Tradingview has announced today an update set to significantly enhance the market market analysis.

TradingView now supports the Crypto Futures markers and the constant exchange from bybit, binance and OKX.

Funding rate

The funding rate is a periodic cash flow that helps align the price of the constant future future future future future fulfillment at the price of the underlying asset.

While the exact type may vary depending on the exchange, it is generally calculated as:

- Financing Interest = Interest Rate + Promotion Index

- Interest – a fixed cost of capital, usually defined by the exchange.

- Premium Index – The difference between the price of the enduring future contracts and the spot price.

Funding can be either positive or negative, depending on how long transactions in relation to the spot. Positive funding is when lasting trade over the spot, Longs pay shorts. Negative funding is when lasting trade under the spot, shorts pay.

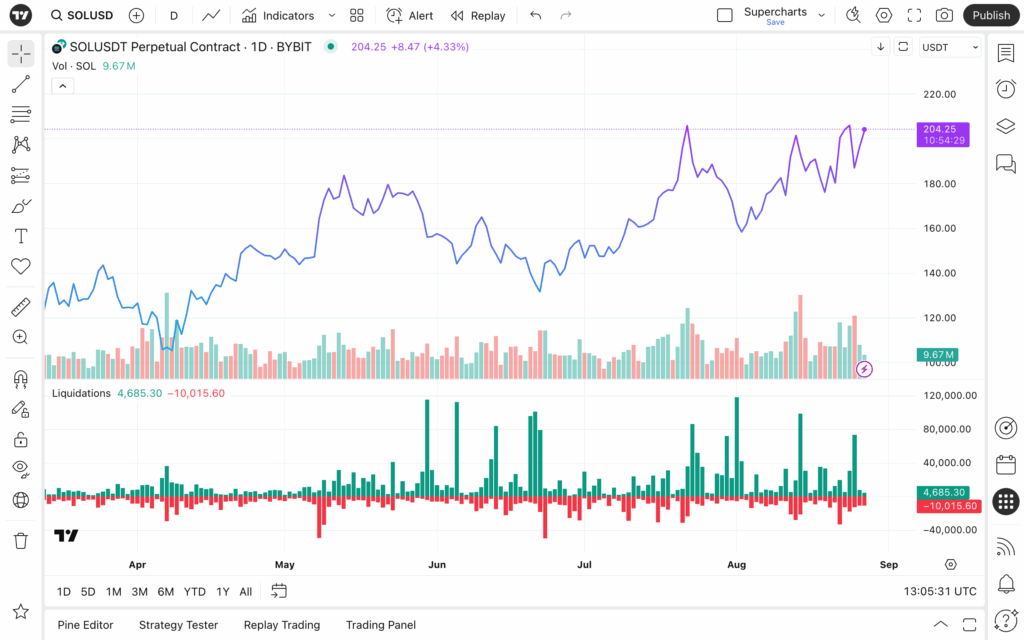

Liquidation

A clearing occurs when a leverage position automatically closes because the margin of the merchant falls below the required level of maintenance.

In the series of the series, clearing may appear as regular transactions, but in fact they are forced by the system forced executions.

With this index, you can monitor clearance volumes:

- Green-forbid the clearing, which means that the exchange closed short positions and bought back the asset

- Red-Clearing Summies, where the exchange closure and the sale of the asset

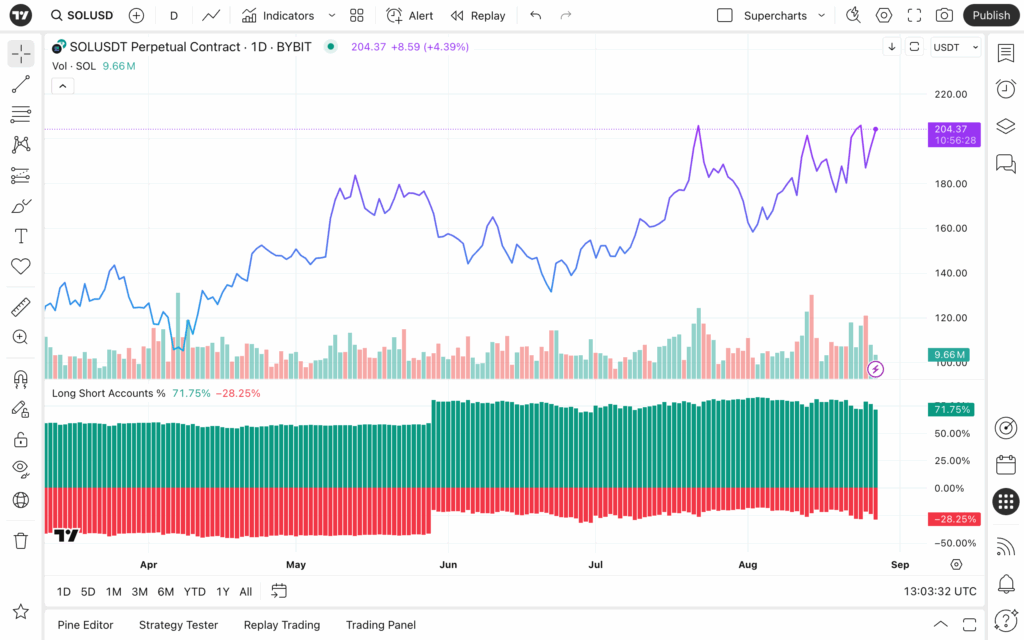

Long/short ratio accounts

This ratio reflects traders’ emotion by showing how many accounts have long against short positions in a given asset. Only the direction of the positions is taken into account, not the volume and the number of transactions.

Each account is calculated as a long or short, regardless of the size of the position.

Measurement is calculated as: Number of large accounts / number of short accounts

This allows you to measure overall market expectations for spot prices.

Long short accounts %

This measurement shows the share of traders that open large or short positions:

- Long Accounts % (Green) – the percentage of traders with long positions, who expect price increases.

- Short accounts % (red) – the percentage of traders with short positions, who expect price reductions.

Together, these measurements are accompanied by 100%.

Crypto open interest

Open Tokyo is the total number of pending contracts at a given time.

Depending on the exchange and the instrument, it can occur either as the number of contracts or converted to the base/stay currency, but in all cases it reflects the same measurement – the total volume of open positions.

Because it counts open positions, prices can rise or fall throughout the day. When combined with the volume of trading, the Open interest helps to evaluate liquidity, making the important tool for updated trading decisions.

You can find all this in the indicators menu as usual. Just click the Financials tab and select one of the new markers.