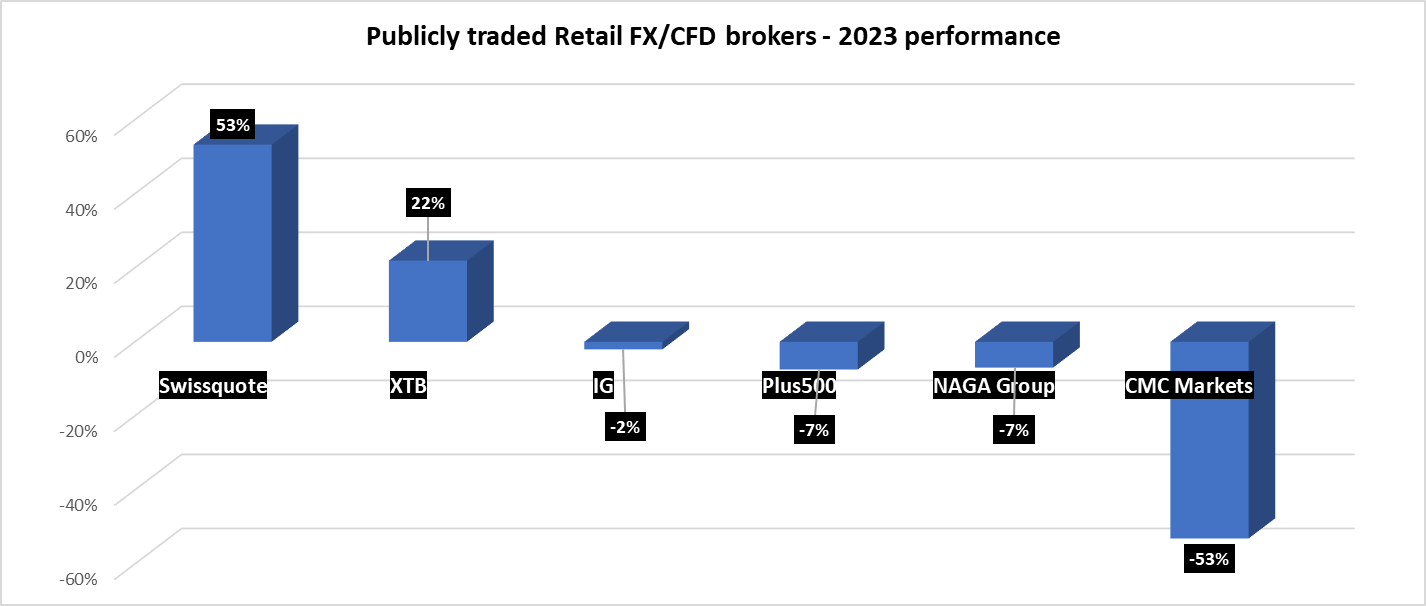

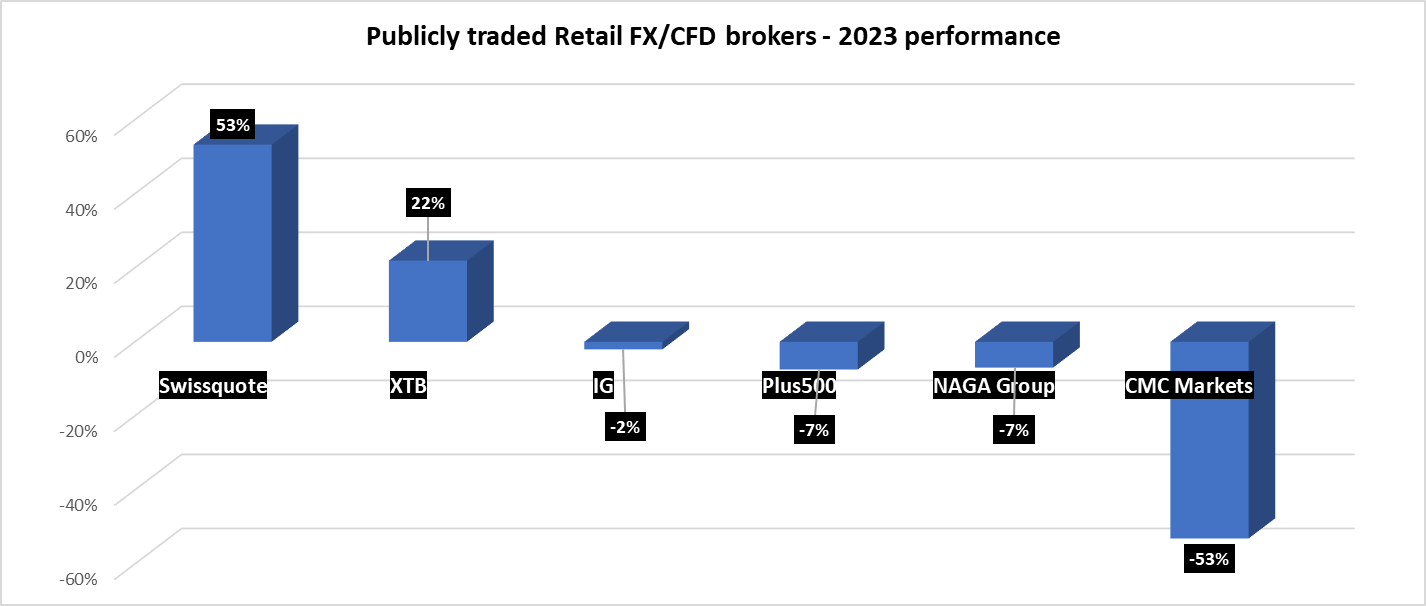

As we enter the new year and look back to 2023, a good barometer of what has happened overall in the global FX and CFD brokerage sector is taking a look at listed brokers and their stock performance.

While the vast majority of the hundreds of licensed Retail FX and CFD brokers (and even more unlicensed / offshore brokers) remain private companies, some of the leading brands are ‘public’ and their shares are traded on a daily basis on various stock exchanges – which it also requires them to report financial and operational results on a regular basis. These include IG Group, CMC Markets, Swissquote, XTB, Plus500 and NAGA Group.

A quick look at the stock performance of these brokers in 2023 provides, we believe, a very good summary of the industry as a whole. It’s been (overall) a good market for FX/CFD brokers in terms of new client registrations and trading volume (and revenue and profits), but not exactly smooth sailing. As we detail in our top FNG FX and CFD trading industry news for 2023, some brokers are clearly doing better than others and some are struggling, in what remains a very competitive environment.

Comparing the numbers in the chart above (with more data in the table below), FX/CFD broker stocks up 0.9% on average in 2023 – basically flat. But a quick “visualization” of the chart gives the real picture a bit clearer – it was a very “mixed” market, from the Swissquote share price up 53% to CMC down 53%.

The performance of these FX/CFD trading brokers must of course be seen in the context of the overall equity market. Which, like our chart above, was also very mixed. In Europe the FTSE 100 (+2%) was basically unchanged, although the S&P500 in the US was up a healthy 25% in 2023. Germany’s DAX saw a similar rise of 19%.

