Switzerland’s leading online banking and trade provider (SWX: SQN) has published its financial results for the first half of 2025, with the company seeing revenue and net profit for six months – for the sixth time in a row!

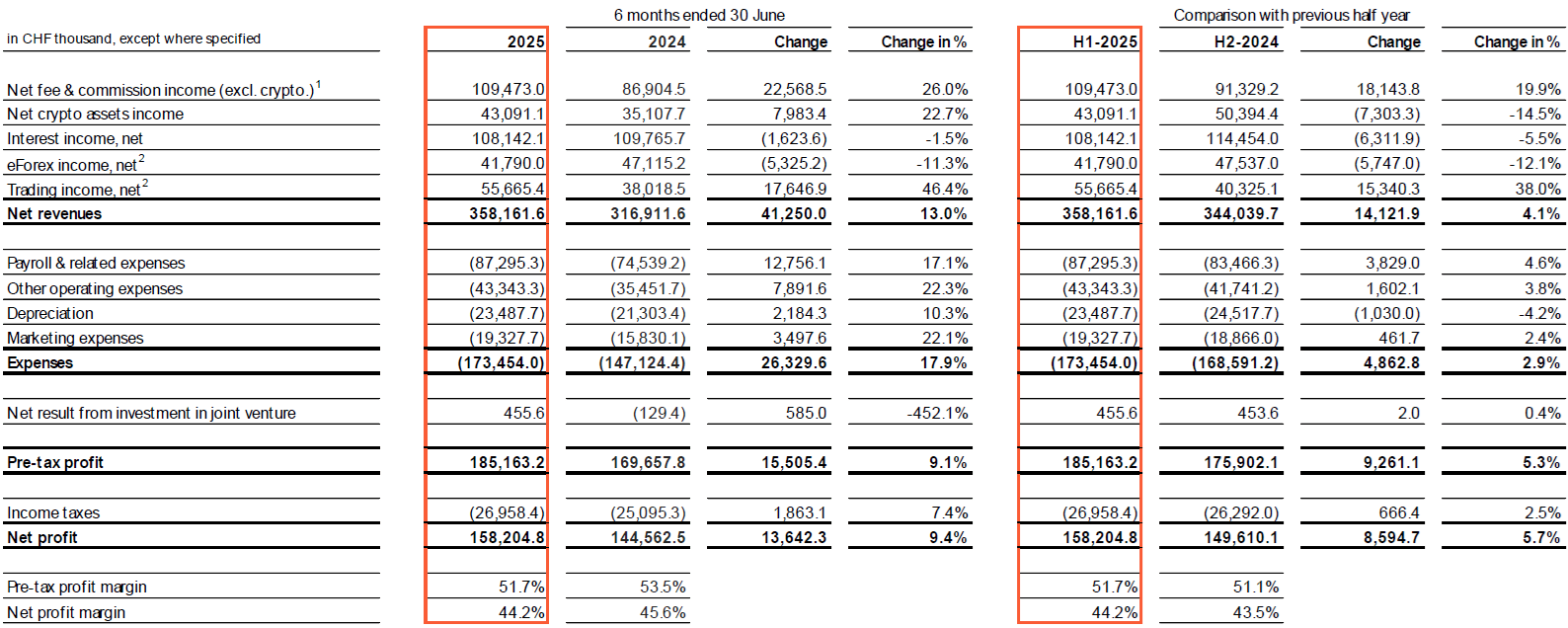

Revenue on Swissquote amounted to Chf 358.2 million (US $ 445 million) H1 2025increased by 4% from 344.0 million CHF in the second half of 2024.

SWISSQUOTE Income Analysis

Swissquote’s trade income increased by +46.4% to H1 2025, backed by more foreign -related commercial activity. Crypto income asset increased by +22.7% to 43.1 million CHF (or 12% of total revenue on Swissquote in H1 2025), thanks to the highest encryption volumes (+16.2% compared to the period). Net interest revenue remained stable (-1.5% compared to the period) thanks to increased customer cash deposits (total balance sheet assets increased by +27.7% in the last 12 months), which helped offset the lowest interest rates (eg 0%). EFOREX net income decreased by -11.3% to 41.8 million CHFs, affected by changes in margin requirements applied during the high variability period.

Increased expense

In accelerating organic development and higher than expected net revenue, Swissquote said it made the strategic decision to increase its investment for the future, in particular by expanding technology groups (+ 50 FTES) and enhancing its international activities (+30 FTES). These investments reflect the company’s willingness to broaden the pipeline (in particular through the use of advanced technologies such as artificial intelligence) and to ensure the extension in accordance with the accelerated future organic development.

As a result, Total expenses in Swissquote increased by +17.9% to 173.5 million CHF: The highest number of employees (1,329 FTES in total) affected payroll and related costs (+17.1% compared to the year). Since June 30, 2025, the team employed 60 FTES temporary staff to tackle seasonal business demand, representing 4.5% of the total number. At the same time, marketing costs were seasonally higher in the semester (+22.1% compared to the period). Increases of other operating expenses (+22.3% compared to the period) and the damping cost (+10.3% compared to the year-return period) were related to the highest cost of benefit and the previous and ongoing capital costs.

In the first half of 2025, pre -tax profit increased by +9.1% compared to last year, at a new level of 185.2 million records (CHF 169.7 million). The pre -tax profit margin reached 51.7% (53.5%), while net profit increased to 158.2 million CHF (CHF 144.6 million), with net profit margin reaching 44.2% (45.6%).

New customers and deposits

Swissquote said it achieved its record results on the back of unprecedented clean new money, hitting the 80 billion CHF on customer assets. The total number of accounts increased by +58,304 in six months, reaching a total of 708,393 bills and representing a +16.0% increase in the last twelve months. The net new money hit a record level of 5.2 billion CHF (+36.5% compared to the period). Since June 30, 2025, customer assets reached 80.4 billion CHF (+18.1% compared to the period).

Tumors of customer trading

Customer trading volumes were on average $ 105 billion monthly At Swissquote in the first half of 2025, in fact below $ 118 billion in $ 2H-2024. The encryption volumes were also below 1.18 billion CHF 1.18 billion against CHF 1.53 billion monthly in the second half of 2024.

View

In July 2025, Swissquote took full control of Yuh, initially established as a following funding consortium. The company said this strategic move would allow Swissquote to fully integrate YUH into its overall supply of products. Combined with Yuh, Swissquote now serves over 1 million accounts, further enhancing its position in the digital banking space.

For the year 2025, net revenue and pre -tax profits are now expected to be about 700 million CHF (initial guidance: CHF 675 million) and 365 million CHF (initial: CHF 355 million).

The brief financial and functional results of Swissquote follow below.