KEYS PRODUCTION:

- The XRT price call to 50% Retramection level marks a healthy disconnection for buyers to recover the Bullish momentum

- The formation of flag patterns in the daily diagram highlights a temporary disconnection before a possible unblocking.

- The declining trend of XRP’s open interest and the expected dive of the funding rate in the negative area indicate a weakening of maturity.

On August 3, the price of the XRP recorded a remarkable recovery +5.4% to reach 2.9 $ 2.9 transactions. The market came as a relief rally in the wider market, as the majority of large assets showed a sudden increase after a sharp sale. While cryptographic encryption follows a similar momentum, the declining voltage in the derivative market data marks the risk of prolonged correction. Will this correction extend under $ 3, or will buyers have the opportunity to cope?

XRP derivatives measurements are turned Bearish:

In the last two weeks, the price of XRP has made a significant correction of $ 3.65 to a low $ 2.7, recording a 25%loss. The sale pressure follows a feeling of correction after the market rally, indicating a cooling period for buyers to regain the momentum.

However, the reduction in the derivative market has recorded a remarkable decline, along with prices marking a warning action by traders amid market uncertainty.

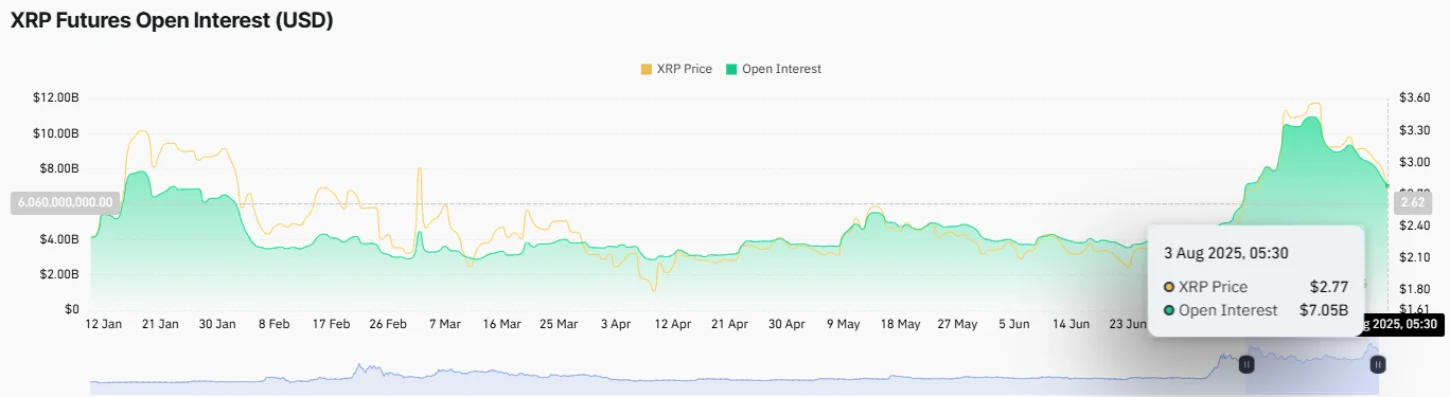

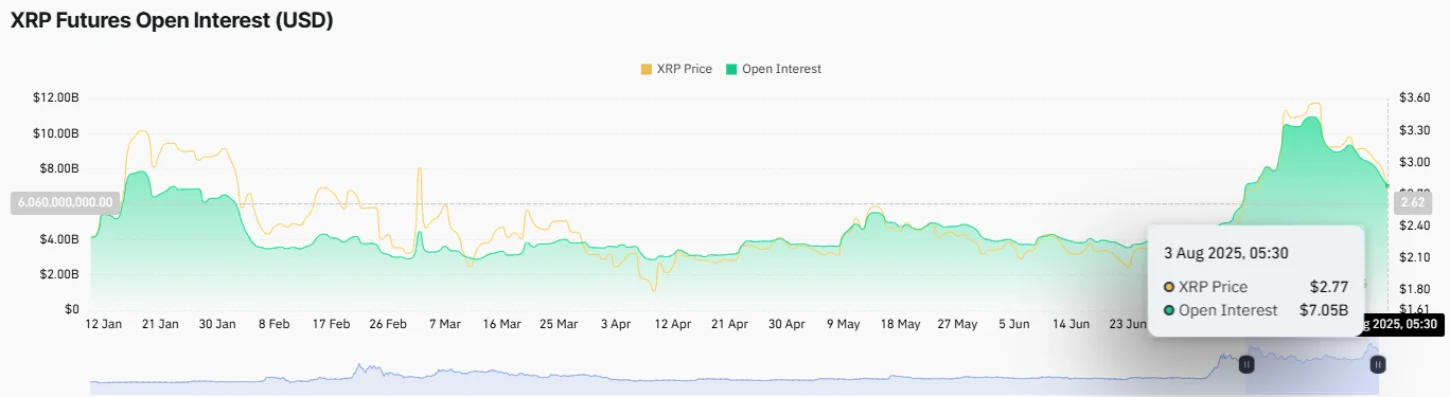

According to Coinglass DataThe XRP Futures Open interest from $ 10.94 billion to $ 7.05 billion, down 35.6%. This significant reduction in OI indicates massive clearance or clearing positions in the market for future fulfillment. This cooling of speculative interest could act as a precursor to an ongoing correction voltage unless strong market pressure yields.

