Six today published its financial report for the first semester (H1) of 2025.

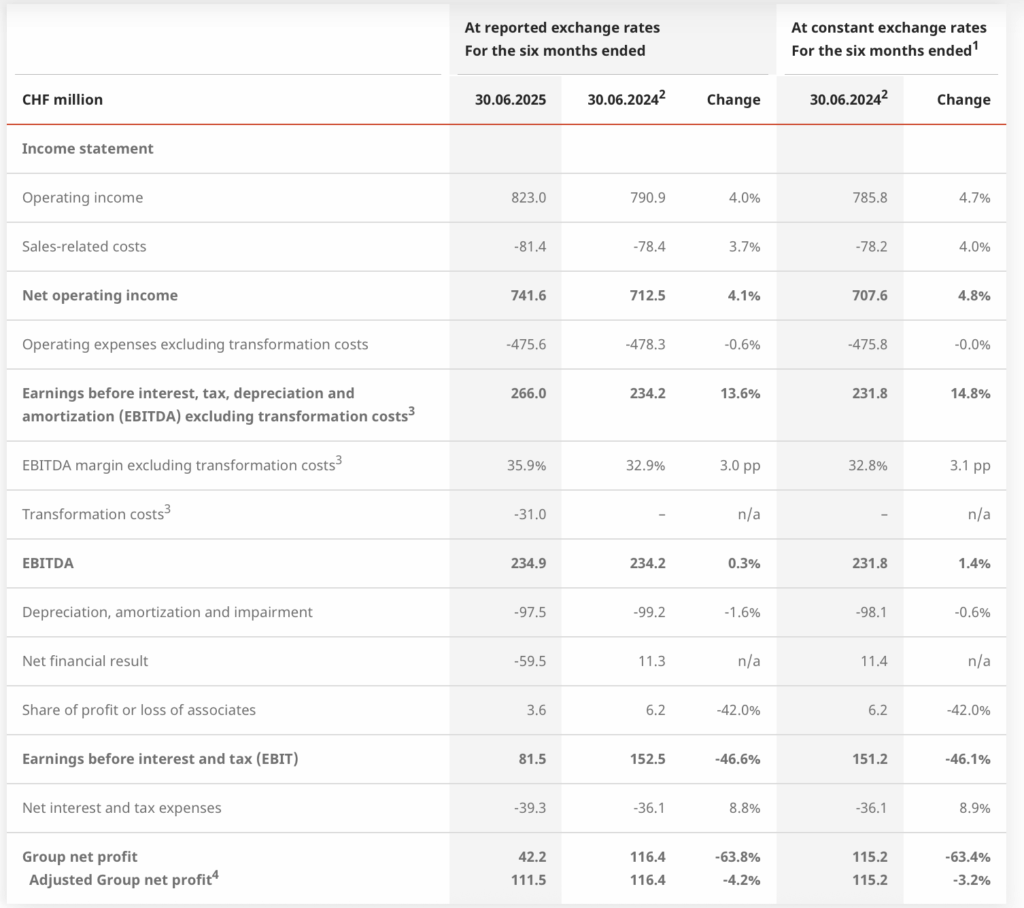

The Group increased its operating revenue by 4.7% annually to CHF 823.0 million (in fixed exchange rates). In the reported exchange rates, this increase was 4.0%.

Less costs associated with sales, net operating revenue was 741.6 million CHFs, up 4.8% in fixed exchange rates and increased by 4.1% in the reported exchange rates. The transformation program increases in 2027, began contributing to both income growth and cost savings. Transformation correlation (TC) correlative expenses in the first half of 2025 were 31.0 million.

Excluding TC, operating expenses were 475.6 million CHF, according to the first half of 2024. net operating income.

Due to the reduction in stock prices in Worldline, six adapted the value of a 10.5% of the European payment provider by 69.3 million CHF.

Profits before interest and taxes (ebit) were 81.5 million CHF. The team’s custom net profit was 111.5 million CHF, compared to 116.4 million CHF in the first half of 2024. The net team profit was 42.2 million CHF.

In the business unit of exchanges, the trend of increasing transactions work launched in the second half of 2024 was strongly supported by elevated levels of volatility in the first half of 2025. In Six Swiss Exchange, the ETF transaction cycle for the reference period increased by more than 100% compared to the first year. Also strong results, leading further growth.

The Mobile Services Business Unit was again able to achieve a strong increase in its basic business sectors over a strong comparative period, thereby compensating partially to reduce net interest income. The main drivers of organic development were domestic and international custody business, followed by mobile funding. SDX has been incorporated into the Securities Services Business Unit to use synergies as part of the wider six ecosystem.

The Business Information Unit also continued its growth trajectory. Moving from the organic development and acquisitions of Factentry in March 2024 and the Swiss Fund’s data at the beginning of 2025, the business unit was able to offset the negative impact of exchange rates. The main drivers of organic development were market data and products and promotion services, special real -time data, followed by tax and regulatory services and indicators.

Banking services have shown a strong increase in processing and billing services, as well as prices and payments. Significant drivers were higher volumes of trading, as well as debit work and related digital services.