- The drop in the Sui price is ready for a distribution under the combined $ 3.25 support and the 200 -day exponential average.

- A flattened voltage in the 100 and 200 -day EMA that reflects the intermediate oblique voltage.

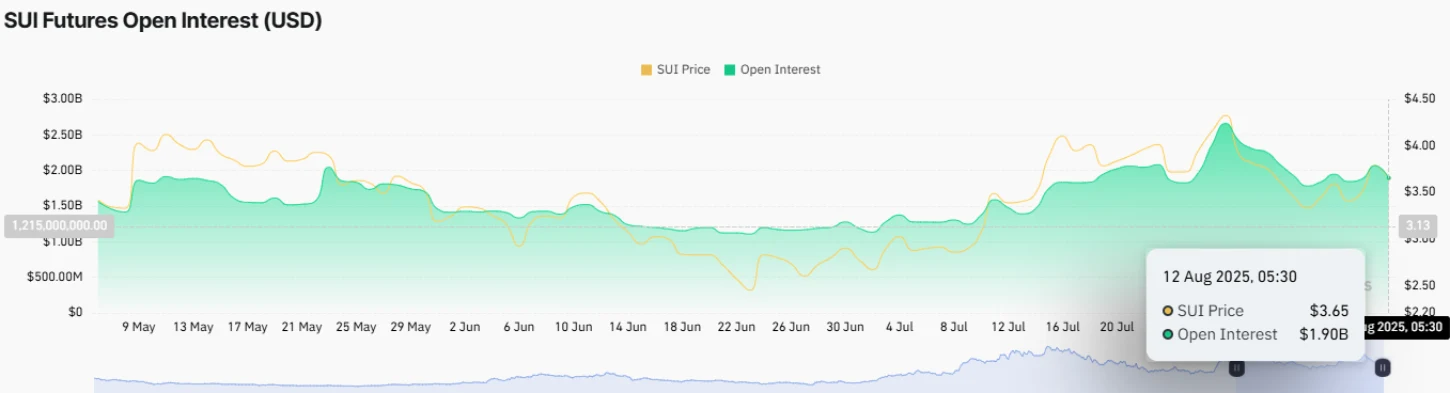

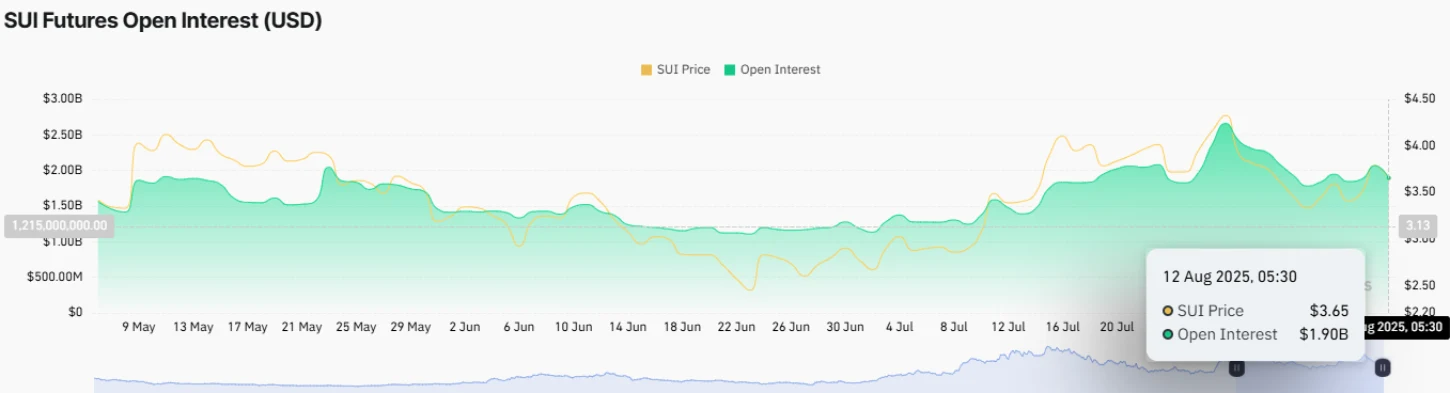

- The Bearish Swing in the Sui Futures Open and the overall volume lock implies the decline in investor confidence in the ecosystem, enhancing the risk of prolonged fall.

Sui, the inherent encryption of the Sui ecosystem, shows a slight decline of 0.18% during US market hours. The Bearish Momentum is aligned with a broader market removal as the Bitcoin price has just returned before the high resistance of all time of $ 123,236. However, the Sui faces an additional movement, as Defi data and derivative data indicate the risk of further correction. Will this Altcoin be broken under $ 3.65?

