Tradeweb Markets Inc. (Nasdaq: tw), a global online market for rates, credit, shares and money markets, said financial results for the quarter today on March 31, 2025.

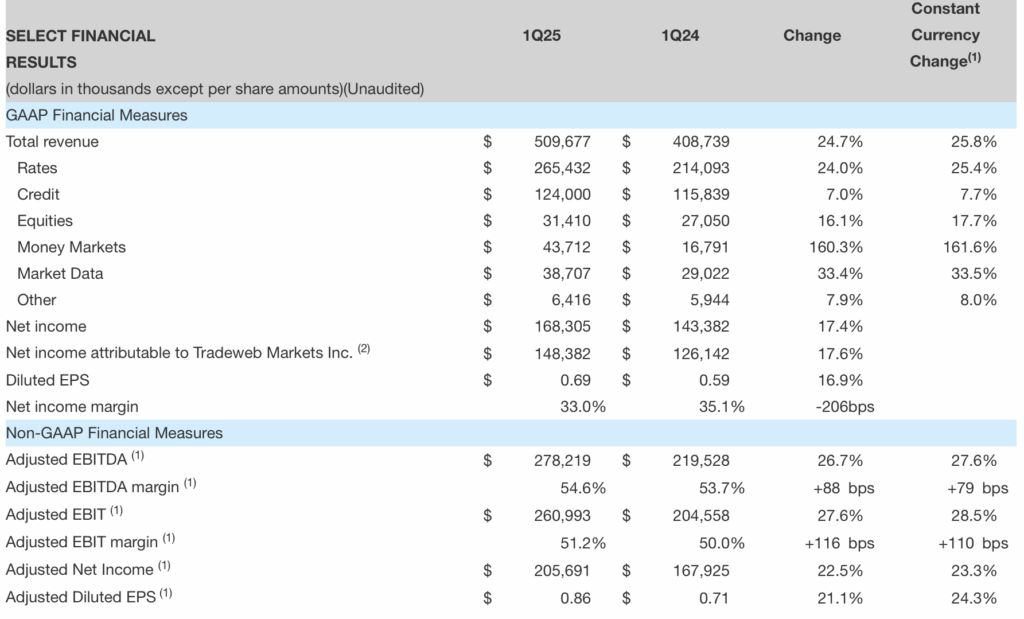

Revenue for the first quarter of 2025 amounted to $ 509.7 million, an increase of 24.7% (25.8% on a fixed monetary basis) compared to the previous year.

The company recorded an average of $ 2.5 trillion (“ADV”) for the quarter, an increase of 33.7% compared to the previous year. Tradeweb has recorded quarterly records in US government bonds, bonds of European government, mortgage loans, US 1 year exchanges/swaptations, fully high -quality US credit, fully electronic US high -profile credit, European credit.

Net revenue for the first quarter of 2025 amounted to $ 168.3 million, an increase of 17.4% compared to the quarter of the year.

The company reported 54.6% customized EBITDA margin and $ 278.2 million customized EBITDA for the quarter, compared to $ 53.7% and $ 219.5 million respectively for the previous year.

Tradeweb has published $ 0.69 diluted profits per share (“diluted EPS”) and $ 0.86 custom diluted profits per share for the quarter.

The Board of Directors declared $ 0.12 per share of quarterly cash dividends, an increase of 20.0% per share since the previous year.

Billy Hult, chief executive of Tradeweb, commented.

“Tradeweb gave strong financial results for the first quarter of 2025, emphasizing how technology reforms the single market and the class negotiation of multiple trillion.

While market volatility contributed to the record volume, we also saw positive market share trends and greater adoption of electronic protocols and tools. At percentages, the performance was fueled by the combined power of the institutional and wholesale platforms of the American treasures of Tradeweb, as well as by the global power exchanges. This quarter also marked the 20th anniversary of the Tradeweb interest rate platform – two decades of innovation in this market. In the credit, we recorded almost 26% of the total and 18% of the fully electronic stake in the US high grade trace elements, respectively, and 10% and 7.5% of the total and fully electronic share of the US high performance trace element, respectively.

In January, Troy Dixon joined our leadership team as co-head of the world markets along with Enrico Bruni and March, welcomed Rich Repetto to our Board of Directors.

More recently, as volatility played Treasury markets in early April, it facilitated the volume of a day of a day of a day of $ 472.5 billion in US government bonds on April 9, despite strong volatility and record volumes.