TP ICAP GROUP PLC (LON: TCAP) today published the Intermediate Management Report for the six months ended on June 30, 2025.

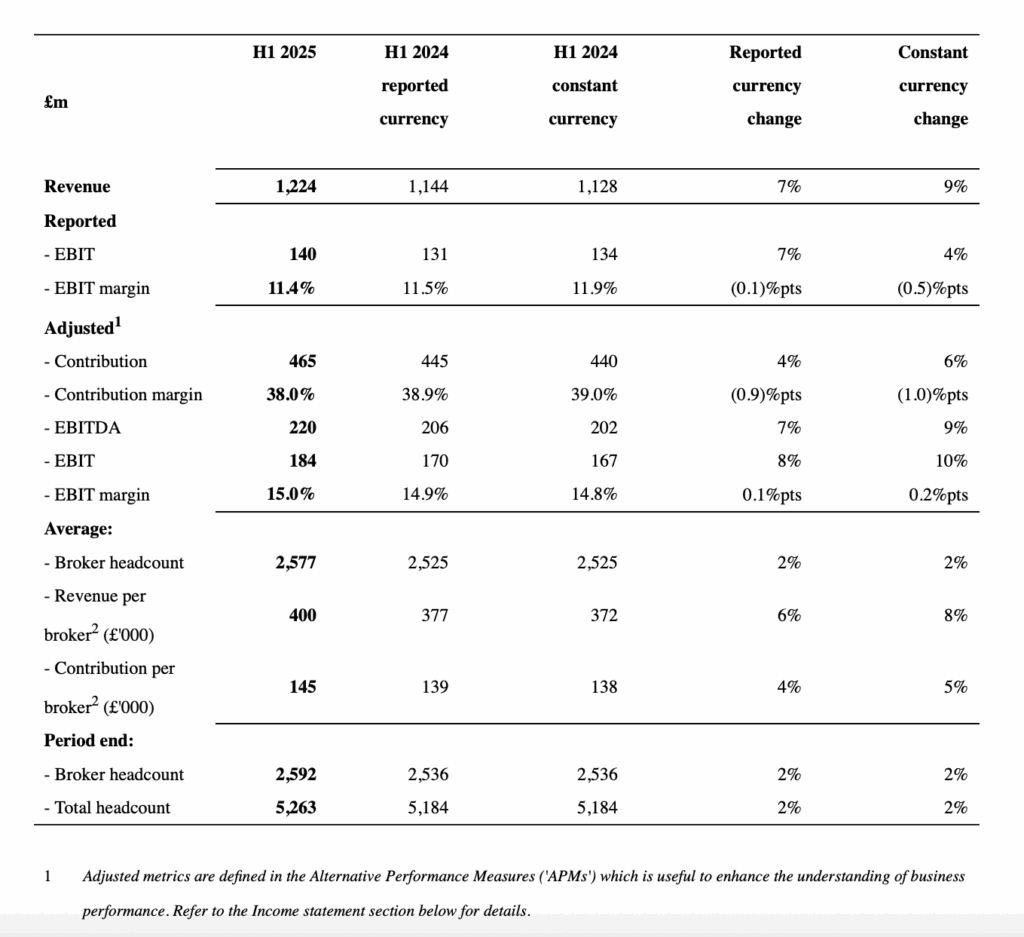

The team gave strong results in the first half of 2025, with revenue rising by 7% to £ 1,224 million (+9% in fixed currency). This performance is mainly led by the Global Broking and Liquidnet departments, supported by increased market volatility and demand for customers in the midst of a complex macroeconomic and geopolitical environment.

Global Broking, which contributed to 58% of the Group’s revenue, has given a double -digit increase of 10% (+12% in fixed currency), with strong contributions to all categories of assets benefiting from support conditions.

Energy and goods saw a moderate reduction in revenue by 2% (-2% in fixed currency) against H1 2024 records and reflecting a competitive talent environment.

Liquidnet gave a record of 14% (+15% in fixed currency) increase in revenue to £ 195 million, reflecting the continuing increase in the execution of the multi -asset organization and stock markets.

Parameta solutions achieved a 3% increase in revenue (+5% in fixed currency). Growth is still supported by the model based on the assistance of the Department, with an annual increase in recurrent revenue (ARR) by 5%. The performance reflects the decision to mitigate prices in 2025 to support sustainable growth and today’s largest larger sales cycles.

The group’s overall performance was characterized by strong operational leverage, backed by disciplined cost management and increased broker productivity, with average revenue increasing by 6%.

This supported a further extension of the Group’s customized EBIT margin to 15.0%, slightly from 14.9% to H1 2024. The customized EBIT increased by 8% (+10% in fixed currency) to £ 184 million. The reported profits increased by 9% to £ 99m (H1 2024: £ 91cm).

Significant data, of which about 35% were not cash included planned investments in the TP ICAP’s main operational performance program and ongoing expenses for the possible list of minorities of the US solutions parameters.

Capital discipline remains a basic focus on TP ICAP. The team has announced another 30 million shares today, bringing the total to £ 150 million in the last 24 months. During the same period, TP ICAP said dividends totaling £ 250 million, including its provisional dividends, announced today, and released £ 100m cash to reduce debt.

TP ICAP’s three -year operational efficiency program launched at H2 2024 to liberate a surplus of £ 50 million through the integration of legal entities and providing annual cost savings of £ 50m, proceeding well and is on the right hand for its surrender.

The Group expects to deliver more than £ 200 million from surplus cash in 2026 and 2027. This includes £ 50 million that will be liberated from the integration of legal entities. This surplus will be available for investment and yields to shareholders.

According to the TP ICAP dividend policy, the Board of Directors proposes a temporary dividend of 5.2 pennies per share (up to 8%).