Morgan Stanley (NYSE: MS) today published its financial results for the second quarter of 2025.

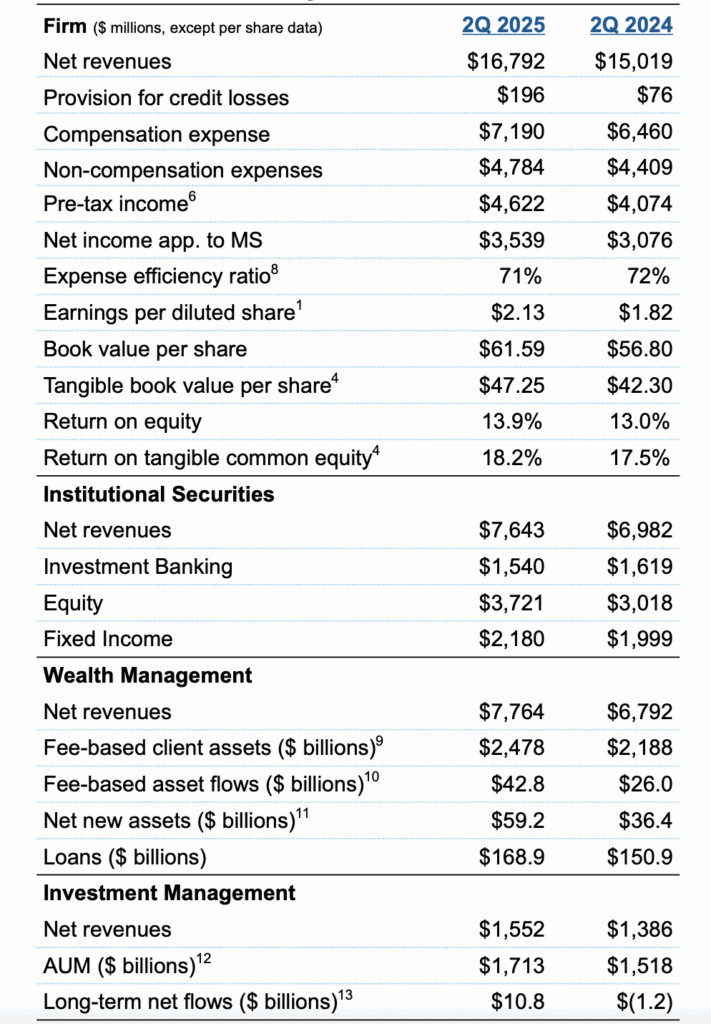

The institutional mobile sector reported net revenue of $ 7.6 billion compared to $ 7.0 billion a year ago. Pre -tax income was $ 2.1 billion compared to $ 2.0 billion a year ago.

Wealth management gave a 28.3% pre -tax margin for the quarter. Net revenue of $ 7.8 billion reflects strong revenue from assets management, higher customer activity and the positive effect of DCP. The company has demonstrated the ongoing power with pure new assets of $ 59 billion and asset flows based on $ 43 billion dollars for the quarter.

The results of investment management reflect the net revenue of $ 1.6 billion, which are mainly based on a higher AUM average management fees.

In all departments, net revenue amounted to $ 16.8 billion for the second quarter ending June 30, 2025 compared to $ 15.0 billion a year ago. The net income applied to Morgan Stanley was $ 3.5 billion or $ 2.13 per share diluted, compared to $ 3.1 billion or $ 1.82 per share diluted, during the same period a year ago.

Ted Pick, President and CEO, said:

“Morgan Stanley handed over another intense quarter, six consecutive fourths of consistent profits – $ 2.02, $ 1.82, $ 1.88, $ 2.22, $ 2.60 and $ 2.13 – reflect higher levels of efficiency in different market environments.

Wealth continues to deliver, adding $ 59 billion of a net new asset and 43 billion in fees. Total customer assets throughout wealth and investment management amounted to $ 8.2 trillion. We announced the increase in our quarterly shares in $ 1.00 per share with flexibility for the development of successive capital. The management team is running throughout the integrated business, acting as a trusted customer consultant and leading durable growth and long -term returns for our shareholders. “