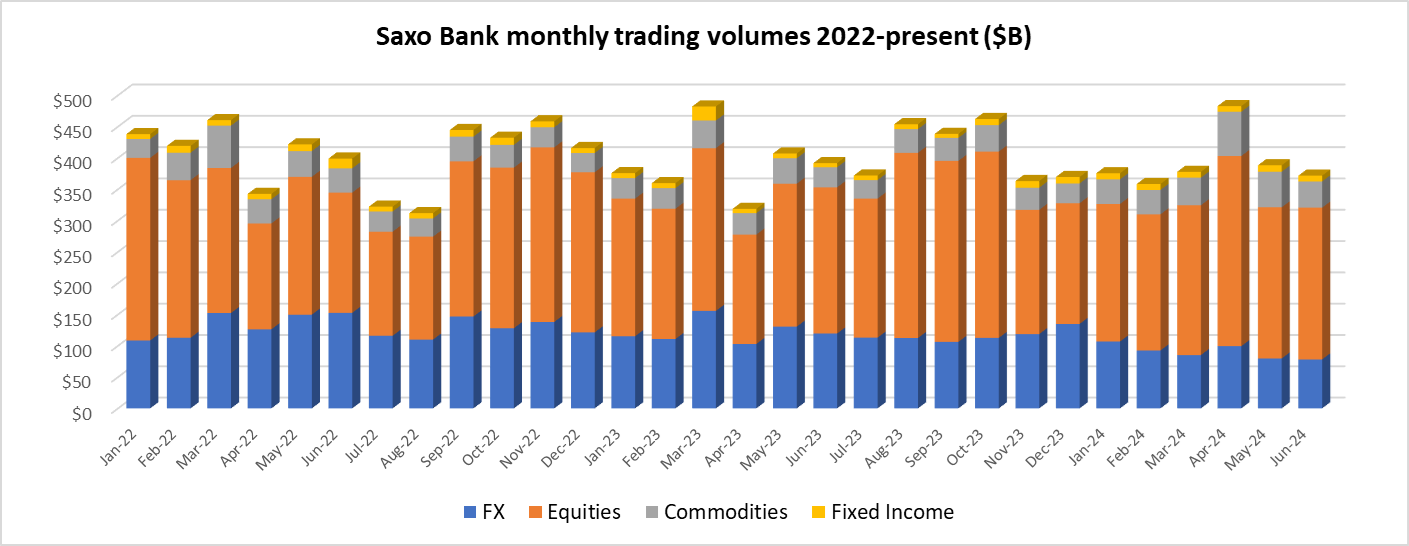

After falling 20% in May, client trading volumes at Copenhagen-based Saxo Bank Retail FX and CFDs continued to decline in June 2024, with total trades at $371.6 billion in the month, down 4% from last month.

While equity trading was flat month-on-month at $242 billion, Saxo’s core forex trading volume fell to another multi-year low, totaling $78.1 billion in June.

For the first half of 2024, Saxo Bank’s trading volume averaged $392 billion per month, down 2% from $399 billion in 2023.

We had exclusively reported earlier this week that the company started the second half of 2024 by sending a note to its institutional partners that Saxo Bank had decided to stop the entry of clients in certain countries, including Brazil, Canada, China, Cyprus, Egypt, India , Indonesia, New Zealand, South Africa, Taiwan and Turkey, among others. We will see in the coming months if this move has an effect on trading volume going forward.

The other major initiative we reported on in the first half of the year was Saxo Bank hiring investment bankers to explore a possible sale of the company. Saxo Bank’s main shareholders are the Chinese conglomerate Geely Group (known increasingly for its electric cars) which owns just under 50% of Saxo (49.88%), CEO Kim Fournais through Fournais’ company Holding (28.09%) and the Finnish company Mandatum (19.83%) ).

Client trading volumes at Saxo Bank in June 2024 were as follows:

- FX trading fell 2% MoM to $78.1 billion.

- Shares remain at $242.4 billion.

- Merchandise fell 26% to $41.9 billion.

- Fixed income trading fell 11% to $9.2 billion.