It appears that the stock market has been in “good shape” over the past year, but investors are quick to reward (or punish) companies that exceed (or fall short) expectations.

Our pack leader in 2023, Swiss e-trading leader Swissquote (+53%), actually outpaced a 15% share price drop in mid-March after posting sluggish results at the end of 2022 as excitement continued to build around the company’s balanced banking – bid and trade, supported by impressive 1H 2023 results at Swissquote. At CHF 204.60, shares of Swissquote ( SWX:SQN ) are again nearing their 52-week high, just above CHF 207.

Poland-based XTB (WSE:XTB) has also had a very good year, with its shares trading up 22% in 2023 to join a very elite club of brokers with a market cap of more than $1 billion.

At the other end of the spectrum, Plus500 (-7%), NAGA Group (-7%) and CMC Markets (-53%), appear to have left investors unimpressed. For NAGA Group (ETR:N4G) following an 85% collapse in share price in 2022 and in late December the company announced acquisition plans from Capex.com.

One more thing to mention is that this list remained the same in 2023 as in 2022, following an attempt by Australia/London-based ThinkMarkets to go public (via a SPAC merger) towards the end of the year. ThinkMarkets’ IPO attempt follows two similar failed attempts by other brokers in the past year and a half, with eToro and Saxo Bank canceling SPAC mergers in the US and Europe, respectively.

How will 2024 shake out for online brokers?

Stay tuned to FNG…

| Share price in: | Market Cap | |||

| 31-12-22 | 31-12-23 | % change | (USD $M) | |

| Swissquote | 133.5 | 204.6 | 53% | 3734 |

| XTB | 31.02 | 37.82 | 22% | 1128 |

| IG | 785 | 769 | -2% | 3771 |

| Plus500 | 1804 | 1669 | -7% | 1682 |

| NAGA Group | 1.15 | 1.07 | -7% | 64 |

| CMC Markets | 224 | 105 | -53% | 374 |

| Average performance | 0.9% | |||

| Average performance | -4.5% | |||

Share prices are quoted in the currency quoted. Market cap statistics converted to USD.