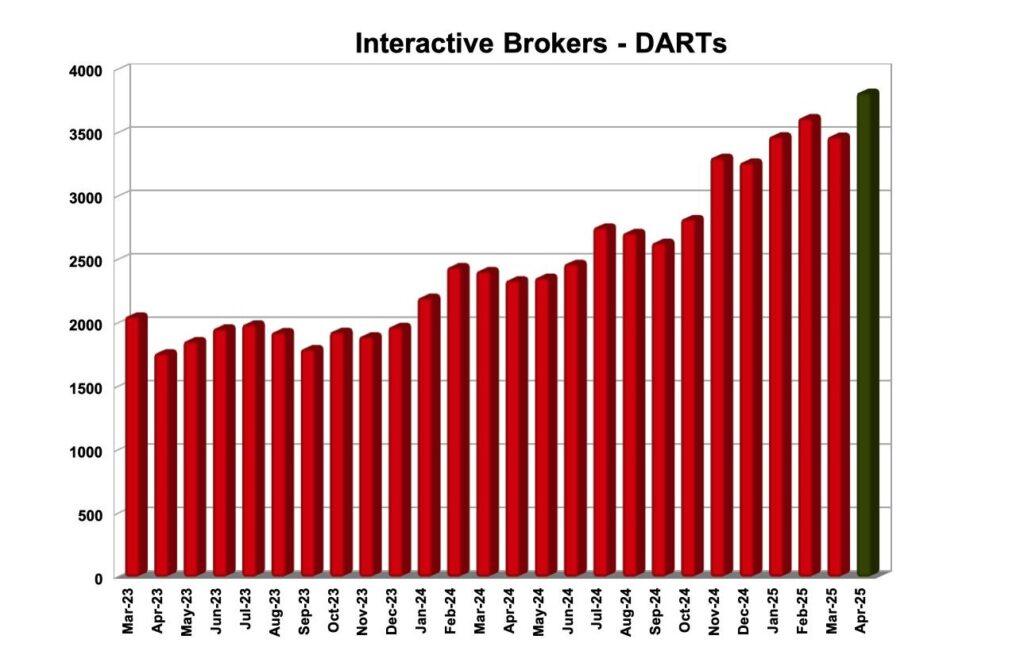

Major Interactive Brokers Group, Inc. (Nasdaq: IBKR) has just published the basic functional measurements for April 2025.

The brokerage recorded 3,818 million daily average revenue transactions (darts), 63% higher than in April 2024 and 10% higher than in March 2025.

Customer shares ended $ 588.1 billion, 28% higher than the previous year and 3% higher than previous month.

The remaining customer margin loans were $ 58.2 billion, 15% higher than the previous year and 9% lower than the previous month.

Customer Credit Credit Out of $ 132.8 billion, including $ 5.0 billion in insured bank deposits, 26% higher than the previous year and 6% higher than previous month.

Interactive brokers reported 3.71 million customer accounts, 32% higher than the previous year and 3% higher than last month.

The average commission per cleared attachment was $ 2.75, including exchange, liquidation and regulatory fees.

Speaking about the performance of the interactive brokers, let us note that the company recently published its financial results for the first quarter of 2025.

The reported net revenue amounted to $ 1,427 million for the first quarter of 2025 and $ 1,396 million as it was adjusted. For the quarter of the year, they reported net revenue was $ 1,203 million and $ 1,216 million as they were adjusted.

Revenue from the Commission increased by 36% to $ 514 million in higher customer trading volumes. The volume of customer trading in stocks, options and future fulfillment contracts increased by 47%, 25%and 16%respectively.

The revenue of income before income tax amounted to $ 1,055 million for the first three months of 2025 and $ 1,024 million as it was adjusted. For the quarter of the year, he said the income before income tax was $ 866 million and $ 879 million as it was adjusted.

Net interest revenue increased by 3% to $ 770 million in higher average customer margin loans and credit balances.