Tradeweb Markets Inc. (NASDAQ:TW), a global operator of online markets for interest rates, credit, equities and money markets, today announced financial results for the fourth quarter and full year ended December 31, 2023.

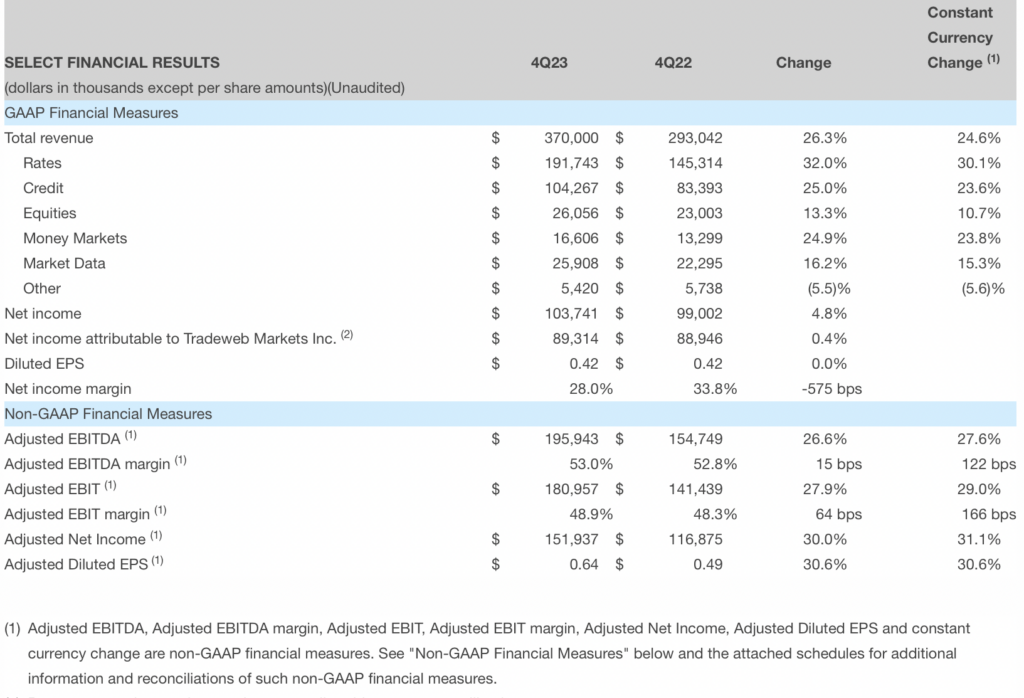

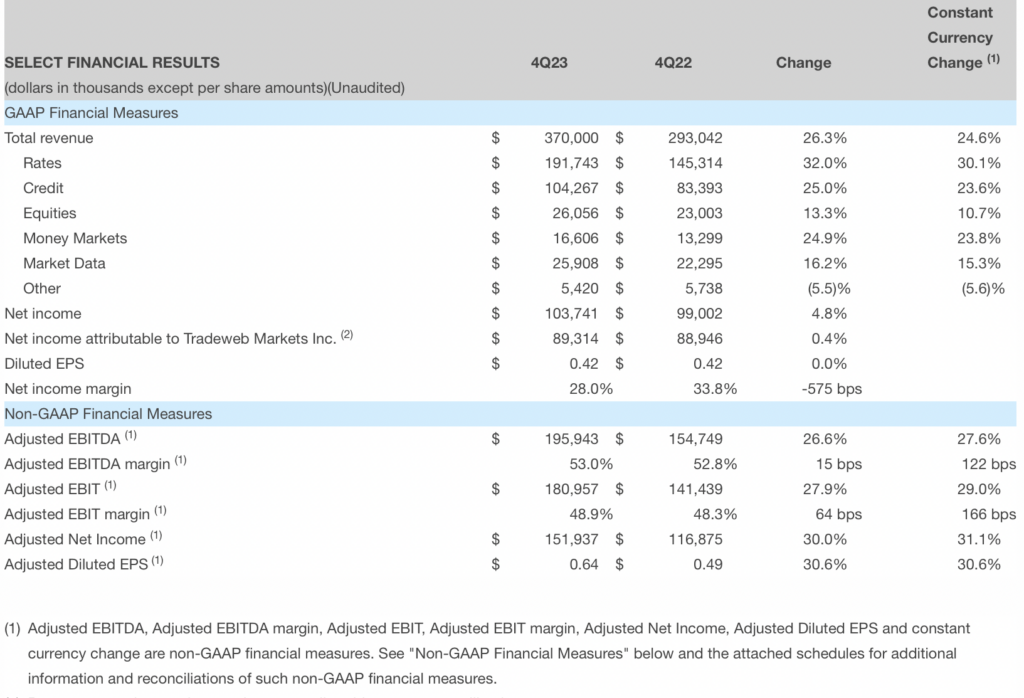

The company reported quarterly revenue of $370.0 million, up 26.3% (24.6% on a constant currency basis) compared to the prior-year period.

The shares generated revenue of $26.1 million in the fourth quarter of 2023, up 13.3% compared to the year-ago period (up 10.7% on a constant currency basis). Equity ADV increased 36.6% year-over-year due to strong institutional US and European ETF activity.

Money Market revenue of $16.6 million in the fourth quarter of 2023 was up 24.9% compared to the prior-year period (up 23.8% on a constant currency basis). Money Markets ADV rose 35.1% year-on-year due to record activity in global repurchase agreements and increased client adoption of Tradeweb’s electronic trading solutions.

Market Data revenue of $25.9 million in the fourth quarter of 2023 was up 16.2% compared to the prior-year period (up 15.3% on a constant currency basis). The increase was primarily due to an increase in third-party proprietary market data fees and increased LSEG market data fees due to the amended and restated market data license effective November 1, 2023 and increased transaction reporting services (APA) revenue.

The company posted $103.7 million in net income and $151.9 million in adjusted net income for the quarter, increases of 4.8% and 30.0%, respectively, from the year-ago period.

Tradeweb reported $0.42 diluted earnings per share (“Diluted EPS”) and $0.64 adjusted diluted earnings per share for the quarter.

The company declared a quarterly cash dividend of $0.10 per share, an increase of 11.1% per share over the year-ago period.

Billy Hult, CEO of Tradeweb, commented:

“Tradeweb performed exceptionally well operationally and financially in 2023, a year with no shortage of macroeconomic challenges. We invested in growing our international footprint in new geographies and expanded our product offerings through two strategic acquisitions, r8fin and Yieldbroker. In keeping with this growth mindset, we announced a number of new or expanded partnerships with FTSE Russell, LSEG Data & Analytics and BlackRock. By capitalizing on organic opportunities, we have grown market share in our global businesses and helped our clients stay ahead of important trends such as the multi-asset class and algorithmic trading.

In credit, we achieved a record 17.2% share of US High Grade all-electronic TRACE in the fourth quarter. Our successes last year led to our 24th consecutive year of revenue and profitability growth, positioning us well for future opportunities. I am proud of what we achieved in 2023 and pleased with our strong start to 2024.”