The following is a guest article by Carolane de Palmas, Markets Analyst at Retail FX and CFDs broker ActivTrades.

After several weeks of steady decline, crude Brent appears to have found a short-term floor around $60 a barrel, the lowest level since May 2025. Over the past three sessions, prices have rebounded by nearly 7% on renewed geopolitical tensions and shifting expectations around global supply.

The sharp recovery follows a new wave of US sanctions targeting Russia’s top oil producers Rosneft and Lukoil, a move that has reignited market concerns about possible supply disruptions. Pressure on Moscow is mounting as Europe’s recently adopted 19th package of sanctions and Britain’s recent measures, which also targeted Rosneft and Lukoil, mark a rare moment of alignment among Western powers over energy restrictions.

This combination of technical recovery and escalating geopolitical risk has reintroduced volatility to the oil market and caught the attention of both traders and investors. So, what do you need to know before you take advantage of this renewed volatility? Let’s take a closer look.

Brent Technical Outlook – 10/23/2025

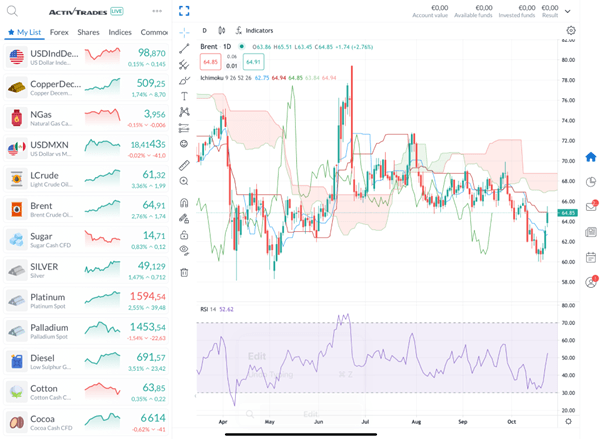

Brent Daily Chart – Source: ActivTrader

Technically, Brent showed strong short-term momentum after testing the $60 support level, which acted as a key reference point for buyers. The recent rally pushed prices above the Kijun-sen and Tenkan-sen lines on the Ichimoku indicator – a sign of a short-term bullish recovery. Meanwhile, the Relative Strength Index (RSI) has risen sharply from near oversold conditions (around 30) to a more neutral reading near 50, reflecting improving buying pressure.

However, the broader trend remains cautiously neutral to bearish. Brent prices are still trading below the Ichimoku cloud, suggesting that a clear trend reversal is yet to be confirmed. The lagging boundary also faces several resistance zones before a sustained bullish breakout is formed. A decisive move above $65–66 and the cloud could signal a return to a more solid upward trajectory, while a failure to hold above $60 could reopen the door to further declines.

Trump has hit Russia’s two biggest oil companies with sanctions

The recent recovery in oil prices came shortly after a major geopolitical move from Washington. On October 23, President Donald Trump announced new sanctions against Rosneft and Lukoil, Russia’s two largest oil producers, which together account for more than 5% of global oil production. The decision marks a dramatic shift in tone from Trump, who just a week earlier had spoken of maintaining open lines of communication with President Vladimir Putin. The planned US-Russia summit was abruptly canceled, with Trump saying it would not produce the “results he wanted”.

According to US Treasury Secretary Scott Bessed, the new measures are aimed at weakening Russia’s ability to finance the ongoing war in Ukraine. “Given President Putin’s Refusal to End This Senseless War, the Treasury Department Sanctions Russia’s Two Biggest Oil Companies Funding the Kremlin’s War Machine,” Bessent he saidurging US allies to align with Washington’s sanctions strategy.

For Moscow, the announcement strikes at the core of its energy sector. Rosneft, which produces about 40% of Russia’s crude oil, and Lukoil, the country’s second largest and most internationally exposed company, are mainstays of Russia’s energy revenues. However, analysts note that the immediate impact on the Russian state budget may be limited, as much of the government’s revenue comes from taxing production rather than exports. Oil and gas revenues – already down 21% year-on-year – still make up about a quarter of Russia’s budget, acting as the main financial lifeline for its war effort.

The Kremlin dismissed the sanctions as “unproductive”, with Foreign Ministry spokeswoman Maria Zakharova insisting Russia had developed “strong immunity” to Western restrictions. However, the move highlights a new phase in US policy against Russia.

