The following is a version of Carolane De Palmas, a shopping analyzer at Retail FX and CFDS Broker Activetrades.

As the US government’s interruption is entering the second week, investors question whether they could reflect the 35 -day record since 2018. However, closure is not the only source of political uncertainty affecting global markets. Developments in Japan and France also apply attention, with the possible election of Japan’s first prime minister and the sudden collapse of the French government by adding new layers of instability to coins, stocks and bonds. There is a closer look at the three political events that lead the market feeling this week.

Two funding proposals failed to the US Senate

The interruption of the US government entered its seventh day following the two major funding proposals that failed to move to the Senate. The latest Democratic Stopgap bill, which tried to fund the government by November 21, fell in a short period of 52-42 votes, while the alternative to the Democrats also failed, receiving only 45 votes in favor. The impasse reflects the deep party divisions that have closed a repetitive characteristic of American politics. Republicans can lead the Congress, but the basic demand for 60 votes in the Senate prevents them from passing their expenditure bills without taking the Democrats on board.

The attitude focuses mainly on a controversy over the funding of healthcare. Democrats seek to include the extension of enhanced Obamacare subsidies in the provisional funding bill, an effort opposed by Republicans, arguing that the issue should be postponed until later in the year. President Donald Trump has enhanced tensions by threatening additional layoffs in the federal workforce, adding to the hundreds of thousands of government officials who have already overcome. About 40% of the federal workforce – about 800,000 people – is expected to be put on a non -remunerated license according to the BBC, raising concerns about the wider financial impact. Economists estimate that the closure continues each week could reduce US GDP growth by up to 0.2 percentage points.

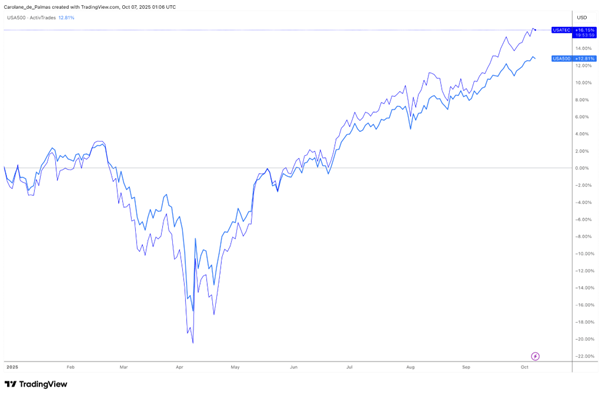

The political stalemate comes at a time when the US economy is already challenged by uncertainty by commercial invoices, previous spending cuts and a slowdown in the labor market. Despite the ongoing interruption, US markets remained resistant at the beginning of the week, as market participants focused on artificial intelligence. The Nasdaq and the S&P 500 also closed high records, supported by optimism about the transactions related to the AI. Gold prices went up to a new record of close to $ 3,997 per ounce, as investors have called for security amid increasing expectations to reduce the Federal Reserve interest rate at the October meeting. Bitcoin also reached a new high -end high over $ 125,000, while Treasury yields moved higher as investors continued to evaluate the possible decline from prolonged government closure.

Nasdaq (Usatec) and S&P500 (USA500) – Source: TradingView with Activtrades data.

The Prime Minister resigned after a month in the office

France has entered a new phase of political turmoil after Prime Minister Sébastien Lecornu resigned only 27 days in his term, marking the country’s shortest administration in modern history. His government lasted less than a day after the announcement of his cabinet, underlining deep divisions in parliament and the growing challenges facing President Emmanuel Macron’s leadership. The time of this collapse is particularly problematic, as it only happened days before the government’s deadline to submit the budget bill of 2026.

France is facing significant pressure on its public finances, with national debt currently at 113.9% of GDP. In addition, last year’s deficit was almost twice the threshold of 3% of the European Union. Although the government’s deadline for presenting its budget is October 7, the constitutional rules offer some limited flexibility by the middle of the month. Today’s political impasse is in danger of delaying the process and could force the use of emergency measures to maintain government businesses. Macron, whose order lasts until May 2027, has not yet commented publicly. It is under increasing pressure from opposition parties to call a parliamentary election or to appoint a new prime minister – possibly a technocrat – to restore stability.