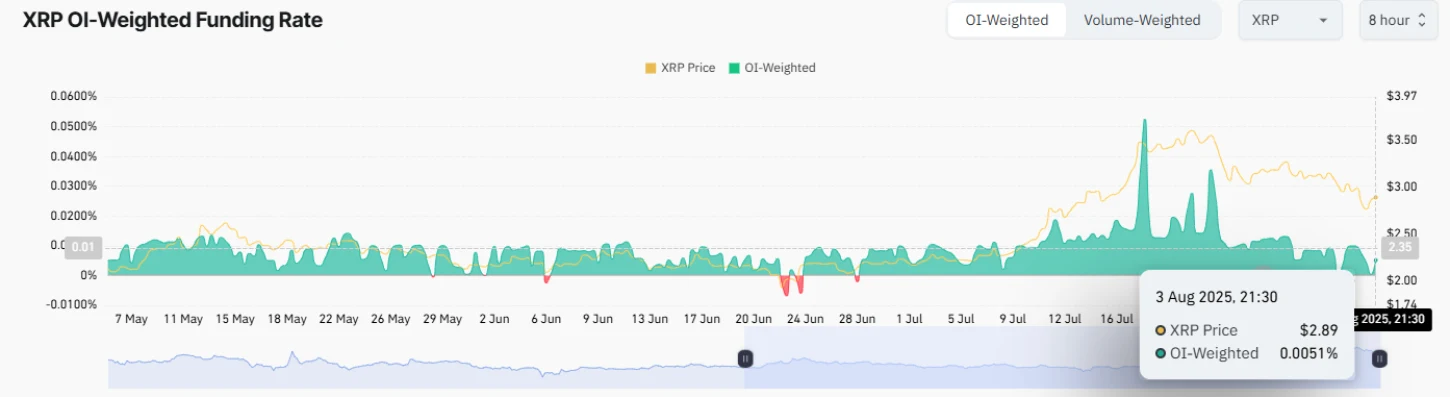

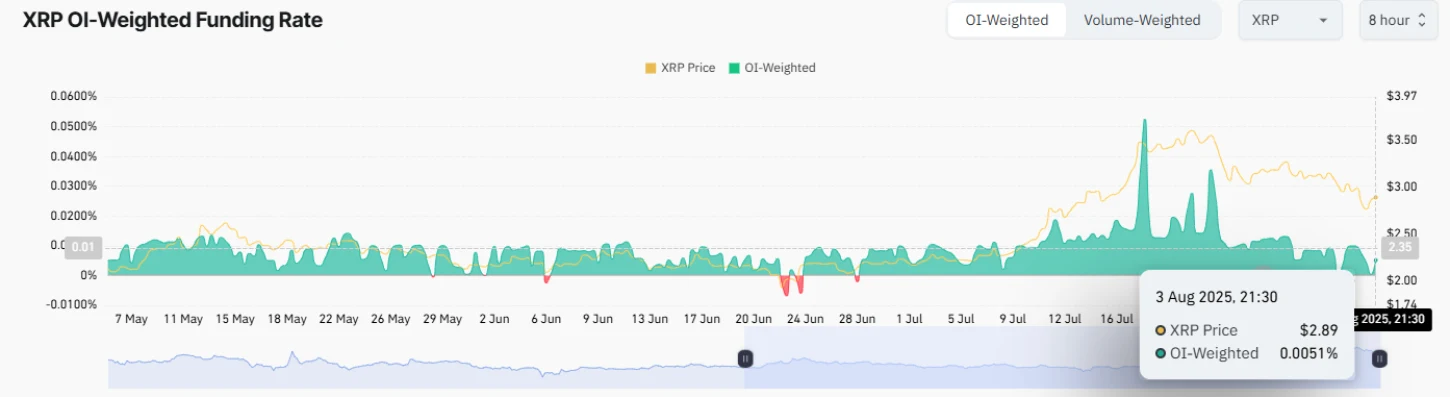

In addition, the XRP funding rate has begun to shrink near the neutral journey. Although profit in the measurement has pushed the measurement to 0.0051%, if the broader market correction insists, the XRP funding rate could be negative.

If implemented, this negative measurement should indicate that short sellers pay an premium to keep their position, enhancing their confidence in a possible fall. As the majority of players are betting on further prices, the current momentum acceleration accelerates prolonged driving down.

Thus, until these measurements indicate a sharp upward trend to mark the revival of market recovery, cryptographic encryption could be further reduced.

XRP value drives current correction within the flag plan

Analysis of the four hours of XRP value chart shows that the recent correction was echoed in two downsloping trends, revealing the formation of a bull flag plan. The diagram adjustment is characterized by a long rising pole, which indicates the dominant market voltage, followed by a temporary pleasure to recover the inflated momentum.

The diagram adjustment is usually located in the middle of an established rise to stabilize the value before the next jump. In addition, Pullback is supported by a declining voltage in the volume of transactions, further affecting the weak condemnation by sellers to maintain lower prices.

With a 5% profit, the XRP price tried to maintain above the 50% FIBONACCI Retraction level. Historically, FIBONACCI levels 23.6%, 38.2%and 50%have provided buyers strong support. As the price of the coin maintains above the daily exponential mobile averages of 50, 100 and 200, the long -term voltage is swollen.

Today it is negotiated at $ 2.91, the XRP price is just 1% from the challenge of the plan’s resistance voltage near the $ 3 psychological barrier. A possible unblocking over this floor will mark the acceleration of convenient momentum and drive a potential rally over 3.65.

However, with the declining trend in the future open interest of XRP, the expected unblocking could delay and lead another bears cycle into the flag formation.

Also read: Bitcoin price is facing $ 110 structurally amidst nuclear tensions and fresh US-Russia invoices