- Solana price leads a medium -term recovery voltage in a growing wedge standard.

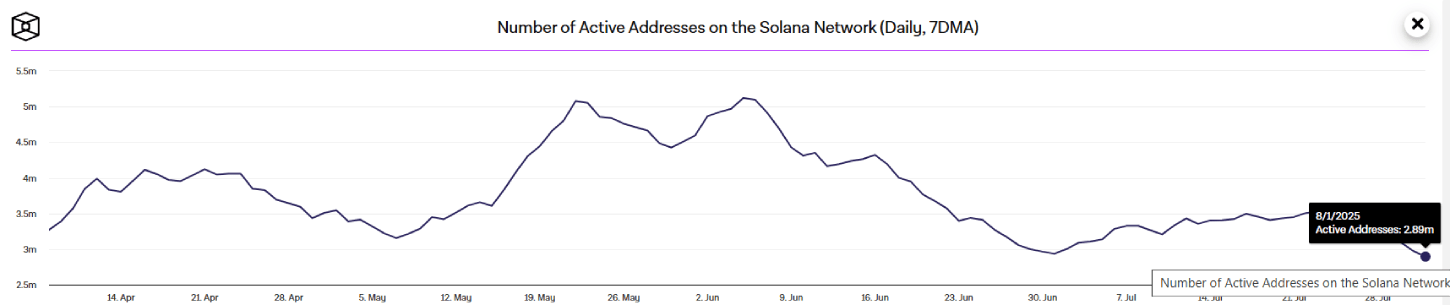

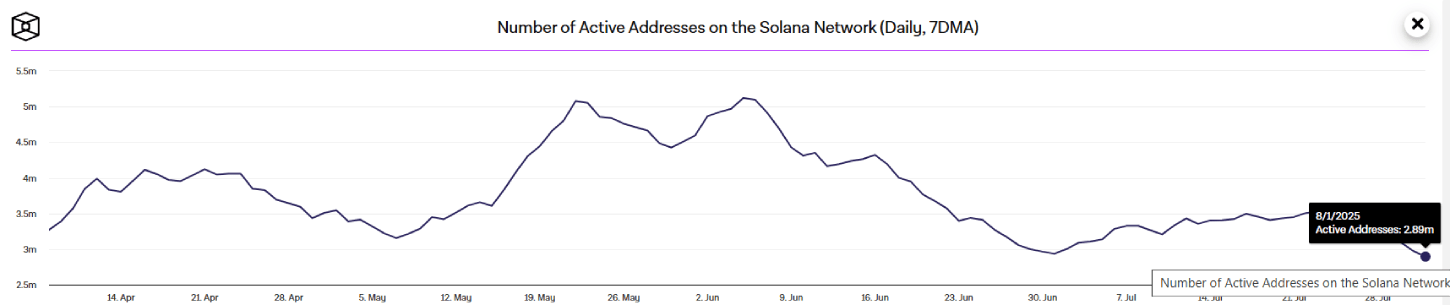

- The number of active addresses on the network was reduced by 18% over two weeks, indicating a clear slowdown in users’ involvement.

- The distribution of SOL prices below the 200 -day EMA slope marks a possible 7% reduction in the near future.

Sol, the inherent encryption of the Solana network, sank more than 3.87% during the US market and traded at $ 1.65. Bearish Pullback has almost evaporated the entire profit on the second market of this Altcoin, marking the continuation of the prevailing correction. The declining voltage in the number of active addresses in the network and open interest markets further enhances the dynamics of the price. Is SOL coin that head under $ 150?

The Solana Price Breaks Bower Crucial $ 165 Support in the midst of a User Activity Fall

In the last two weeks, the Solana price has been a significant correction of $ 205.75 at the current trading price of $ 162.28, recording a loss of 21.13%. Initially, the sales pressure came as a correction after the Rall on the wider market, but it won an additional impulse with the remarkable reduction in the number of active addresses on the SOL network.

According to Block details, the Active addresses in Solana They have been immersed abruptly from 3.53 million to 2.89 million, which now records a loss of 18.1%.

This decline indicates a notable delay in the involvement of users and trading on the Solana network. The fall can be attributed to the feeling of danger to the market, resulting in reduced Defi activity. If the voltage continues, the momentum of the Solana network can face a short -term failure, possibly by limiting the prospects of price recovery.

