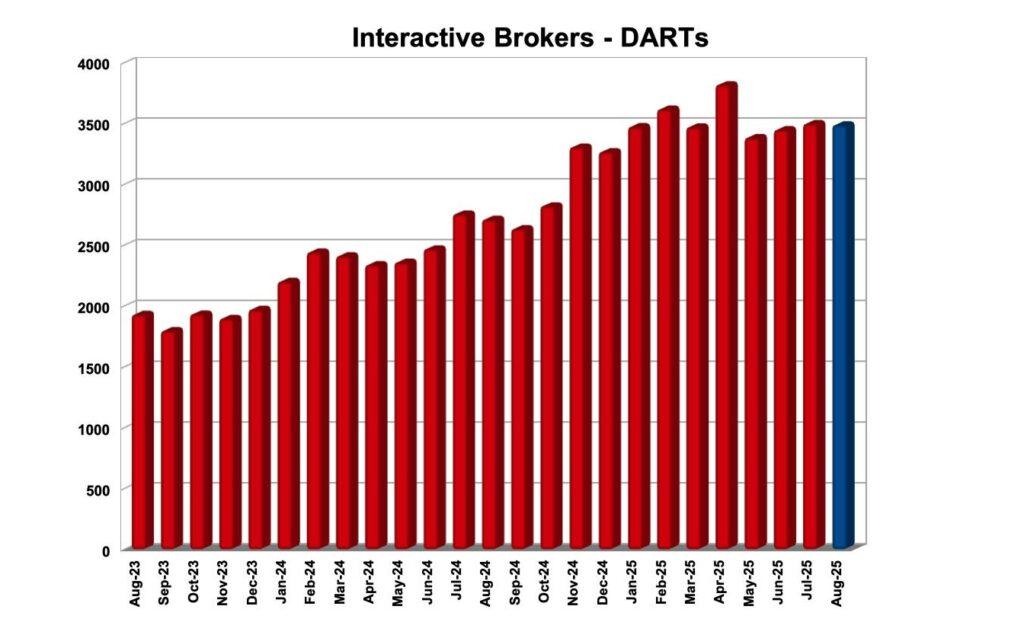

Major Interactive Brokers Group, Inc. (Nasdaq: IBKR) just mentioned the basic functional measurements for August 2025.

The brokerage reported 3,488 million daily average revenue transactions (darts) for August 2025, 29% higher than in August 2024 and around July 2025.

The end of customer capitalization amounted to $ 713.2 billion, 38% higher than the previous year and 4% higher than the previous month, while the remaining customer loans were $ 71.8 billion, 31% higher than the previous year and 6% higher than the previous month.

The company reported 4,054 million customer accounts, 32% higher than the previous year and 2% higher than previous month. Last month, there were 187 annual average cleared darts per customer account.

The average committee per cleared attachment was $ 2.68, including exchange, liquidation and regulatory fees.

Speaking about the performance of the interactive brokers, let us note that the published broker reported the customized diluted profits per share of $ 0.51 for the second quarter of 2025.

The reported and adjusted income before income taxes were $ 1,104 million.

Revenue from the Commission increased by 27% to 516 million to higher customer trading volumes. The volume of customer trading in stocks, options and future fulfillment contracts increased by 31%, 24%and 18%respectively.