The electronic negotiation of the large IG Group Holdings PLC (LON: IgG) today announced the acquisition of an independent reserve, an exchange of encryption based in Australia, for initial business value of $ 178.0 million (£ 86.8 million).

Matt Macklin, CEO of Asia Pacific & Middle East at IG, commented:

“This acquisition marks an important step in the IG encryption strategy in a basic area.

Adrian Przelozny, CEO and co -founder of the Independent Reserve, said:

“Inclusion in IG provides us with the platform to accelerate our growth. IG’s vision is aligned with our mission to provide safe, adjustable encryption and this transaction will allow us to expand our market product and range.”

The Independent Reserve offers a negotiation of 34 digital assets in multiple coins, serving retail and institutional customers, with rights operating in Australia and Singapore. The transaction gives IG direct access to these markets and provides optional to expand the supply to the Asia -Pacific and Middle East areas.

The leadership team and the workers will remain with an independent reserve and will maintain a 30% collective participation during completion, bringing strong cryptocurrency experience to lead future proposals to IG. After completion, the team will maintain the trademark of the independent reserve and integrate its product into the IG trading platforms, initially in Australia and Singapore.

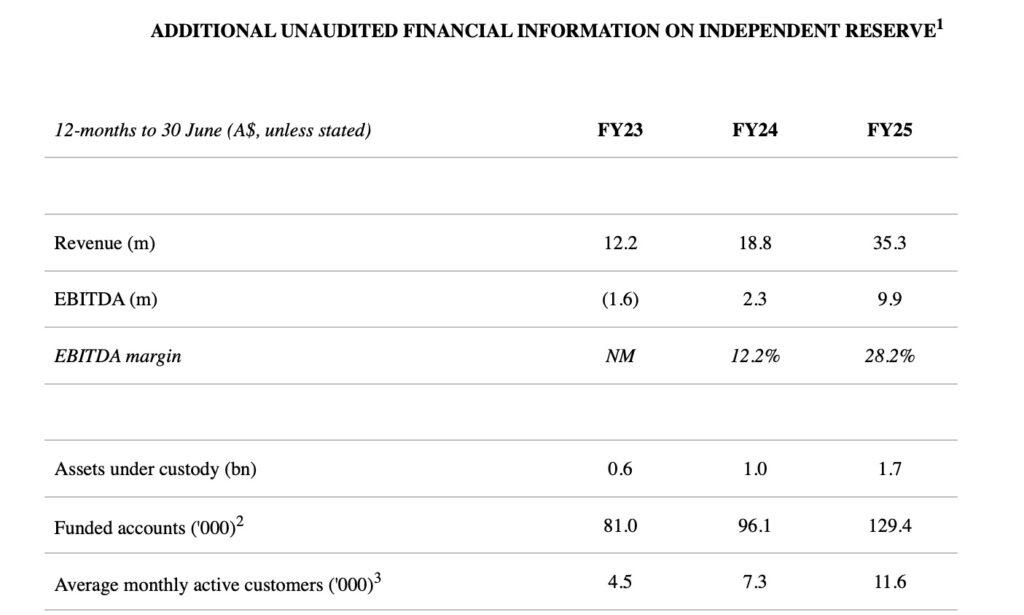

The independent reserve has a strong growth potential, with revenue of 12 months expiring on June 30, 2025 from $ 35.3 million (£ 17.7 million), increasing 88% for the previous year and representing CAGR 70% over the past two years. About 76% of revenue was created in Australia and 24% in Singapore. EBITDA at 12 months ended on June 30, 2025, was $ 9.9 million (£ 5.0 million).

The independent reserve had C.11,600 average monthly active customers in the 12 months ending June 30, 2025, increased by 60% in the previous year and representing CAGR 60% over the past two years.

IG will acquire an independent reserve for an initial business value of $ 178.0 million (£ 86.8 million) representing a multiple of 5.0x revenue for 12 months expiring on June 30, 2025.

IG will have an initial 70% of the independent reserve for examination of $ 109.6 million (£ 53.4 million), with the exception of the group’s expected shares from the up -to -date cash surplus of $ 8.4 million (£ 4.1 million). An additional payment of $ 15.0 million (£ 7.3 million) depends on the yield of FY26, taking into account ownership of 70% to $ 124.6 million (£ 60.8 million).

IG has a call option to buy a 30% share that will not be closed, with a performance based on FY27 and FY284.

Completion is subject to regulatory approvals by MAS in Singapore and FIRB in Australia and is expected today in early 2026.

The acquisition of an independent reserve complements the strategic progress made by IG to strengthen the encryption proposals in the United Kingdom and the US.

In the United Kingdom, the Group launched the spot crypto trading in May 2025. It started in collaboration with the support, the offer includes 35 coins and is fully integrated throughout the IG and IG Invest app.

In the US, Tastytrade has expanded its product range to 23 coins and allowed Stablecoin account funding for investors in multiple blockchain networks. This innovative method of funding allows Tastytrade customers around the world to fund their brokerage accounts with Stablecoins, 24/7/365, powered by zero hash, the leading chain infrastructure provider.