Payments Paysafe Limited (NYSE: PSFE) platform announced its financial results for the first quarter of 2025.

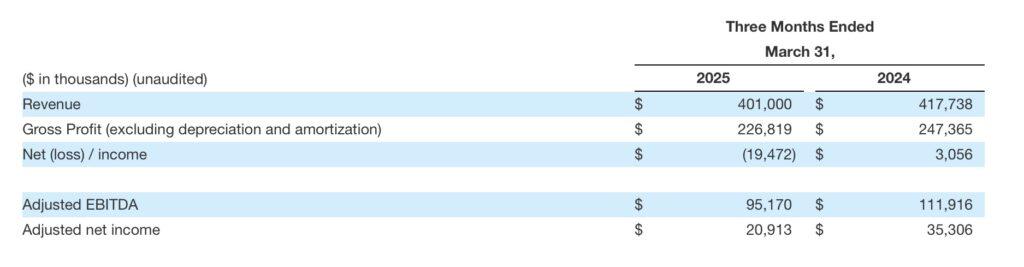

The revenue reported for the first quarter of 2025 was $ 401.0 million, a $ 4% reduction, compared to $ 417.7 million in the previous period, reflecting a 6% reduction from the business solutions driven by the business disposal, as well as a 2% reduction in exchange rates.

The increase in organic revenue was 5%, reflecting 6% organic growth from commercial solutions and 3% organic development from digital wallets.

The net loss for the first quarter was $ 19.5 million, compared to the net income of $ 3.1 million in the previous year, mainly due to revenue reduction, the reduction of other incomes associated with the lowest profits in foreign foreign exchange and revenue. This was partially offset by the recognition of an income tax benefit during the current period, as well as by reducing the sale, general and administrative expenses, including lower credit losses.

Customized net income for the first quarter decreased to $ 20.9 million, compared to $ 35.3 million during the previous year, reflecting mainly the reduction of custom EBITDA and increasing the customized effective tax rate resulting from the inclusion of the taxpayer.

Customized EBITDA for the first quarter decreased to $ 95.2 million, compared to $ 111.9 million during the previous year, reflecting businesses in addition to Business Mix and lower interest revenue, which was adverse to gross profit.

The combined headlines from exchange rates and interest revenue to consumer deposits in the first trimester and custom EBITDA were $ 9.3 million (2 percentage points) and $ 5.4 million (5 percentage points), respectively.

The first quarter cash flow was $ 52.5 million, compared to $ 58.8 million in the previous period. The Unlevered Free Cash Flow amounted to $ 57.3 million, compared to $ 69.2 million during the previous year.

As of March 31, 2025, total cash and cash equivalents were $ 234.3 million, total debt was $ 2.4 billion and net debt was $ 2.2 billion. Compared to December 31, 2024, total debt increased by $ 21.1 million, reflecting net repayments of $ 26.8 million and traffic in exchange rates.