Electronic trading major Interactive Brokers Group, Inc. (NASDAQ:IBKR) just released its key operating metrics for January 2024.

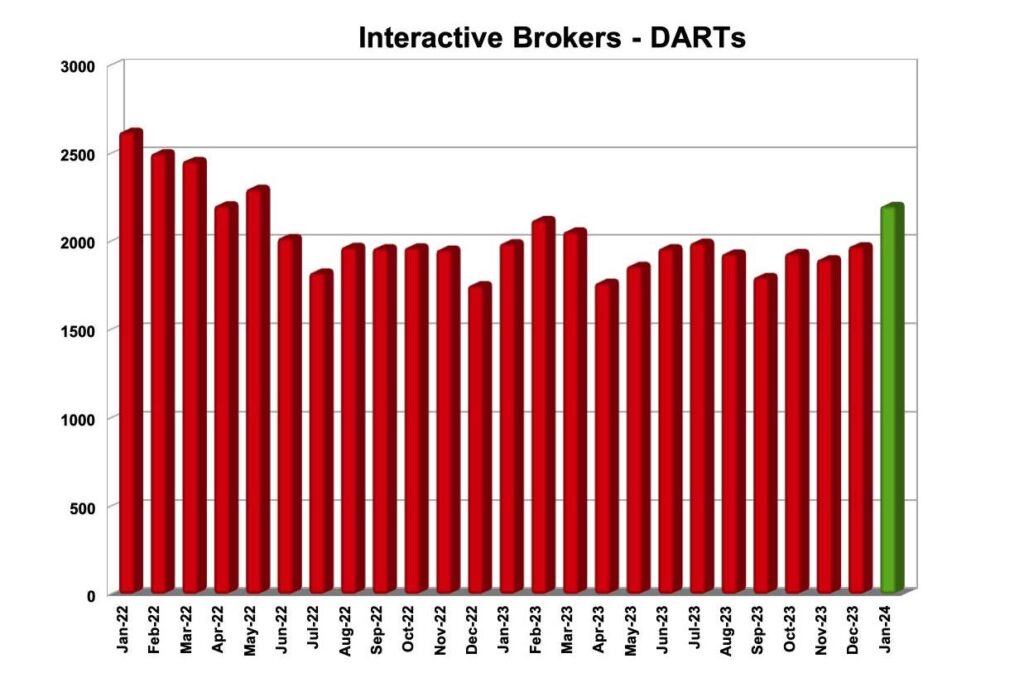

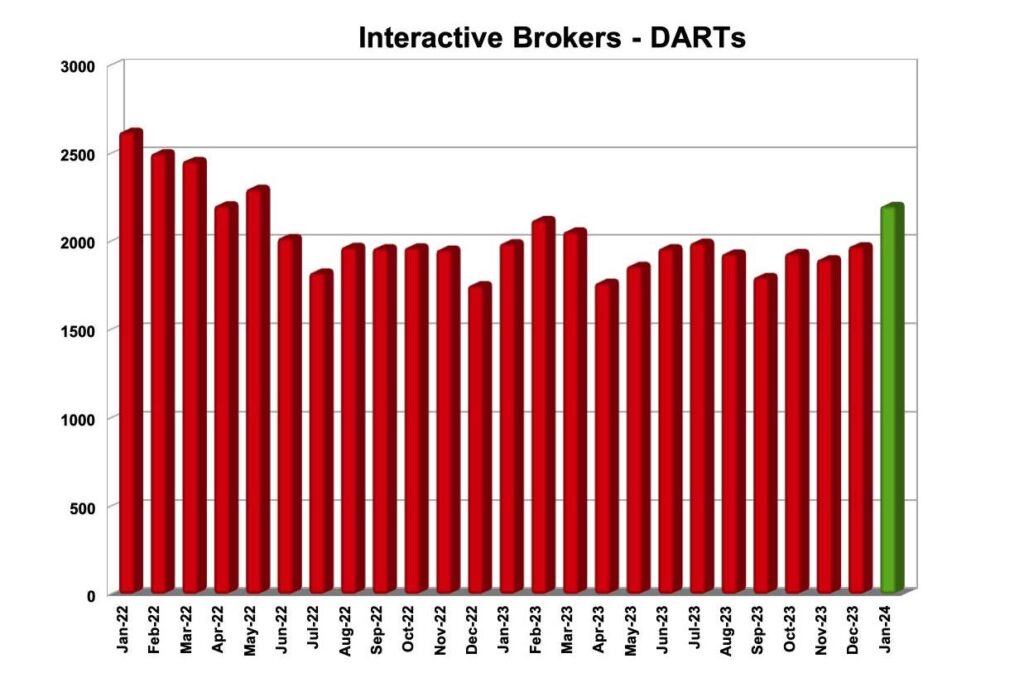

Interactive Brokers recorded 2.201 million daily average revenue transactions (DARTs), 11% higher than January 2023 and 12% higher than December 2023.

End-customer equity was $424.0 billion, up 26% year-over-year and about even with the previous month, while customer end-margin loan balances were $44.3 billion, up 12% year-over-year year and about even with the previous month.

The company recorded 2.63 million customer accounts, 23% higher than last year and 2% higher than the previous month.

The average commission per cleared order was $3.03, including exchange, clearing and regulatory fees.

Interactive Brokers recently reported its financial metrics for the final quarter of 2023.

Reported net income was $1,139 million for the fourth quarter of 2023 and $1,149 million as adjusted. Reported income before income taxes was $816 million for the final quarter of 2023 and $831 million as adjusted.

Commission revenue rose 5% from the prior quarter to $348 million. Client trading volume was mixed across product types, with options and futures volumes down 21% and 4%, respectively, while equity volume was down 22%.

Net interest income increased 29% from the fourth quarter of 2022 to $730 million on higher benchmark rates, customer margin loans and customer credit balances.