The FX and CFD Broker Plus500 Ltd (Lon: Plus) retail trade today published the intermediate results for the six -month period that ended on June 30, 2025.

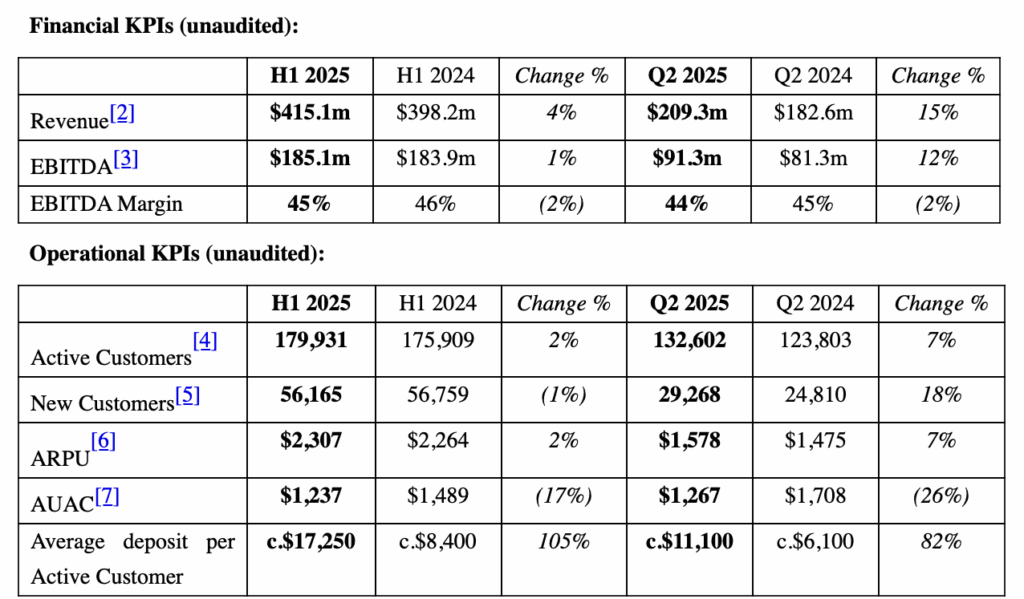

The Plus500 delivered strong financial performance to H1 2025, in accordance with the numbers provided in previous trading update. Revenue and EBITDA increased by 4% and 1% annually, respectively and in the 2nd quarter 2025 by 15% and 12% respectively.

For H1 2025, revenue amounted to $ 415.1 million (H1 2024: $ 398.2 million), including $ 385.5 million trading income (H1 2024: $ 369.1 million) and interest from interest of $ 29.6 million ($ 2024):

EBITDA for H1 2025 was $ 185.1 million (H1 2024: $ 183.9 million), equivalent to EBITDA 45% (H1 2024: 46%), including $ 91.3 million in Q2 2025 with EBITDA 44% (Q2 2024 respectively).

Net profit in H1 2025 was $ 149.6 million (H1 2024: $ 148.8 million) and the basic EPS increased by 8% to $ 2.05 (H1 2024: $ 1.90).

The cost of the group remained particularly flexible and responding to the changing market conditions, which allowed its privately owned technology. For H1 2025, 70% of the group’s spending was variable (H1 2024: 70%), allowing the Plus500 to respond quickly and effectively to a series of different scenarios and customer feedback.

The total SG & A costs were $ 232.7 million for the H1 2025 (H1 2024: $ 218.0 million). The main figures were $ 69.5 million marketing technology (H1 2024: $ 84.5 million), $ 21.9 million payment costs (H1 2024: $ 19.6 million), payroll and $ 32.0 million ($ 22): American future businesses.

Today, the Plus500 has announced additional yields of shareholders of $ 165.0 million, including $ 90.0 million and total dividends of $ 75.0 million. The $ 90.0 million shares program includes a temporary $ 35.0 million acquisition program and a special acquisition program of $ 55.0 million. These programs will begin after the completion of the current $ 110.0 million stock market program, which was announced and launched on 18 February 2025.

Dividends of $ 75.0 million include a temporary dividend of $ 35.0 million, representing $ 0.4925 per share and a special dividend of $ 40.0 million, representing $ 0.5628 per share, equivalent to a total of $ 1.055. The intermediate and special dividends are dated from the afternoon of August 21, 2025, a record date of August 225, 2025 and the date of payment of 11 November 2025.

The total yields of the shareholders were announced in 2025 at $ 365.0 million.

Since June 30, 2025, the company was held at the Ministry of Finance a total of 43,246,147 ordinary shares, which were purchased by the start of the original shares of the Plus500, which issue shares with shares issued in shares. The usual shares that have repurchase by the company under its acquisition programs are held at the Ministry of Finance and are not entitled to dividends and have no voting rights.