Retail FX and CFD broker Plus500 Ltd (LON:PLUS) today provided a trading update for the second quarter and first half of 2024.

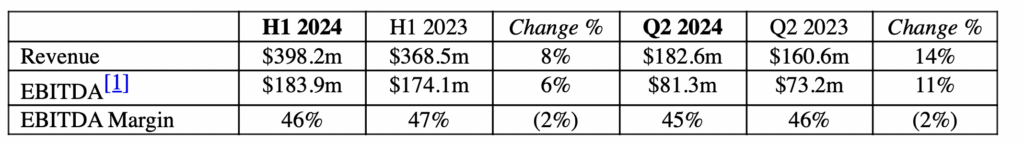

For the second quarter of 2024, the company reported revenue of $182.6 million, up 14% from the same period last year. This follows the revenue growth recorded in the first quarter of 2024.

For the six months ending June 30, 2024, the company reported revenue of $398.2 million, up 8% from a year earlier.

The Group’s balance sheet remained robust and its own cash balances at 30 June 2024 were over $1 billion.

The Group successfully onboarded 56,759 new customers during the first half of 2024 (1H 2023: 50,449), including 24,810 in the second quarter of 2024 (2Q 2023: 22,248). The Group’s active customer base was 175,909 in the first half of 2024 (1H 2023: 175,762), including 123,803 in the second quarter of 2024 (2Q 2023: 122,833).

During the first half of 2024, Plus500 announced shareholder returns of approximately $175 million through dividends and share repurchases, supported by its strong financial position. During the first half of 2024, the Company bought 3,229,215 shares, with an average price of £19.73, for a total price of $80.7 million. As of June 30, 2024, the remaining number of the Company’s common shares in issue was 76,509,277.

Plus500’s Board of Directors remains confident about the outlook for 2024 and beyond and expects Plus500’s revenue and EBITDA for the current financial year to be in line with current market expectations.

David Zruia, CEO, commented:

“Plus500 remains well positioned to capitalize on both near-term market conditions and longer-term growth trends in its end markets. In the short term, our increasingly diversified offerings and intelligent trading platforms enable customers to access a wide variety of products, services and functions across multiple markets. In the medium term, we will continue to invest in our strategic roadmap initiatives, which are made possible by our leading technology, deep customer loyalty and strong financial position.”