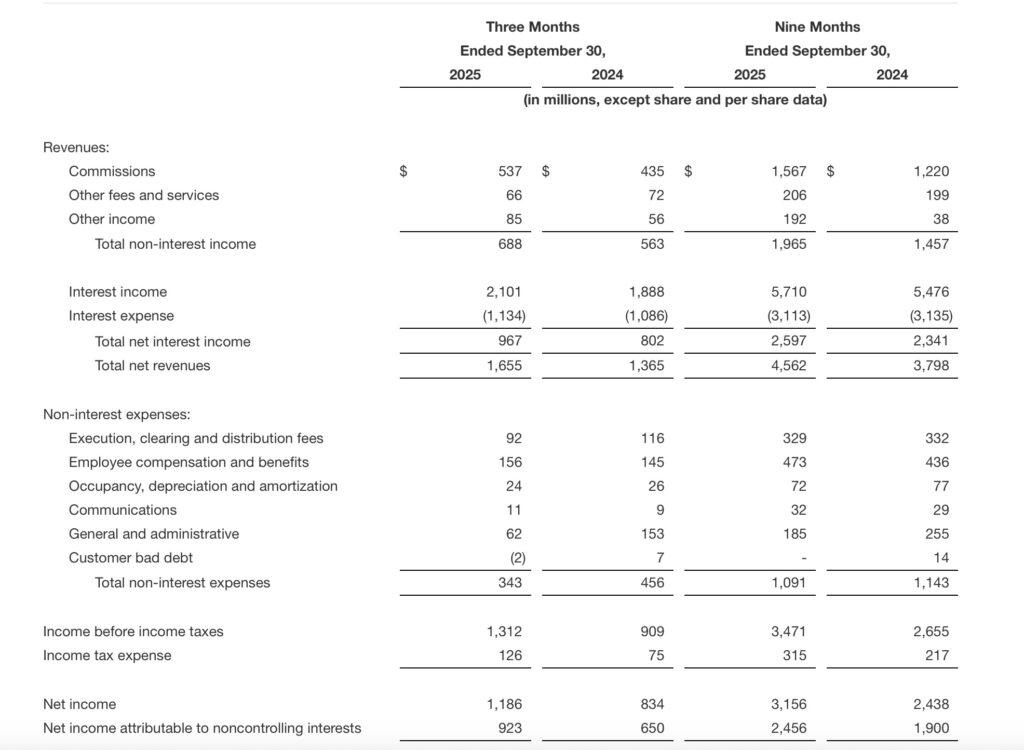

Electronic trading major Interactive Brokers Group, Inc. (NASDAQ:IBKR) today announced its financial results for the third quarter of 2025.

Diluted earnings per share reported were $0.59 for the current quarter and $0.57 as adjusted. For the prior-year quarter, reported diluted earnings per share were $0.42 and $0.40 as adjusted.

Reported net income was $1,655 million for the current quarter and $1,610 million as adjusted. For the prior year quarter, reported net income was $1,365 million and $1,327 million as adjusted.

Commission revenue increased 23% to $537 million on higher client transaction volumes. Client trading volume in stocks and options increased by 67% and 27%, respectively, while futures fell by 7%.

Reported income before income taxes was $1,312 million for the current quarter and $1,267 million as adjusted. For the prior-year quarter, reported income before income taxes was $909 million and $871 million as adjusted.

Net interest income increased 21% to $967 million due to stronger securities lending activity and higher average customer margin loans and customer credit balances.

Other fees and services decreased 8% to $66 million, driven by a $12 million decrease in risk exposure fees, partially offset by a $3 million increase in FDIC sweep fees.

Execution, clearing and distribution fees decreased 21% to $92 million, due to lower regulatory fees as the SEC Section 31 transaction fee rate was reduced to zero on May 14, 2025, and a higher commitment of liquidity returns from certain exchanges due to higher trading volumes in stocks and options.

Pretax margin for the third quarter of 2025 was 79% both reported and adjusted. For the prior year quarter, pretax margin was 67% as reported and 66% as adjusted.

Total equity was $19.5 billion.

The Board of Directors of Interactive Brokers Group, Inc. announced a quarterly dividend of $0.08 per share. This dividend is payable on December 12, 2025, to December 1, 2025 shareholders.

Customer accounts grew 32% to 4.13 million.

Client equity rose 40% to $757.5 billion.

Total Daily Average Revenue Transactions (DART) increased 34% to 3.62 million.

Customer loans rose 33% to $154.8 billion.

Customer margin loans increased 39% to $77.3 billion.