The shares of the NAGA brokerage and investment team (ETR: N4G) traded 5% on Thursday, after the company reported its financial results for Q1 2025.

The All-in-One Financial Superapp Naga provider also said it is expanding its capital market activities and will publish regular temporary announcements in its quarterly results, starting with results for Q1 2025.

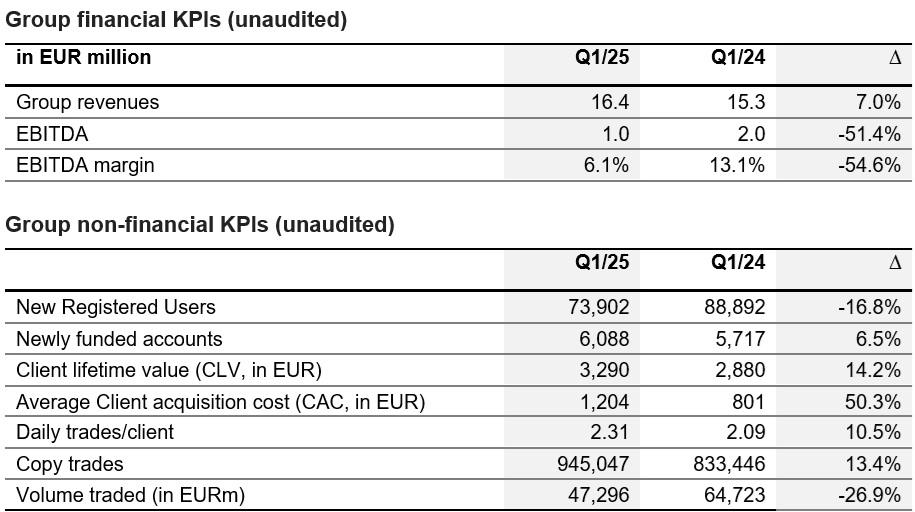

Economics KPI highlight prolonged growth as revenue scales

- Proceeds from the group increased by 7% to EUR 16.4 million (Q1 2024: 15.3 million euros).

- EBITDA at € 1.0 million, despite the strategic increase in marketing spent on boosting brand growth and construction initiatives – EBITDA margin was temporarily affected (Q1 2024: 13%).

- Recent funded accounts have increased by 6.5% to 6,088 reflect a positive orbit as the team activates the marketing machine after the merger.

- The results of Q1 enhance the prediction of 2025.

According to undetected numbers, the NAGA Group – set by the merger of NAGA and Capex.com last year, stated that revenue increased by 7% to EUR 16.4 million (Q1 2024: 15.3 million euros), which led to higher supply incomes, Capital markets.

On the cost of the cost, conscious synergies in staff and operating expenses have contributed positively. The EBITDA team amounted to EUR 1 million (Q1 2024: 2 million euros) despite the strategic increase in marketing expenditure – increasing by EUR 1.6 million compared to Q1 2024 – resulting in a temporary reduction in EBITDA margins to 6% (Q1 2024: 13%). This scheduled investment marks a deliberate step towards boosting NAGA growth and escalation in the following quarters.

Non -financial KPIs are growing positively

In Q1 2025, Naga Group AG welcomed 73,902 new registered users (Q1 2024: 88,892), this decline is expected as the team strategically shifted the focus of Q1 marketing from direct efficiency campaigns. This reposition is expected to enhance NAGA’s long -term visibility and lead to more viable, organic user development in the following quarters.

Despite the shift of the strategy, the number of recent funding accounts increased to 6,088 from March 31, 2025, increased by 6.5% from 5,717 in the third quarter of 2024. In addition, the Customer’s Life Price (CLV) increased by 14.2% to EUR 3,290 (Q1 2024: 2,880 euros), underwriting the powerful. higher revenue production per user.

Octavian Patrascu, chief executive of the NAGA team, said,

Octavian Patrascu, chief executive of the NAGA team, said,

“With our quarterly reporting and our monthly updates, we are boosting the communication of our capital market and offer the international investor community high in transparency and clarity.

Outlook 2025 confirmed

For the financial year 2025, the NAGA Group is on the right track to return to 2023 (Pro Forma), driven by stable organic growth, effective marketing expenditure and business focus. The administration also expects a significant improvement in the EBITDA margin-it is expected to reach the middle double-digit percentage-regulated by the continued implementation of synergies across the group.