Major Interactive Brokers Group, Inc. (Nasdaq: IBKR) just mentioned its basic functional measurements for September 2025.

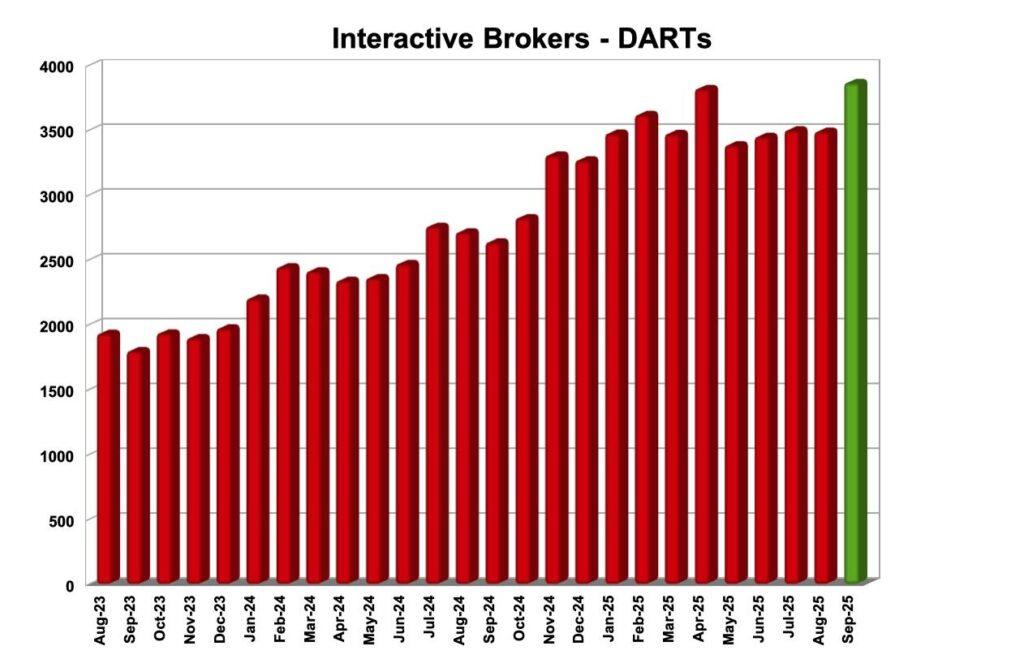

The brokerage has published 3.864 million daily average revenue transactions (darts) for September 2025, 47% higher than in September 2024 and 11% higher than August 2025.

Customer shares ended at $ 757.5 billion, 40% higher than the previous year and 6% higher than previous month.

Customer margin loans amounted to $ 77.3 billion, 39% higher than the previous year and 8% higher than previous month.

The remaining credit customers were $ 154.8 billion, including $ 6.2 billion in insured bank deposits of 2, 33% higher than the previous year and 6% higher than last month.

The broker reported 4,127 million customer accounts, 32% higher than the previous year and 2% higher than the previous month.

The actual account increase in September was 111.9 thousand accounts compared to the calculated 73.1 thousand accounts. The difference is due to the withdrawal of an incoming broker with 38.8 thousand accounts and $ 413.5 million in assets from a subsidiary of Futu. Interactive brokers are expecting an additional 2.9 thousand accounts to complete this action after September 30.

Speaking about the performance of the interactive brokers, let us note that the published broker reported the customized diluted profits per share of $ 0.51 for the second quarter of 2025.

The reported and adjusted income before income taxes were $ 1,104 million.

Revenue from the Commission increased by 27% to 516 million to higher customer trading volumes. The volume of customer trading in stocks, options and future fulfillment contracts increased by 31%, 24%and 18%respectively.