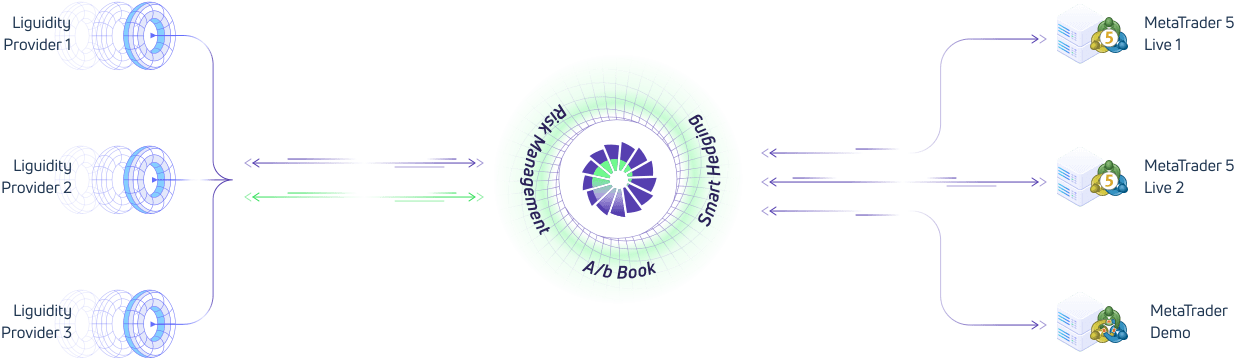

Starprime, the FX Prime Services Unit and CFDS Brokerage Group Startrader, announced its participation as an approved liquidity provider in the new Metaquotes matching engine.

Recently, Metaquotes launched the innovative Ultency matching engine, which will enhance the way Metatrader 5 brokers and liquidity providers. Through the product, liquidity providers can utilize the basic features of Ultency as an ECN mechanism, which fits the engine, battery and order execution to flawlessly connect to the transport environment. With the execution of extremely low delay, the Ultency matching engine offers immediate growth, rapid connectivity and a comprehensive range of risk management tools.

Jay Mawji, Starprime’s chief executive, said, said,

Jay Mawji, Starprime’s chief executive, said, said,

“This is a revolutionary product from post-transcendentists and we are proud to be one of the first adopters. Facing the main challenges between brokers and liquidity providers, this solution offers a very necessary aid to all Metatrader 5 customers.

“Metaquotes have been the cornerstone of our industry from the beginning and continue to lead their way to their contribution to our industry. We are privileged to be part of it.”

Metaquotes said she is excited to welcome Starprime as an approved liquidity provider on the matching engine. The Ultency matching engine was created to bridge the gap between Metatrader 5 brokers and ECN advanced liquidity processors, engine matching, battery and order execution-all designed for seamless completion and extremely low delay.

Renat Fatkhullin, CEO of Metaquotes, said,

Renat Fatkhullin, CEO of Metaquotes, said,

“The existence of Starprime on the boat as one of the first adopters highlights the value and innovation that Ultency brings.

For Starprime

Starprime (www.starprime.com) is a liquidity supplier, in a mission to redefine the liquidity providing to establish new standards and contribute positive to the FX & CFD industry. Starprime is the institutional section of Startrader, with its central center in Dubai and offices around the world. The world -renowned brand has a regulation in 6 jurisdictions (ASIC, FCA, FSA, FSC, FSCA and SCA). Institutional customers can exchange a wide range of CFD instruments, access to multiple liquidity groups through a connection within a technology suite.