SIX today launched a family of global equity indices designed specifically for the retail, private banking and asset management sectors.

The new indices come in response to the growing appetite of financial institutions to gain a clearer picture of the stocks and markets in which their clients’ money is invested, as well as their performance. In addition to empowering financial institutions to provide clients with a simple, digital portal through which they can view their equity investments, the new offering will significantly reduce the administrative burden for many existing SIX clients. Instead of subscribing to multiple sources, SIX can provide access to equivalent indexes with reduced administrative overhead.

In addition, SIX’s use of API technology means that financial institutions can offer additional data sets to clients, such as real-time pricing information around a particular equity, along with more granular details about its performance. Also, financial institutions will no longer need to interact with multiple index and data providers in order to be able to offer these services to their clients.

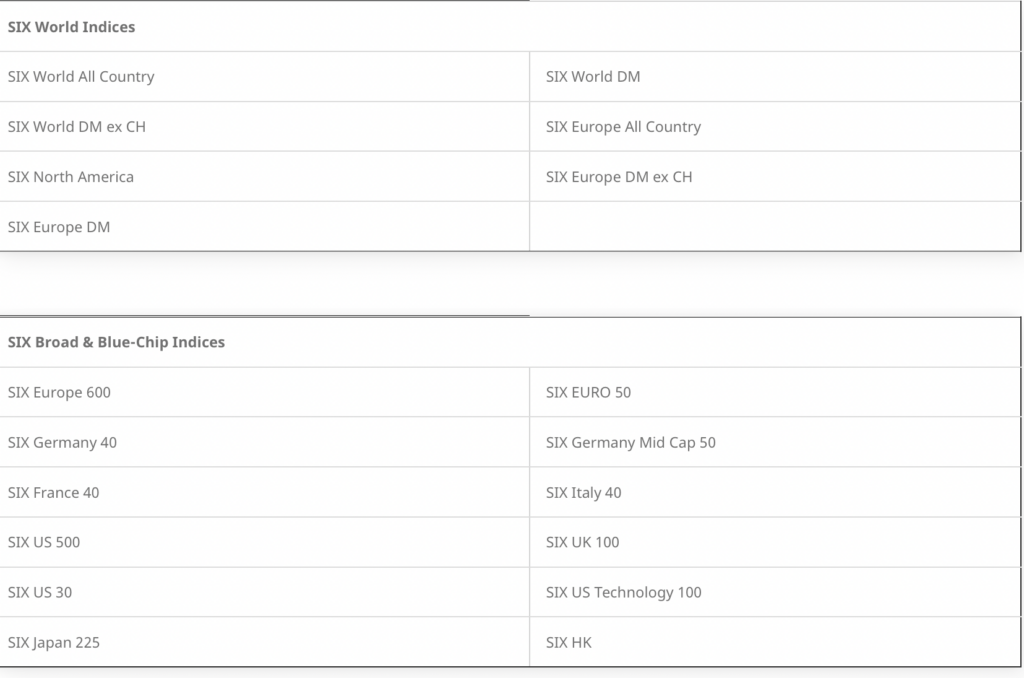

The SIX Global Equity Indices include the SIX World and the SIX Broad & Blue-Chip Indices.

The SIX World Indices have a variable number of components that aim to provide the broadest market representation for a diversified set of major geographies. The indices are reviewed on a semi-annual basis in June and December and their figures are weighted by market capitalization with a free float. The calculation is done in USD, EUR and CHF, and the spread is done only at the end of the day.

The SIX Broad & Blue-Chip Indices comprise indices with a fixed number of components that aim to capture the most representative companies of geographic or economic settlements from a medium to country level. Review frequencies are determined individually (with the majority balanced on a quarterly, annual or semi-annual basis). Index components are typically market capitalization-weighted with free float, although some indices are offered as price-weighted.

The existing Swiss (SMI/SPI/SBI/SARON), Spanish (IBEX35), Nordic and ESG indices from SIX are already popular with a wide range of global banks, asset managers and asset owners. To improve and simplify the customer experience, the solution combines all key indicators and instrument data into a single delivery channel, the Web API. This includes share prices, index values, index data, reference data, company action information and regulatory data.

All indices are available in USD, EUR, CHF and local currencies and as price, net and gross returns. SIX Global Indices also serve as the basis for fully customized indices, depending on individual client requirements and use cases in visualization, derived data, reporting, portfolio, risk and asset management.

Dr. Christian Bahr, Head Index Services, Financial Information, SIX, commented:

“Building a strong presence in the banking sector is paramount to being recognized as a key player in global market indices and data. With the continued growth of passive investing, this has become increasingly important in recent years. Many financial institutions are in the process of revamping their online banking products, including their own websites and apps. SIX supports them with a more sophisticated overview of market performance for their investment-savvy clients, and our combined API delivery proposition will make access to this data faster, simpler and more cost-effective for financial institutions. We look forward to creating further innovations in this exciting space.”