MetaTrader 5 (MT5), starting from version 4150, introduces mobile leverage support in the admin terminal, allowing brokers to adjust leverage settings depending on the situation and company policies.

With mobile leverage, you can flexibly adjust the required margin size depending on the open position volumes. This offers smaller traders the opportunity to use maximum leverage. It also reduces risks when dealing with larger clients.

This solution is integrated into the MetaTrader 5 trading platform and you can start using it immediately at no additional cost.

While some brokerages had previously worked with mobile leverage in MetaTrader 5, they had to use third-party solutions, which caused some inconvenience due to lack of compatibility with the platform. The MetaQuotes solution is free of compatibility issues and offers a number of advantages that open up even more opportunities for your business growth.

Native inclusion. Developed in-house by MetaQuotes, the solution is integrated into the platform, ensuring accurate interaction with all components. The new functionality does not affect the speed, reliability or any other aspect of MetaTrader 5 operation.

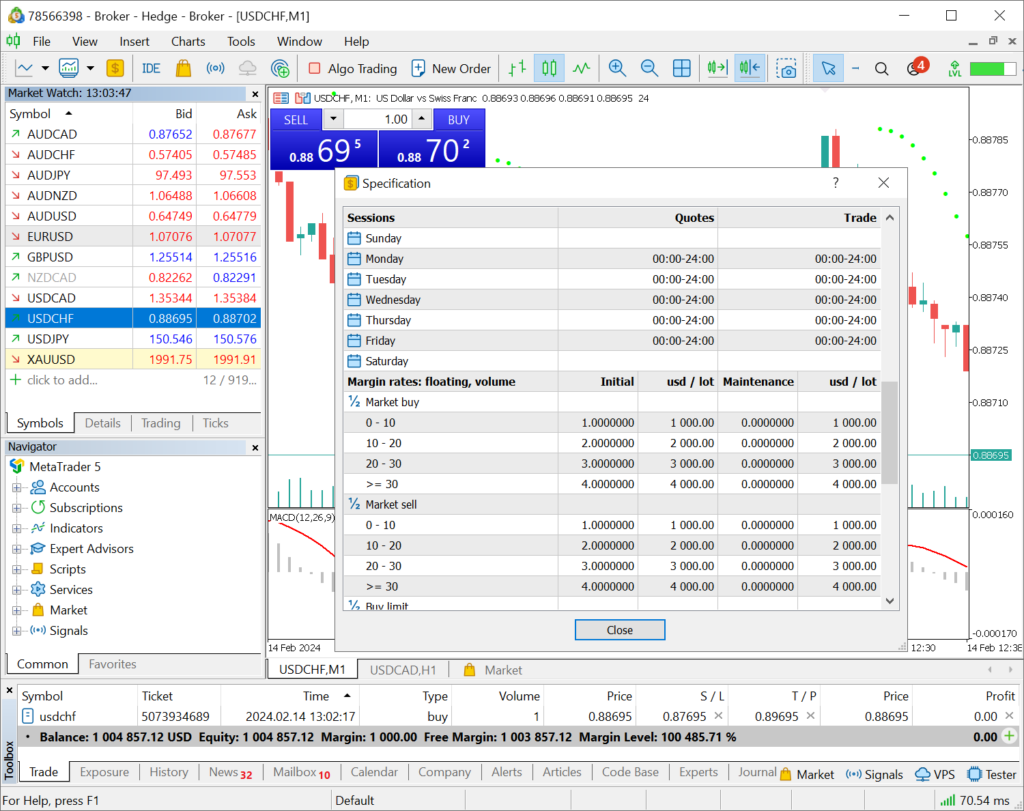

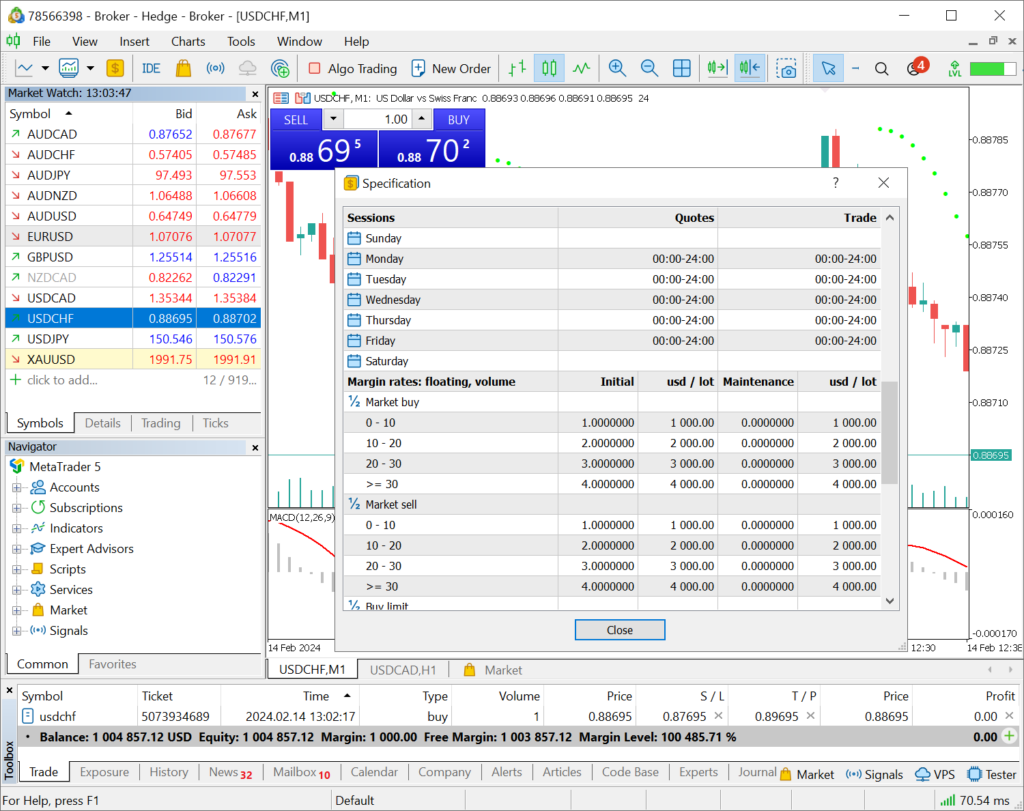

Transparency. The entire process is transparent to the brokerage firm, which fully manages the leverage arrangements. More importantly, end users also benefit from full transparency as they can see all conditions directly on their terminals.

Compatible with trading robots. The solution is fully compatible with trading robots, ensuring accurate margin calculations by algorithmic programs. This unique advantage cannot be achieved through third-party solutions, which may interact incorrectly with the trading platform, leading to inaccurate execution of trading strategies.

Automation capabilities. Using Automations, a built-in service in the platform, you can enable automatic rule adjustments. The changes will be applied automatically under certain predefined conditions. For example, leverage can be automatically reduced one hour before trading close, when market liquidity is low, to mitigate potential trading abuse. This automation can help plan risk mitigation strategies and respond promptly to any significant events that pose potential threats to your business.

Flexibility. Leverage settings can be applied to individual symbols or groups of symbols, allowing you to apply common settings to the symbols you expect changes to. Create multiple rule sets and switch between them automatically or manually as needed.

Without cost. There is no need for investment, either financial or time. Configure the required rules with just a few clicks and take advantage of new opportunities without additional costs or complexity.