Electronic trading major Interactive Brokers Group, Inc. (NASDAQ:IBKR) just announced its operating metrics for September 2024.

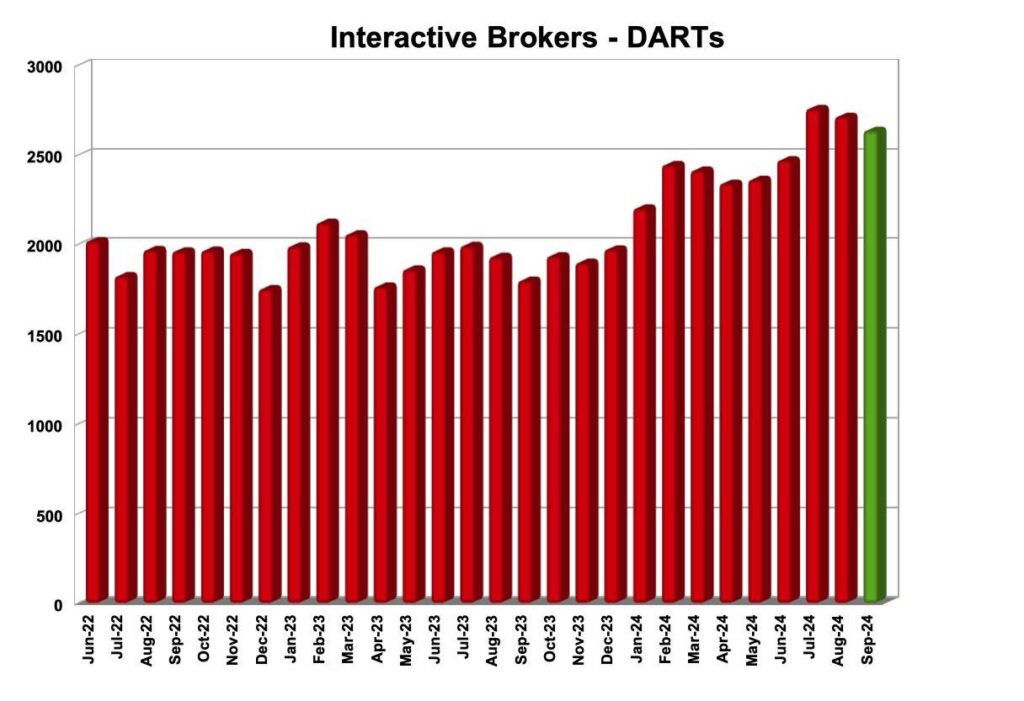

The broker recorded 2.634 million Daily Average Revenue Transactions (DARTs) in September 2024, up 46% from September 2023 and down 3% from August 2024.

End customer equity was $541.5 billion, up 46% from last year and up 5% from last month.

Ending customer margin loan balances were $55.8 billion, up 28% from last year and up 2% from last month.

Ending customer credit balances totaled $116.7 billion, including $4.6 billion in insured bank deposits, up 19% from last year and up 4% from last month.

Interactive Brokers reported 3.12 million client accounts, 28% higher than last year and 2% higher than the previous month.

The average commission per cleared order to assign was $2.88, including exchange, clearing and regulatory fees.

Speaking of Interactive Brokers’ performance, let’s recall that net income was $1,230 million for the second quarter of 2024 and $1,290 million as adjusted. For the prior year quarter, reported net income was $1,000 million and $1,064 million, as adjusted.

Income before income taxes was $880 million for the second quarter of 2024 and $940 million as adjusted.

Commission revenue increased 26% to $406 million on higher client transaction volumes. Client trading volume in options, stocks and futures increased by 35%, 26% and 10%, respectively.

Net interest income increased 14% to $792 million due to higher benchmark rates, customer margin loans and customer credit balances. Other fees and services increased $21 million, or 45%, to $68 million, primarily due to increases of $14 million in risk exposure fees and $3 million in order flow payments from swap order programs and sweep program fees FDIC.