Sui price slides as weak volume and tvl bearish pressure signal

Last week, the Sui price showed an upgrade of $ 3.26 to $ 4 swing high, recording 22.46%. The market followed a renewed recovery momentum in the broader encryption market, as Bitcoin hit a new high high amount of $ 123,236.

However, the recovery of Sui prices was backed by a declining voltage in the volume of trading, signaling a weak belief by buyers. Thus, the currency price watched a brief 9% reversal to market $ 3.66 today. At the same time, the maximum market for assets sank to $ 12.73 billion.

In spite of the volatility of the price, the Sui Futures Open Interest There is no major increase and today is $ 1.9 billion. Open interest reflects the total value of the pending future contracts that have not yet been settled. This stagnant or declining voltage in value OI shows that traders are careful for a new position or exist from the existing one amid market uncertainty.

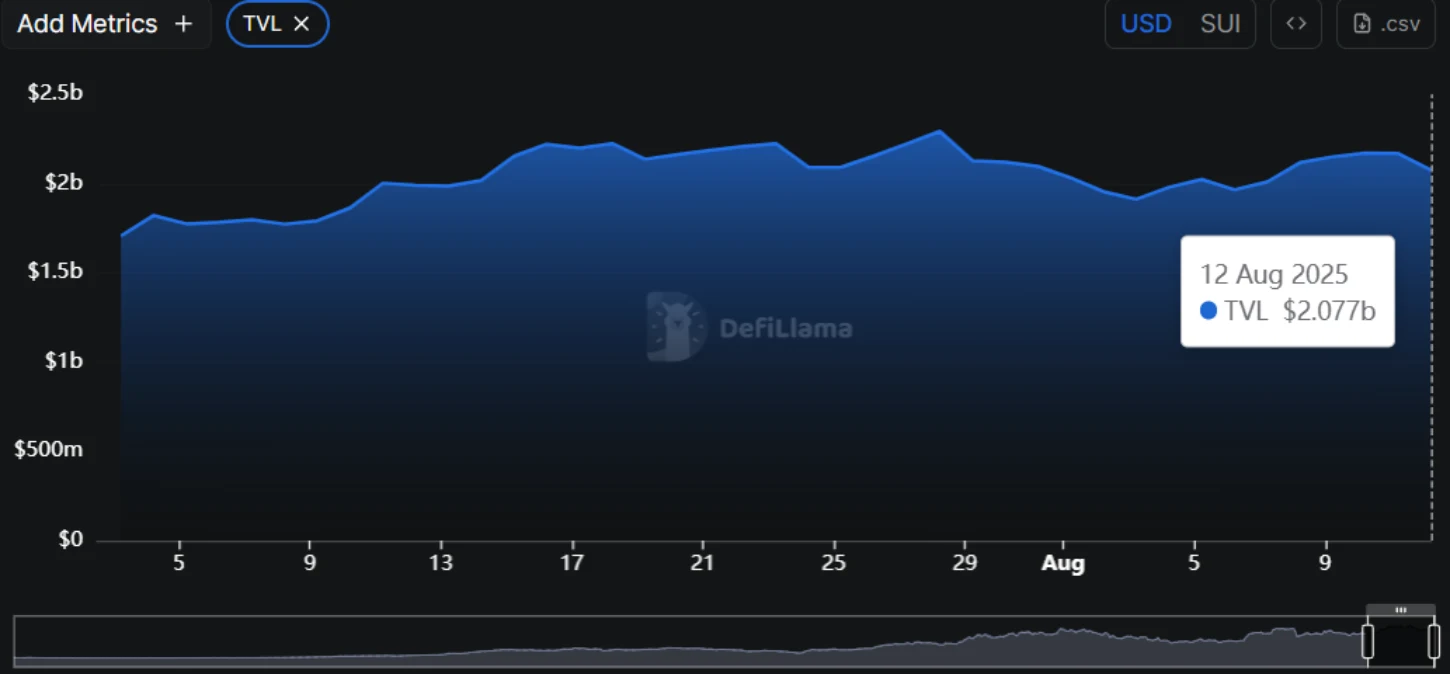

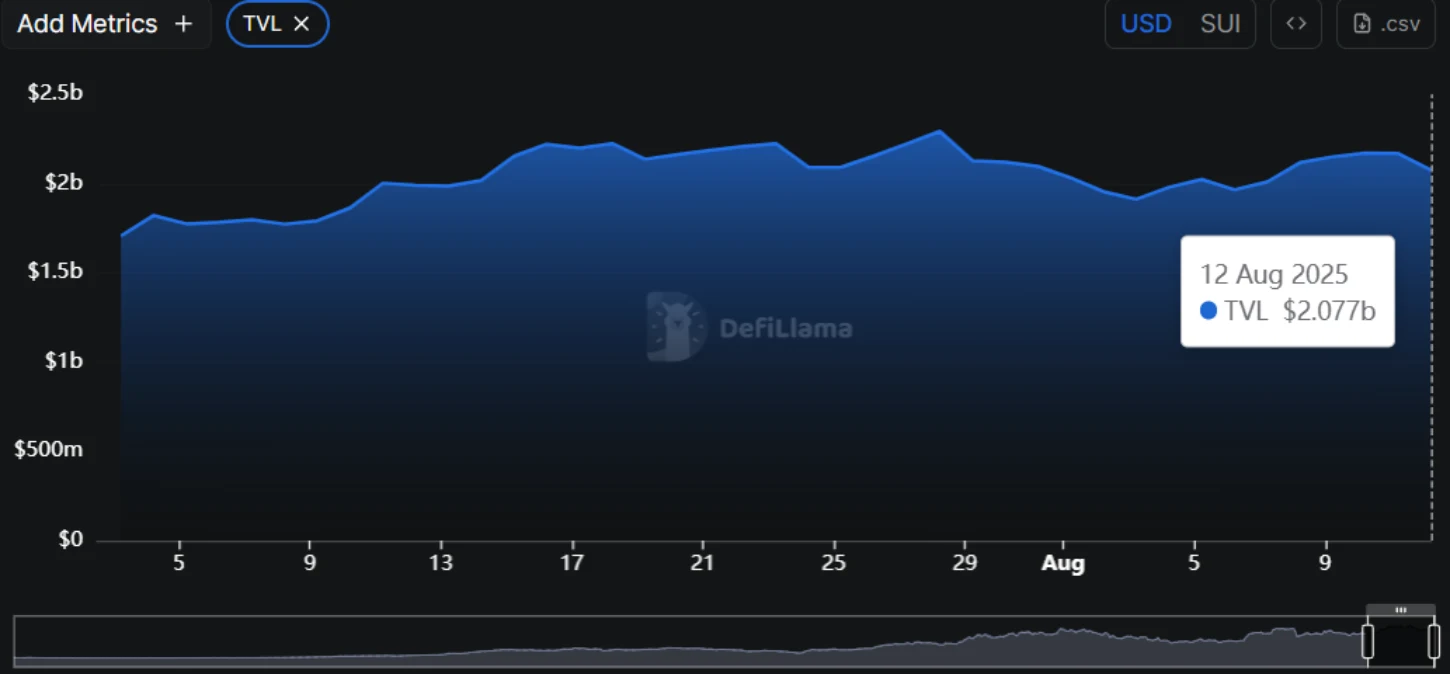

Add to Bearish Outlook, The total tumor locked (TVL) The Sui network records a Bearish Downtick at $ 2.07 billion. The reduction of TVL can highlight fewer active users involved in Defi protocols, reducing the available liquidity in the ecosystem.

If the voltage continues, the price of the coin will struggle to maintain stable dynamics or push a prolonged correction in the near future.

The recent recession at the Sui price shows the formation of a new lower high in the four -hour chart, reflecting the feeling of selling on the market. Aerial supply could push this Altcoin over 9.6% and challenge the combined support of $ 3.25 and the 200 -day exponential average.

Sui Price ready to collapse Bearish in the channel standard

Daily analysis of the Sui Price chart shows a medium -term side voltage echoing with two trends. Since August 2024, the coin has received dynamic support from the rising voltage line, acting as a basic accumulation zone for buyers. Meanwhile, buyers have been facing a steady resistance to an aerial trend intact since February 2025.

In the midst of the expected distribution of EMA 200 days, the price of the coin drove a bear circle into the two -voltage channel. If the distribution closes a daily candle down, sellers could promote a 16% drop to review the lower voltage at $ 2.7.

Until the support voltage is intact, the Sui currency will keep its lateral trend and prevent a significant correction.

If the history is repeated, the Sui value could restore the inflated momentum to the lower voltage for its next jump.

On the contrary, a recently displayed downsloping bracket from $ 4 forms the current price correction. If the price of the coin manages to keep the 200 -day EMA, buyers could tease a tension of resistance to accelerate the bullying impulse for a renewed recovery.