US, UK and EU step up concerted pressure on Russia

President Trump’s sanctions did not come in isolation—they follow a broader, coordinated increase in Western pressure on Moscow. Days before the US announcement, Britain imposed new sanctions on Rosneft and Lukoil, targeting the same two Russian oil giants. London also moved against 44 ships in Russia’s “shadow fleet”, a network of tankers used to disguise the origin and movement of Russian crude. The British government described the measures as part of a renewed effort to cut off the Kremlin’s oil revenue, imposing asset freezes, director bans, transport restrictions and bans on UK trust services.

Meanwhile, on October 23, the European Union approved the 19th package of sanctions against Russia – the toughest yet. The European Commission hailed the move as a decisive step to step up pressure on Russia’s war economy, extending restrictions to key sectors such as energy, finance and defence.

The new EU measures include a complete ban on imports of Russian liquefied natural gas (LNG) — effective from January 2027 for long-term contracts and within six months for short-term deals. They are also introducing a complete trading ban on Rosneft and Gazprom Neft, two mainstays of Russia’s energy exports. In addition, the EU took the unprecedented step of sanctioning third-country companies, including two Chinese refiners and an oil trader, accused of facilitating crude sales to Russia and helping to maintain war revenues.

Together, these measures represent the most concerted Western effort since the early stages of the conflict in Ukraine. The alignment of US, British and EU sanctions signals a renewed determination to limit Moscow’s access to global energy markets and financing channels. For global oil traders, this policy convergence raises the risk of further supply disruptions, explaining the recent recovery in Brent prices.

Why the next moves by India and China could redefine global oil prices

The reaction of India and China – Russia’s two biggest oil customers – is key to the future of global oil prices. Following Washington’s sanctions on Rosneft and Lukoil, both countries appear to be reassessing their energy ties with Moscow, a shift that could dramatically reshape global supply dynamics.

In India, refiners are preparing to sharply reduce imports of Russian crude to stay compliant with US sanctions. This marks a major shift for the world’s third-largest oil consumer, which has relied heavily on discounted Russian oil in recent years. Russia provided about 36% of India’s oil imports in the first half of 2025 (Kpler), making it New Delhi’s top source of crude oil. The country imports about 80% of its total oil needs and domestic production cannot meet rapidly growing demand

However, India’s decision is not purely political. The move is also linked to economic negotiations with Washington. The US recently imposed 50% tariffs on Indian exports, half of which were justified as retaliation for continued purchases of Russian oil. A potential trade deal could reduce those tariffs if India ends its energy ties with Moscow. However, a decline in Russian crude would pose serious challenges: after earlier US pressure forced India to halt imports from Iran and Venezuela, affordable alternatives are limited.

India also plays a unique role as a global refining hub. Much of the Russian crude it buys is refined locally and re-exported as refined fuel to Western markets. This has created a paradox: Western countries, while imposing sanctions on Russian oil, have continued to import fuel produced from it through Indian refineries. The new US sanctions, with a grace period until November 21 for companies to end Russian oil trades, could disrupt this complex trade flow and reshape global refining dynamics.

Meanwhile, China, Russia’s biggest energy partner, is similarly wary. Major state refiners have suspended purchases of offshore Russian oil, although imports from smaller independent refiners – so-called “tea makers” – continue. China currently buys about 1.4 million barrels per day by sea, plus another 900,000 barrels per day by pipeline. While pipeline flows to PetroChina are expected to continue largely unaffected, the temporary suspension of seaborne imports by state-owned companies signals a clear intention to avoid entanglement with US sanctions.

If both India and China significantly cut crude purchases from Russia, Moscow could lose access to two of its most important customers, putting severe pressure on its revenues. At the same time, the sudden shift in demand would likely push up prices for unsanctioned oil from the Middle East, Africa and Latin America, curbing global supply and pushing up prices.

Sources: Wall Street Journal, Reuters, CNN Business, European Commission, US Treasury

The information provided does not constitute investment research. The material has not been prepared in accordance with legal requirements intended to promote the independence of investment research and should therefore be regarded as a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT prices, nor an offer or solicitation to trade in any financial instrument. No representation or warranty is made as to the accuracy or completeness of this information.

Any material provided does not take into account the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Accordingly, any person acting on the information provided does so at their own risk. Forecasts are not guarantees. Prices may change. Political risk is unpredictable. Central bank actions may vary. Platforms tools do not guarantee success.