StoneX Group Inc. (NASDAQ:SNEX), owner of Forex brands such as FOREX.com and City Index, released its financial results for the first quarter of the 2024 fiscal year ended December 31, 2023.

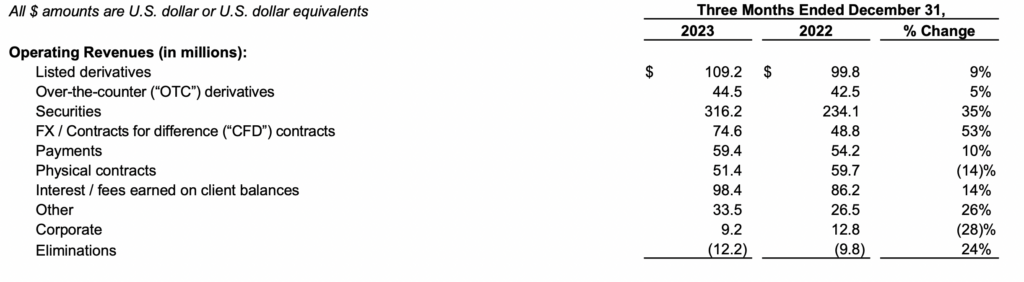

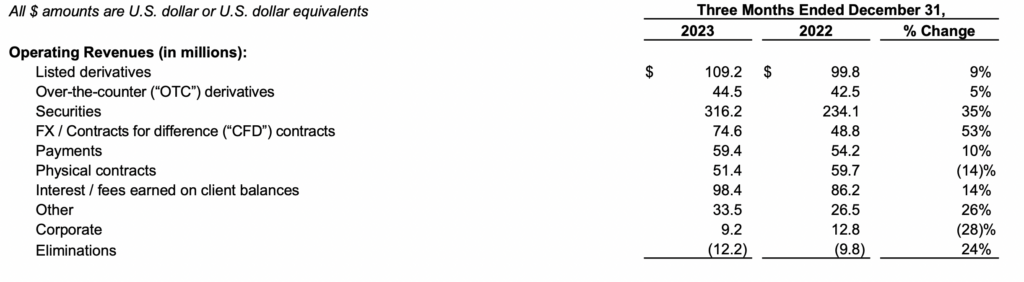

Operating income from FX/CFD contracts increased $25.8 million, or 53%, to $74.6 million in the quarter ended December 31, 2023 compared to $48.8 million in the quarter ended December 31 2022, primarily due to a 73% increase in FX/CFD RPM, which was partially offset by a 15% decline in FX/CFD contracts ADV, compared to the quarter ended December 31, 2022.

Operating income derived from listed derivatives increased $9.4 million, or 9%, to $109.2 million in the quarter ended December 31, 2023 compared to $99.8 million in the quarter ended December 31, 2022. This the increase was primarily due to a 26% increase in listed derivatives contract volumes, partially offset by a 13% decrease in the average rate per contract compared to the quarter ended December 31, 2022.

Operating income derived from OTC derivatives increased $2.0 million, or 5%, to $44.5 million in the quarter ended December 31, 2023 compared to $42.5 million in the quarter ended December 31, 2022. increase was the result of a 14% increase in OTC derivative contract volumes, partially offset by a 9% decrease in the average rate per contract compared to the quarter ended December 31, 2022.

Payments operating income increased $5.2 million, or 10%, to $59.4 million in the quarter ended December 31, 2023 compared to $54.2 million in the quarter ended December 31, 2022, primarily due to an increase 10% of RPM, compared to the quarter ended December 31, 2022.

Operating income derived from physical contracts decreased $8.3 million, or 14%, to $51.4 million in the quarter ended December 31, 2023 compared to $59.7 million in the quarter ended December 31, 2022. This decrease is due to decreases in both our natural farming operations and energy and precious metals retail businesses, compared to the quarter ended December 31, 2022.

Across all segments, operating income increased $129.4 million, or 20%, to $784.2 million in the quarter ended December 31, 2023 compared to $654.8 million in the quarter ended December 31, 2022.

Sean M. O’Connor, CEO of StoneX, said:

“We had a very strong start to fiscal 2024, with net income of $69.1 million representing a return on equity of 19.3%, return on tangible book value of 20.5% and diluted EPS of $2.13. The comparable prior-year period included a $23.5 million acquisition gain, which contributed $0.74 in diluted EPS. Excluding this acquisition gain, diluted EPS increased 28.0% over the prior year. We continue to see a supportive market environment with good customer engagement and increased interest earnings for our customers. We are pleased to see that our business continues to deliver what we believe are superior returns to our shareholders.”