Electronic trading major Interactive Brokers Group, Inc. (NASDAQ:IBKR) just released its December 2023 key operating metrics.

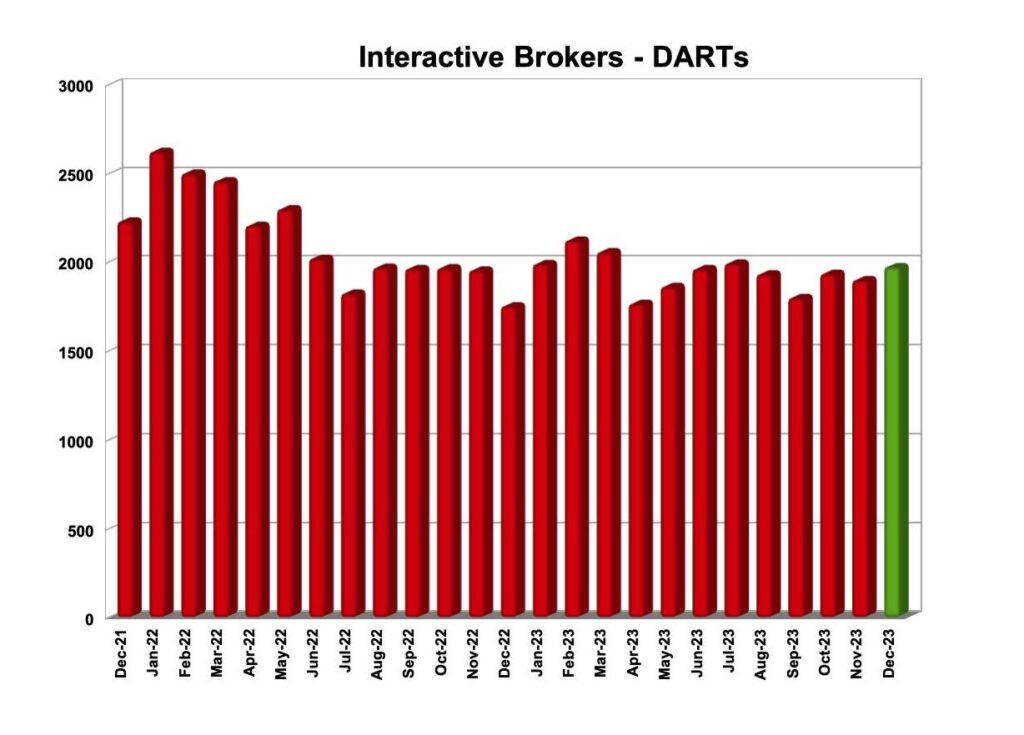

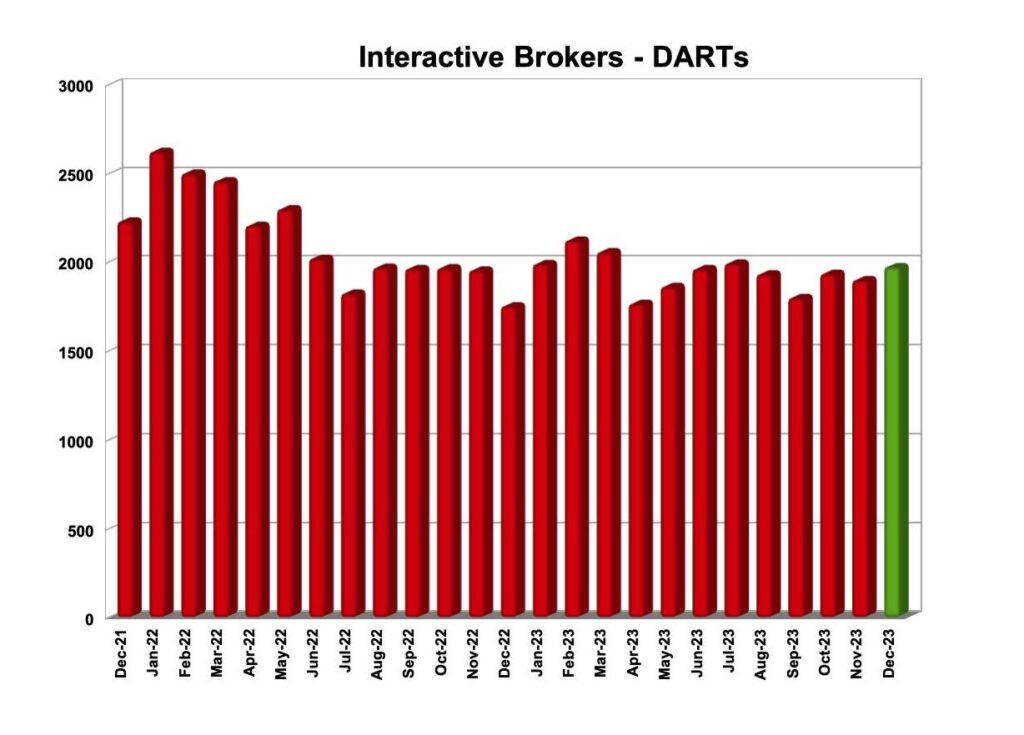

The brokerage recorded 1.972 million daily average revenue transactions (DARTs) in December 2023, 13% higher than the previous year and 4% higher than the previous month.

End customer equity was $426.0 billion, up 39% from last year and up 5% from last month.

Ending customer credit balances totaled $104.5 billion, including $3.7 billion in insured bank deposits, up 10% from last year and up 3% from last month.

Interactive Brokers recorded 2.56 million client accounts, 23% higher than December 2022 and 2% higher than November 2023.

The average commission per cleared orderable order was $3.17 including exchange, clearing and regulatory fees.

Interactive Brokers recently announced its financial results for the third quarter of 2023.

Diluted earnings per share were $1.56 for the quarter to the end of September 2023. For the prior year quarter, reported diluted earnings per share were $0.97 and $1.08 as adjusted.

Net income was $1,145 million for the third quarter of 2023 and $1,139 million as adjusted. For the prior-year quarter, reported net income was $790 million and $847 million, as adjusted.

Income before income taxes was $840 million for the third quarter of 2023 and $834 million as adjusted. For the prior quarter, income before income taxes was $523 million and $580 million as adjusted.