The multilevel investment special Saxo Bank begins the provision of its investors-a research designed to ask customers what they pay attention to and how they plan their investment strategy in the last three months of the year.

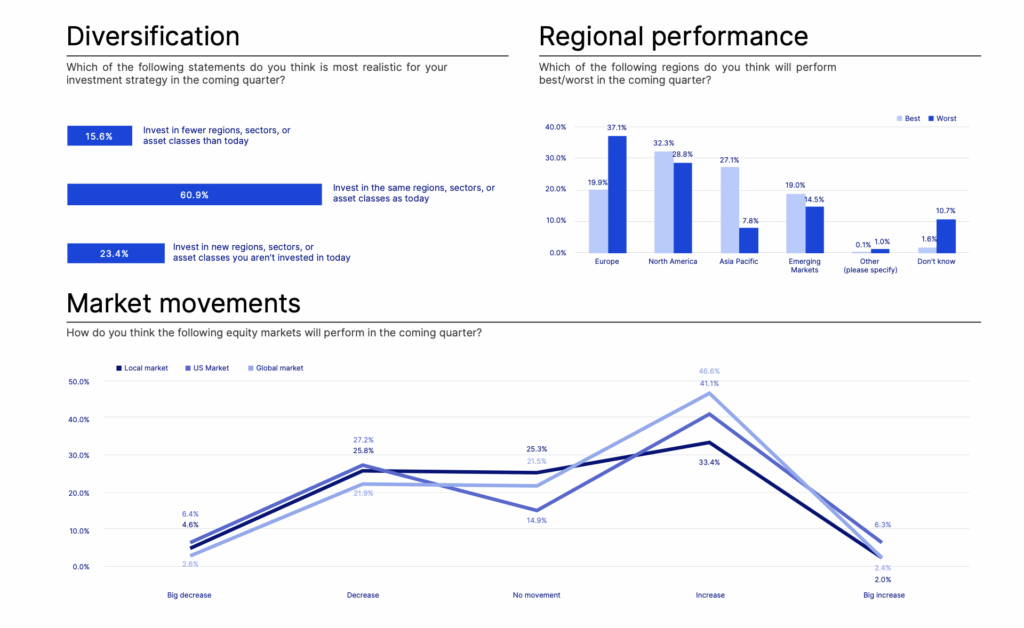

In the forecast of investors, Saxo asked its customers how they believe that three different stock markets – local, US and World – will execute. The survey reveals that 49% of the 1,834 respondents believe that the global stock market will see an “increase” or a “large increase”, while the same number for their local markets is 35%.

Global confidence is also supported by customers’ answers around areas where investors believe will execute the best and worst. Here, North America and Asia-Pacific are described as the most popular, with 32% and 27% choosing these two and 37% choosing Europe (where most of the respondents reside) as the worst performance.

“Seeing how our customers see that the world of investment is so interesting and their faith in global markets compared to local is really something to be noted, especially in two respects. Jacob Falkencrone, World Head of Investment Strategy.

The investor’s prediction characterizes the differences of countries, which paint an interesting picture of what investors’ minds are in the different markets of Saxo. For example, Denmark is the most supportive of its local stock market, the French are the most open to differentiate their portfolio, while the Dutch use AI at least as part of their investment process, and Japan is the most optimistic on behalf of the US.

You can read the full report here.