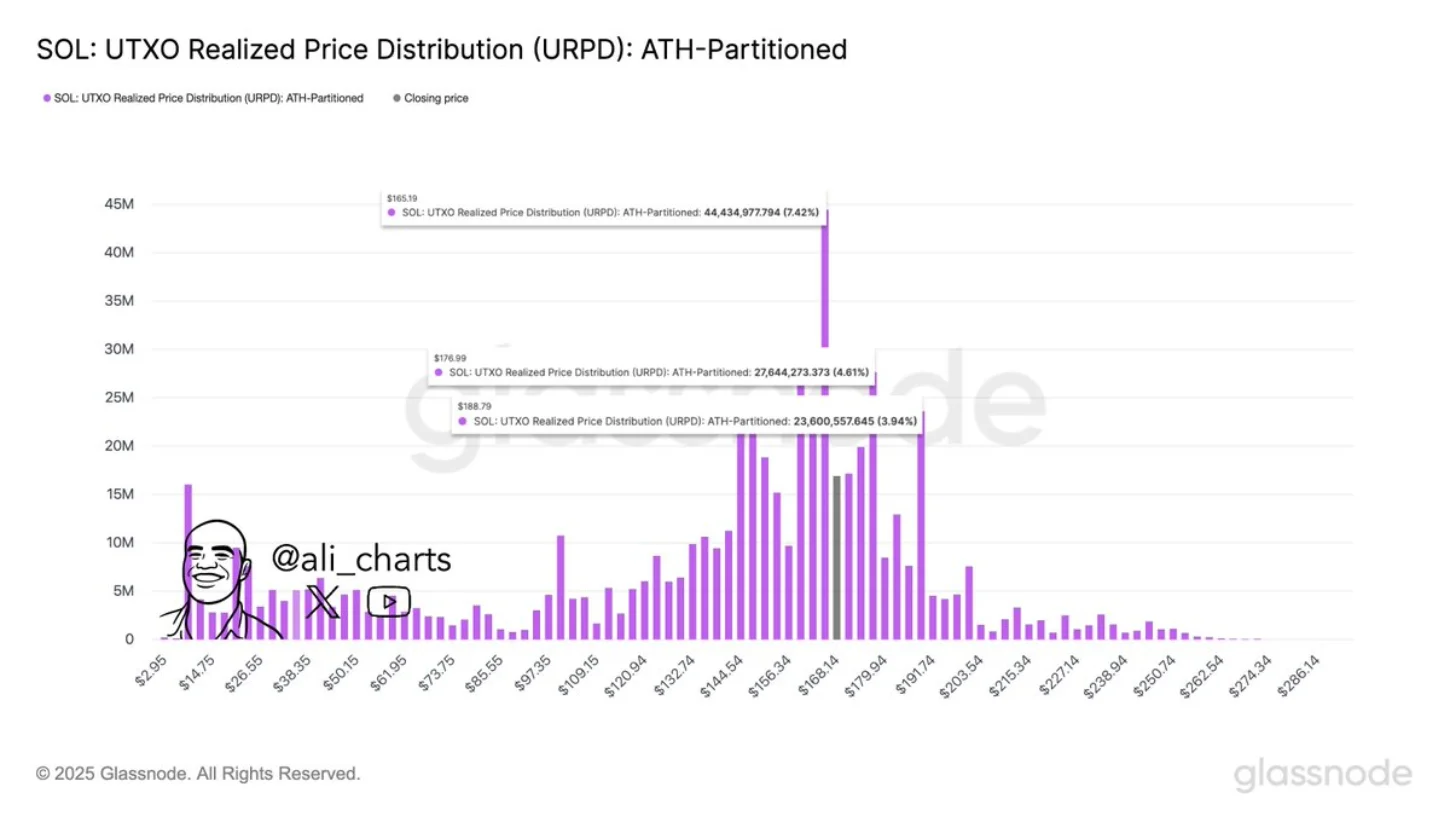

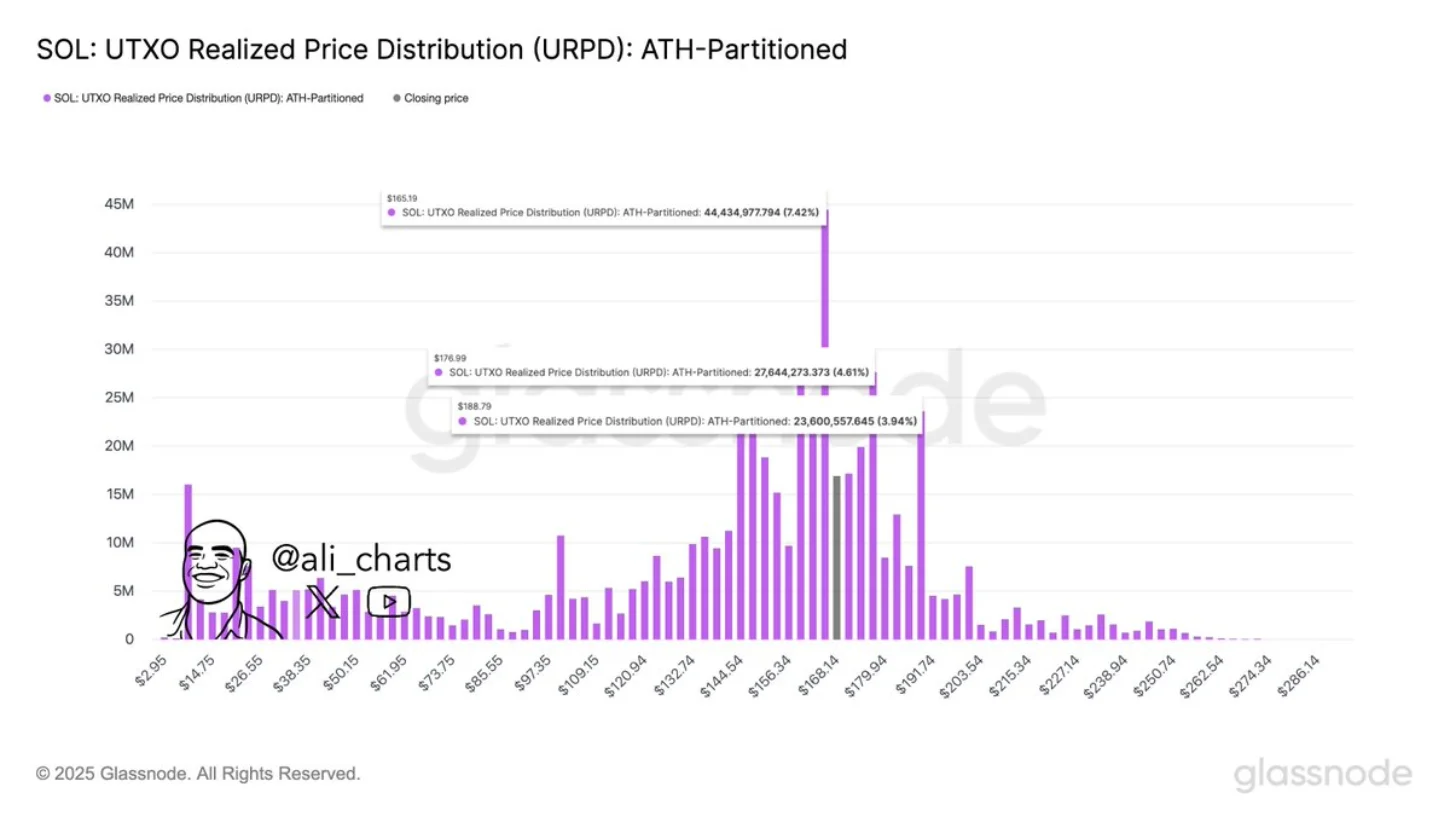

In addition, a recent tweet by market analyst Ali Martinez He emphasized that the $ 165 level is a crucial level of support for Solana price with potential resistance levels at $ 177 and $ 189. According to UTOX data, more than 44.4 million Solana brands were carried out, 7.42% of current offer, were acquired close to 165. For traders.

However, with Intraday sell-off, the price of coins dissolves under the support of $ 165 to reach the focus of $ 162. This violation of the damage reverses a strong demand zone in possible resistance, enhancing the risk of further correction.

As market uncertainty remains, the possible increase to $ 165 could allow the volume of mass masses to sell their coins to Breakeven, mainly by accelerating market selling pressure.

Also, read: Bitcoin demand remains resistant amid price volatility. $ 125K BTC soon?

SOL DRIVE prolonged correction with a standard wedge

Daily Solana Price diagram analysis shows a V-Top invert from the resistance line of a growing wedge pattern. Since March 2025, the price of coins resonates between the two converging trends of the project, as it leads a steady medium -term trend in price.

Currently, the fall of SOL prices tease a distribution below the 200-day exponential average-one level that offers a general market feeling for an asset.

If the distribution maintains, sellers could push another 7% drop to hit the lower limit of the pattern to the $ 150 signal.

This is saying, the bottom of support has acted as a powerful accumulation zone for buyers to restore the inflated momentum. Historically, a reversal of this support enhanced a recovery trend, offering an increase of 63% to 97%.

Until the value is broken below the bottom voltage of the wedge pattern, the value of the coin could keep its wider voltage.

Also read: Metamask, Stripe is preparing to start Stablecoin “MMUSD”