Nasdaq, Inc. (NASDAQ:NDAQ) today announced financial results for the fourth quarter and full year 2023.

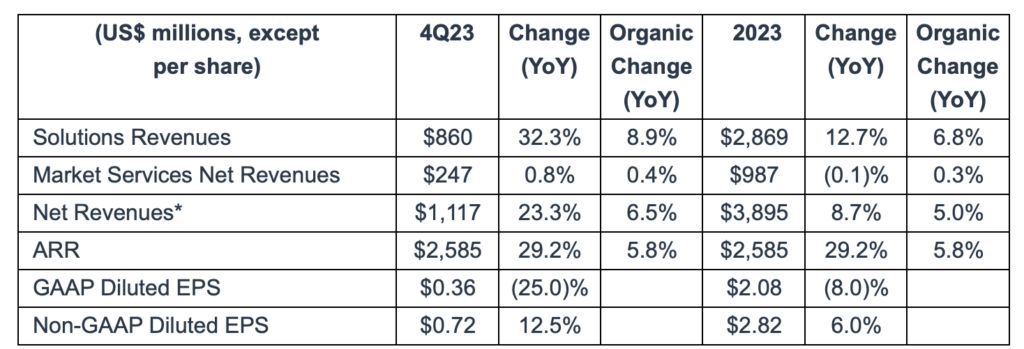

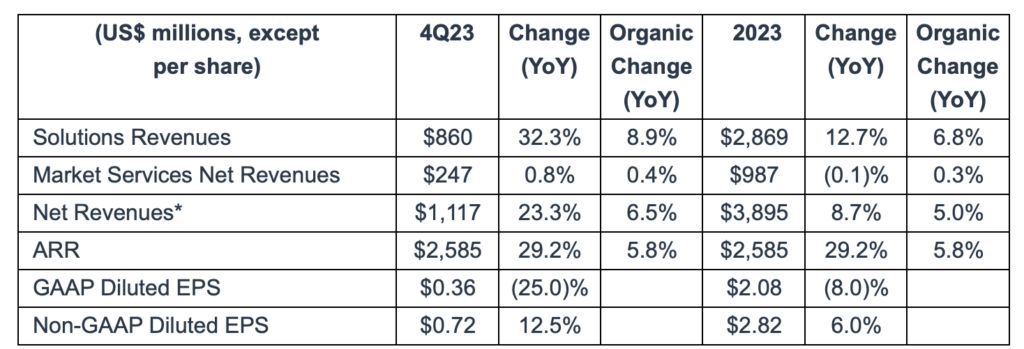

Fourth quarter 2023 net income was $1,117 million, an increase of $211 million, or 23%, from $906 million in the prior year period. Net income reflects a positive impact of $59 million, or 7%, from organic growth, a net benefit of $148 million from acquisitions and divestitures including Adenza and a $4 million increase from the impact of changes in foreign exchange rates.

Solutions revenue was $860 million in the fourth quarter of 2023, an increase of $210 million, or 32%, with organic growth of 9%, reflecting growth from both our capital access platforms and Financial Technology segments.

Market Services net revenue was $247 million in the fourth quarter of 2023, an increase of $2 million, or 1%. The increase reflects $1 million in organic growth and a $1 million positive impact from changes in foreign exchange rates.

Diluted earnings per share were down 8% in 2023 and 25% in the fourth quarter of 2023. Non-GAAP diluted earnings per share were up 6% in 2023 and 13% in the fourth quarter of 2023.

Nasdaq generated $1.7 billion in cash flow from operations.

The company returned $127 million to shareholders in the fourth quarter of 2023 through dividends and $110 million in repurchases of our common stock.

Adena Friedman, President and CEO, said:

“We delivered another strong year of operating performance in a dynamic economic and capital markets environment. We performed well in 2023, maintaining our US listing leadership, achieving an important year for Verafin in our go-to-market strategy and introducing new innovations in our products and services.

We successfully completed the acquisition of Adenza, enhancing our suite of mission-critical technology solutions and accelerating our strategic vision to be the trusted fabric of the global financial system.”