verifying and confirming that they are indeed who they claim to be.

Domantas Ciulde, CEO of iDenfy, explained,

Domantas Ciulde, CEO of iDenfy, explained,

“The facial authentication process, in general, is based on biometric technology and offers a more efficient, simple and user-friendly way to confirm a user’s identity compared to traditional methods. If the user cannot pass the authentication, the company can immediately take the necessary steps to avoid dealing with a potentially fraudulent customer. In this way, this tool can help online platforms enhance their effectiveness in their internal risk management processes.”

According to iDenfy, one of the key features of iDenfy’s Face Authentication is face matching. After successfully onboarding a new customer, businesses can use this feature to re-verify the customer’s identity at any point in the customer lifecycle. This ongoing due diligence process is vital to ensure businesses continue to meet regulatory Know Your Customer (KYC) requirements. The Face Authentication solution also helps companies keep records of up-to-date customer data, especially when it comes to high-risk customers who need to undergo Enhanced Due Diligence (EDD). According to iDenfy, its new solution accurately assesses the potential risks associated with the customer’s activities.

Most importantly, the new facial authentication tool has built-in active liveness checks to ensure that the person being verified is real and not an imposter trying to trick the system. Through a quick onboarding process, companies can see an immediate positive impact, which iDenfy says results in better user conversion rates. This simplified authentication approach helps retain customers and supports faster scaling, especially for online platforms in fintech or crypto, which have strict requirements but aim to avoid adding unnecessary hassle for their users.

According to Domantas Ciulde, the new service is not only about verifying identities:

“Face authentication also gives businesses the information they need to make informed decisions. Our updated dashboard now offers details like match ratio, failure reasons, passive liveability and more.”

This comprehensive data allows compliance officers to see all results in one place, track and analyze ongoing verification sessions, and ensure that all security measures are as effective as possible. Additionally, businesses can initiate new verification sessions directly from the integrated users section of the dashboard.

As regulations evolve and the need for secure, efficient identity verification grows, iDenfy’s facial authentication service is positioned as an essential tool for businesses across industries. Whether onboarding new customers, verifying users at account access, or maintaining ongoing compliance, this service offers a comprehensive solution that meets the demands of today’s fast-paced digital environment.

“With the launch of Face Authentication, we are committed to providing our customers with simple and fully automated RegTech tools to improve security, streamline operations and meet regulatory requirements. Our goal is to make the onboarding process as seamless as possible, while ensuring that businesses can trust the identity of their platform users,” added Domantas Ciulde.

About iDenfy

iDenfy, a platform of identity verification services and fraud prevention tools, ensures AML, KYC and KYB compliance for every company — from large-scale enterprises to small organizations. The fast-growing business was named the best Fintech startup of 2020. Recently, iDenfy was featured in G2’s Summer 2024 report as the top identity verification software.