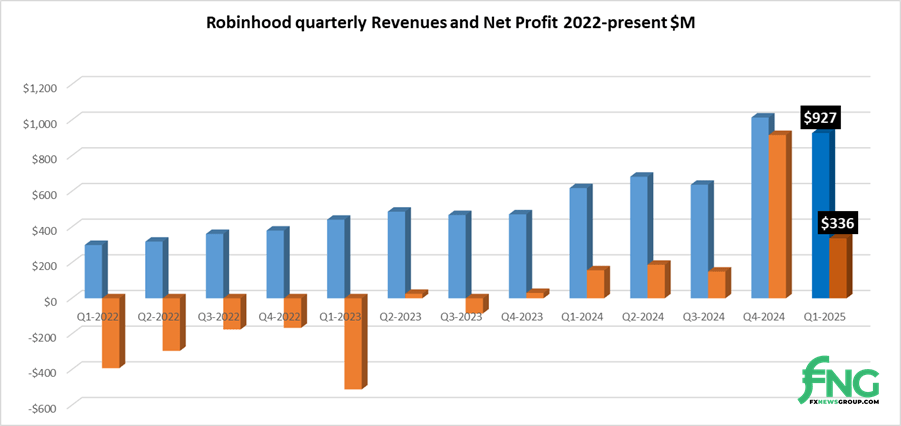

After a record setting, inflating the Q4 led by the encryption pending after Donald Trump’s elections, American Neobroker RobinHood reported results for Q1 2025 which was not as good as the previous quarter, but still very impressive from a historical perspective.

After seeing $ 1 billion revenue and net profit hit $ 916 million in the fourth quarter (thanks to a tax benefit of $ 358 million), RobinHood reported $ 927 million ($ 33 million) and $ 33 million in Q1 2025.

RobinHood’s shares responded positively to the news, with the exchange after purchase late Wednesday and early Thursday seeing a 1% increase in Nasdaq: Hood. RobinHood’s shares (in about $ 49) are still good from the high 52 weeks of $ 66.08, in mid -February, before buying shares (and encryption).

The RobinHood Board of Directors increased the company’s shares with $ 500 million to $ 1.5 billion.

Vlad Tenev, President and CEO of Robinhood, said,

“This quarter, we have greatly accelerated the innovation of products in all our basic initiatives, highlighted by the announcement of Robinhood, banks and bark strategies.

Jason Warnick, head of financial director of Robinhood, said,

Jason Warnick, head of financial director of Robinhood, said,

“We started the year from the powerful, driving market share profits, closing the acquisition of Tradepmr and remaining disciplined for expenses,” said Jason Warnick, head of RobinHood’s financial director. “As a result, in the third quarter, we increased the revenue by 50 % annually and EPS by over 100 percent.

RobinHood Q1 2025 Results

- Total net revenue It increased by 50% on an annual basis to $ 927 million.

- Revenue based on transactions It increased by $ 77%annually to $ 583 million, driven mainly by $ 252 million incase revenue, up 100%, revenue of $ 240 million, a $ 56%increase and $ 56 million shares, up $ 44%.

- Net income from interest It increased by 14% on an annual basis to $ 290 million, based mainly on the increase in assets and lending to securities, is partially offset by lower short -term interest rates.

- Other revenue It increased by 54% annually to $ 54 million, mainly due to increased gold subscribers.

- Net income It increased by 114% on an annual basis to $ 336 million.

- dProfits per share (EPS) Increased by 106% on an annual basis to $ 0.37.

- Overall operating expenses It increased by 21% on a year to $ 557 million.

- Customized operating expenses and shares-based compensation (SBC) (Non-GAAP) increased by 16% annually to $ 533 million, including tradepmr costs.

- Custom EBITDA (Non-GAAP) It increased by 90% on a year to $ 470 million.

- Funded customers It increased by 1.9 million, or 8%, on an annual basis to 25.8 million.

- Investment Accounts It increased by 2.6 million, or 11%, on an annual basis to 27.0 million.

- Total assets of platform It increased by 70% on an annual basis to $ 221 billion, driven mainly by ongoing clean deposits and the acquisition of Tradepmr.

- Clean deposits It was $ 18.0 billion, an annual rate of 37% growth over the total assets of the platform at the end of the 2nd 2024.

- Media revenue per user (ARPU) Increased by 39% on an annual basis to $ 145.

- Gold Subscribers RobinHood It increased by 1.5 million, or 90%, on an annual basis to 3.2 million.

- Cash and cash equivalents A total of $ 4.4 billion compared to $ 4.7 billion at the end of Q1 2024.

- Repurchase It was $ 322 million, representing $ 7.2 million shares of Class A shares at average per share of $ 44.87. This is more than the compensation of the 2.0 million shares of the Common Share of Category A issued in relation to the acquisition of Tradepmr.

RobinHood Q1 Highlights

RobinHood said it was executed in a strategy with strong product speed in Q1, releasing cutting -edge products for customers, with more in pipelines.

- Reinforced products for active traders – RobinHood continues to develop advanced capabilities and tools for active traders aimed at making faster, clearer and more intuitive transactions. The desktop trading platform, the RobinHood legend, now has increased speed, support for index and encryption options and new markers and charts. In March, RobinHood expanded the prediction markets it offers with the start of a hub and giving customers the opportunity to exchange the results of some of the world’s biggest events. During the last six months, customers have negotiated more than 1 billion of events.

- Increasing wallet share by serving all the financial needs of customers – During the second annual Gold Keynote event in March, Robinhood presented offers New Advisory, Banking and AI: Robinhood Strategies, RobinHood Banking and Robinhood Cortex. With plans to be released to all customers in the coming weeks, RobinHood strategies already serve more than 40,000 customers and manage more than $ 100 million in assets from April 25, 2025.

- Creation of a global economic ecosystem – RobinHood continues to make progress internationally, with more than 150,000 customers across the United Kingdom and the EU. The acquisition of the world -gradient Exchange Bitstamp Ltd. It is on the right track to close in the middle of this year, without prejudice to the usual closing conditions.

- RobinHood’s board allows an additional $ 500 million in shares – Following the authorization of a $ 1 billion repurchase program announced in May 2024, the Robinhood Board of Directors has authorized an additional $ 500 million, bringing the program to $ 1.5 billion in total. Until April 25, 2025, 20 million shares of Class A shares have acquired an average price of $ 33.40, representing a total of $ 667 million. The rest of the authorization is now about $ 833 million, which the administration expects to be executed in the next two years, with flexibility accelerating if market conditions justify.

Additional Q1 2025 Operating Data

- Worthy AUC retirement It increased more than 200% on a year -long basis on a record of $ 14.4 billion.

- Cash scanning It increased by 48% on an annual basis on a record of $ 28.2 billion.

- Marginal book It increased by 115% on an annual basis on a record of $ 8.8 billion.

- Shares It increased by 84% on a year to $ 413 billion.

- Options contracts are negotiated It increased by 46% on an annual basis on a record of 500 million.

- Encrypted volumes of trading It increased over 28% on an annual basis to $ 46 billion.

The full report of RobinHood Q1 results 2025 can see here.