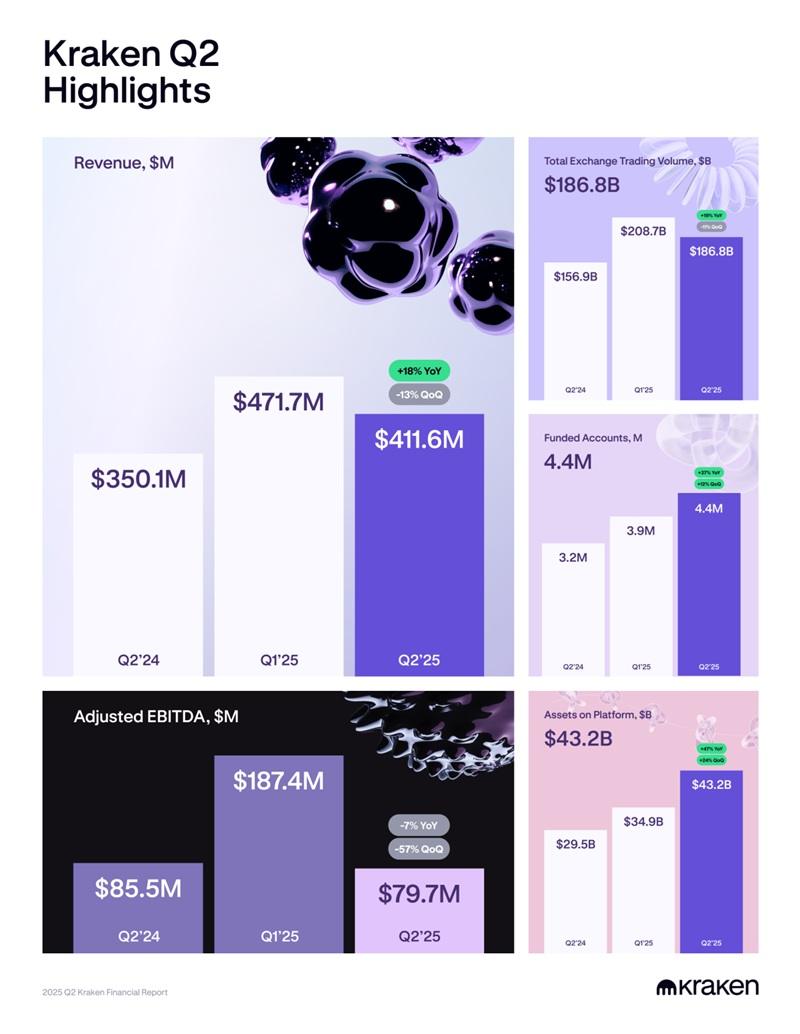

The American Kraken encryption body, stating that it is “in construction mode”, has released brief financial and operational information on Q2-2025, including revenue reduction of $ 478 million per 1st to $ 412 million per Q2.

The customized EBITDA amounted to $ 80 million in the 2nd quarter, decreased by $ 57% from $ 187 million in the first quarter.

The total Kraken exchange volume was $ 186.8b the Q2 2025 increased by 19% on an annual basis. After a powerful Q1, Kraken said there were market turmoil related to US invoices and wider macro. Q2 volumes slow down the fourth-Quarter (from $ 208.7b to Q1), as Q2 tends to be a seasonally lower quarter for commercial activity across the industry.

The funded accounts in Kraken were 4.4 million in the quarter 2025, increasing 37% annually. The assets on the platform were $ 43.2b at the end of the Q2 2025, increasing 47% on an annual basis.

Kraken Q2 Highlights

Kraken said his financial performance of Q2 remained durable, he was pointed out by three basic trends:

- Extension of the Pharmacy Share: We continued to increase our share in the volume. This is due to continuing investments that enhance product experience, as well as our strong position in Stablecoins, where our share of stable volumes increased from 43% to 68%.

- Investment in growth: As Tradfi and Crypto markets converge, we are strategically investing in innovation and expand our product suite to accelerate growth. In Q2, we supported faster product delivery improvements and platforms, along with targeted marketing efforts that showed a strong, effective investment yield (ROI).

- Discipline: To strengthen our business in all market circles, we remain strongly focused on enhancing operating leverage to build a sustainable business.

Based on the top of the Pro-Mader platform

Kraken said the pro -dealers are the heartbeat of his platform. Their participation in the ecosystem and liquidity provide power the rapid development of more products for Kraken’s consumer and institutional businesses, which in turn supply the overall ecosystem.

Kraken’s strategy is evidenced by various new products in Q2, including non -supplies, assets and a global money application.

The company also continued to enhance its overseas potential and offers, along with the introduction of a complete mediation and a white label solution for fully compatible encryption.

Professional Product updates

Constant future in Europe – We made the debut of Europe’s largest Crypto Futures suite. We entered 24/7 FX Standing Contracts (EUR, GBP, AUD, JPY and CHF Couple) to Kraken Pro, expanding derivatives under a reliable regulatory framework.

Future of the US – We started an adjustable American derivative that offers US users, providing immediate access to encryption contracts reported to the CME through the integrated commercial experience Kraken Pro.

Institutional Product updates

Kraken Prime – We have opened a complete Prime Service Stock Exchange that consolidates the best transactions, specialized diligence, deep multi -investment liquidity and 24/7 white flower support for institutional customers.

Storage – We added the USDG that responds to the reward for institutional and HNWI customers and added diligence support for SOL and XRP.

Kraken is incorporated -We started a Crypto solution -as -a -service of the white label that allows banks, brokers and fintechs to add fully compatible encryption transactions within a few weeks. The second largest neobank in Europe – Bunq – and Alpaca were the first partners to incorporate the offer and there are additional incorporation in the pipeline.

Consumer Product updates

Professional shares without commission – We have introduced US shares negotiating in the Kraken application for most US states, giving customers the ease of reserves management and cryptography.

xstocks – We tokenived 55 Blue Blue shares and 5 ETFS in Blockchain, which opens the exposure to shares around the clock for eligible customers outside the United States, with seamless transport transfer to the chain.

Apply krak – We started a global Money application that allows customers to pay, transfer and earn to 300+ encryption assets and Fiat in more than 160 countries.

Brazil’s dedicated offer – We have added instant BRL funding through Pix, fully identified web and mobile applications and 24/7 support to Portuguese, Brazil, bringing Kraken’s global platform closer to Brazilian users.

Kraken+ – We have started a premium membership that offers zero -measures trade compensation, priority support and USDG rewards. He has seen strong hiring with more than 100K subscribers with more than $ 1 billion on the platform both by young and experienced investors.

Perspectives: H2 2025 and beyond

Kraken said her team was relentlessly focusing on receiving the company on the next level. This is what customers require and what the company has committed to deliver. In the second half of 2025, the momentum is built throughout the global footprint: new licenses, added local rails, multi-asset experiences and innovative products that launch-all extinguish Kraken’s central infrastructure.

Basic initiatives on the horizon include:

International shares – Extension of shares without commission and ETF trading to major markets beyond the US, starting with the United Kingdom, Europe and Australia.

Shares – Bringing shares to more jurisdictions and steadily increasing the number of listed assets.

Kraken Debit Cards – Presenting natural and virtual debit cards issued by Mastercard to allow Fiat and Crypto to be seamless and online through the Krak application.

Ninjatrader development – accelerating the platform range in the United Kingdom, Europe and Australia and allowing multiple assets to be traded without friction on the Kraken and Ninjatrader ecosystems.