JP Morgan has revealed a wave of new features, including an innovative constant income experience on JP Morgan’s investment platform.

Improvements facilitate investors to explore and invest in corporate bonds, treasures and much more.

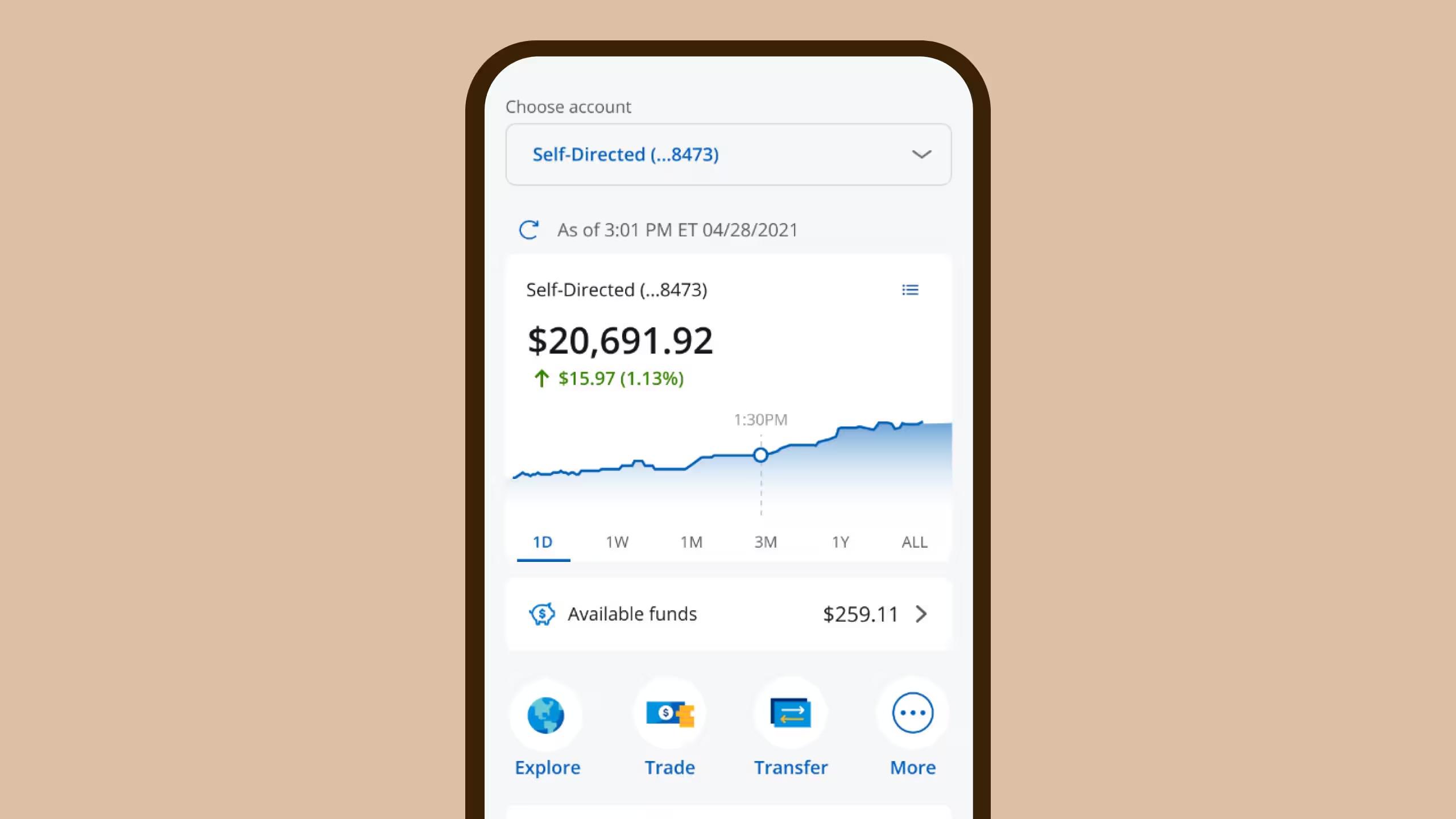

With the simple connection of the Chase Mobile App or Chase.com app, investors can now have access to user -friendly tools that simplify the process of finding and negotiating fixed income products.

New features and improvements include:

- Performance Comparison: Investors can quickly see and compare yields on fixed income products and filter them with a preferred time frame.

- Adaptable Inspectors: New filter options help investors find treasuries, corporate bonds, municipal bonds and CDs that match their criteria with just a few clicks. Screening can also be stored for future use.

- Expatored Trade ticket: Trade faster and more efficiently with fewer steps and a quick view of yields. Investors can also see the smallest and largest number of bonds they can buy at a specific price. Drivers contexts are particularly useful for those young people in fixed income.

“Fixed income investments are an essential part of a differentiated portfolio, helping to balance the volatility of the stock market and the provision of fixed income through regular interest payments,” said Paul Vienick, head of online investment management. “We have created a handy experience for a fixed income that will feel familiar to investors, but what really separates us is that we offer both the desktop and the chase mobile application.”

Customers who are considering retirement account overturns can also be connected to the JP Morgan retirement office, which gives them access to a retirement specialist who can answer in -depth questions and walk them through the subversion process or funding a retirement mediation account.

“We are excited about the future and the constant improvements we make to strengthen our customers,” said Andrea Finan, head of JP Morgan-Government Investment. “These new features are just the beginning. We encourage customers to watch this space as we continue to innovate and raise the investment experience.”