Key points

- Kwon is expected to change its application, possibly acknowledging its guilt in its hearing in Manhattan

- The court ruling proposes a possible resolution agreement that will help them accelerate the resolution and avoid a test for January 2026

- Kwon has already hit a $ 4.5 billion penalty

Kwon, the 33 -year -old South Korean businessman who is once celebrated as a Mogul encryption, is expected to admit guilty in one of the largest cases of fraud in the history of digital currency. The hearing could be the final act in an epic that saw the impressive surprise of two cryptocurrency, Terrausd and Luna, wiping about $ 40 billion in value and shaking global confidence in the whole sector.

(Source: Inner City Press on x;

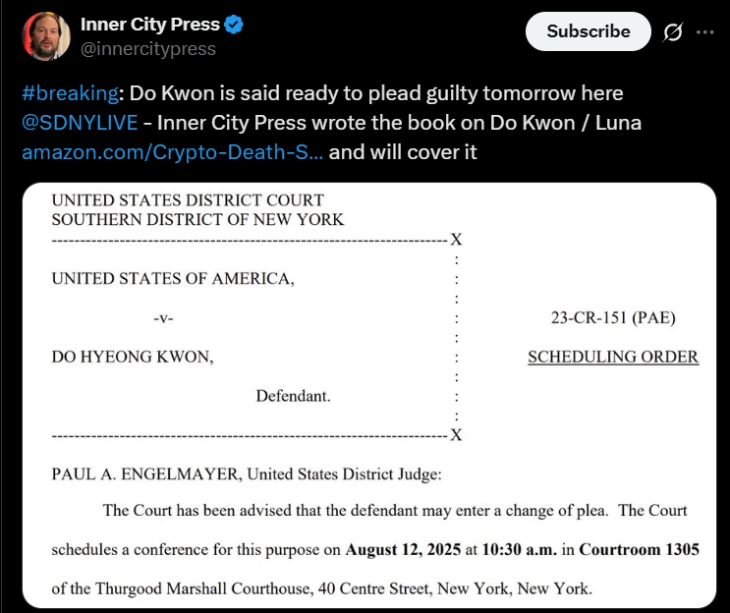

Court’s deposits on Monday revealed that Do Kwon, co -founder of TerraForm Labs based in Singapore, may change his appeal to a hearing on Tuesday morning at the Manhattan Federal Court.

This is a major shift so far, as it has insisted on Do Kwon’s innocence against a sweeping list of categories, including title fraud, cable fraud, basic products fraud, and conspiracy for money laundering.

The briefing, first reported by Bloomberg, came in the form of a short order by US judge Paul Engelmayer, who noted that he had said that Do Kwon could change his appeal.

The hearing, scheduled for 10:30 am Edt, could see Kwon describe his role in the 2022 crash that extinguished the luck and left thousands of investors, from retail traders in large capital, measuring their losses.

Kwon’s Journey: Crypto Star to Lawbreaker

Kwon’s rise to the cryptographic world was meteric. Through the TerraForm workshops, Terrausd started, a so -called algorithmic stablecoin intended to remain connected to the US dollar without traditional stocks such as cash or bonds. Instead, he was based on a complex system associated with his brother, Luna, to maintain stability.

For some time, it worked and Kwon became a star. Investors saw Terrausd as a major discovery in decentralized funding and Luna’s value increased. But in May 2022, the algorithm failed. Terrausd slipped by $ 1 Peg, causing a death spiral for Luna. Within a few days, the price of Luna sank near zero.

The crash was catastrophic. Estimates indicate that it has evaporated $ 40 billion in market value. For ordinary investors, some of whom had plunged saving to brands, losses were devastating. The event was also launched in the broader encryption market, reducing other projects and supplying calls for tougher regulation.

Flight, arrest and issue

After the collapse, Kwon’s image shifted from Crypto Visionary to Fugitive. South Korea authorities issued a warrant for his arrest, accusing him of breach of capital market laws. In March 2023, he was held in Montenegro, which was caught trying to board a flight with fake travel documents.

What followed was a legal towing between the US and South Korea on where to trial. Montenegro finally sent him to the US in late 2024.

Since then, Kwon has been detained, looking down a criminal indictment of nine measurement. Prosecutors claim to be misleading investors and manipulating markets to artificially support Terrausd and Luna.

Tuesday’s listening could determine if Kwon admits that guilt or negotiate a deal to reduce the possible prison time. Judge Engelmayer made it clear that Kwon’s legal team had been ordered to review any agreement with him in advance.

Initially, a trial was scheduled for January 2026. Prosecutors were preparing to present six Terbites of evidence, a data mountain that could have stretched the proceedings for months. A culprit would be the circuit in the short term, providing a faster analysis.

This criminal case follows an urban blow earlier in 2025, when the US Securities and Exchange Commission (SEC) won a $ 4.5 billion decision against Kwon and Terraform Labs.

SEC accused Kwon of falsely promoting Terrausd as a reliable, secure investment, while knowing her fragile design. This case did not bring prison time, but the criminal charges.

The collapse of Terrausd and Luna remains a warning story. Unlike traditional coins, cryptocurrencies depend on technology and investor confidence and not state support. When the system supporting Terrausd retreated, Luna not only sank. He was shocked all over the market.

For small investors, it was like watching a reliable bridge collapse all night. Many believed that Kwon’s assurances that Terrausd was safe, only to find himself holding chips that deserve a fraction of what they paid.

On X (formerly twitter), reactions to the news of a possible guilty appeal have been mixed. Some see it as long -term accountability, while others remain bitter, knowing that no verdict will restore the billions lost.