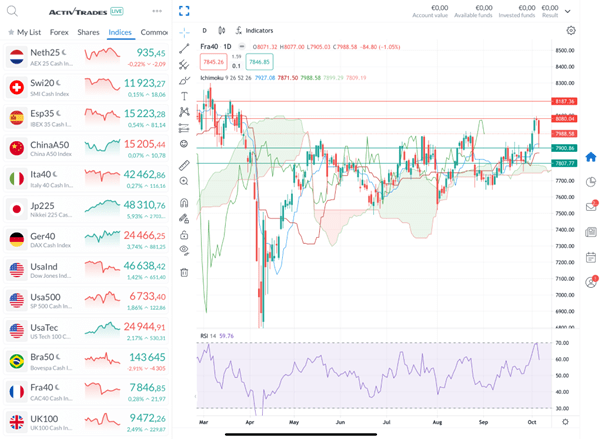

Financial markets responded abruptly to political uncertainty. The CAC 40 declined by 1.4%, the steepest drop of one day since August, after losing up to 2.1% earlier in the session, ending in six days of race. Selloff was partly a knife from the profits in semiconductor stocks following the AMD agreement with Openai, but the French shares remain among the late in Europe this year, up to 7% compared to two -digit advances in most major markets. Bond yields went up, with a 10 -year reference index reaching a high week, while the euro weakened. The decline was driven by luxurious and banking shares, reflecting investors’ concerns about France’s fiscal prospects and ongoing political instability.

Daily French CAC 40 – Source: Ontice online platform.

The new leader of Japan’s LDP is likely to become the first prime minister

The Liberal Democratic Party (LDP) elected Sanae Takaichi as a new leader this weekend, a move that paves the way for Japan’s first prime minister. A close ally of the late Shinzo Abe, Takaichi is known for his strong conservative attitude and commitment to reviving the spirit of “ABENOMATIC” through expansive budgetary and monetary policies. Its platform emphasizes increased government spending on strategic sectors such as artificial intelligence, semiconductors, nuclear fusion and defense – it considers it to be central to enhancing Japan’s competitiveness and national security.

Although the LDP coalition has lost its majority in both houses in the past year, the party continues to have enough power in the critical inferior chamber to ensure that Takaichi will be elected prime minister when parliament votes in mid -October. Japan’s political system gives the lowest home the final reason if the two chambers disagree, a previous one that has historically secured the LDP leader the Premiership as in 2008.

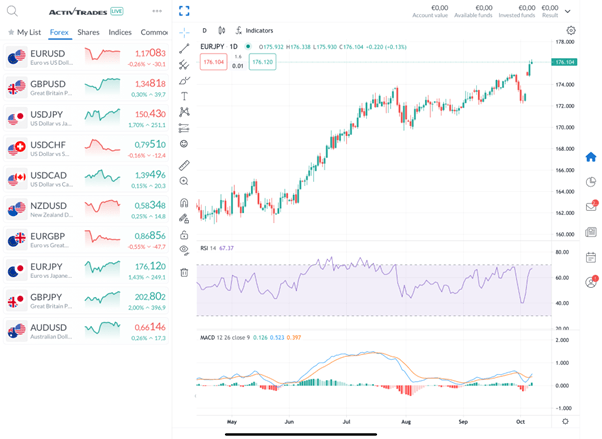

Japanese stock markets have responded positively to its elections, with the Nikkei 225 blinking 48,000 for the first time in history, marking the second successive record today. Profits were stronger in technological and defensive reserves, the sectors are expected to benefit from Takaichi’s pre-risk agenda. Meanwhile, expectations for increases in short -term interest rates by the Bank of Japan has declined, leading to a sharp leveling of the performance curve. The long -term yields of Japanese government bonds have increased with the performance of the 30 -year JGB of high records, while lower yields decreased more moderate. The yen weakens nearly 2% against the dollar and has reached low over the euro, reflecting investors’ prediction that monetary policy will remain favorable under the new leadership.

Daily EUR/JPY Chart – Source: Activtrader.

Sources: Wall Street Journal, Reuters, CNN, BBC, CNBC

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements aimed at promoting the independence of investment research and therefore must be regarded as marketing communication.

All information has been prepared by Activtrades (“AT”). The information does not contain a record of AT prices or an offer or attraction for a transaction in any financial instrument. No representation or guarantee of the accuracy or completeness of this information is given.

Any material provided does not take into account the specific investment target and the financial situation of any person who may receive it. The previous performance is not a reliable indicator of future performance. AT provides a service only for execution. Consequently, every person acting for the information provided does so at his own responsibility. Forecasts are not guarantees. Prices can change. The political risk is unpredictable. The actions of the Central Bank may vary. Platform tools do not guarantee success.