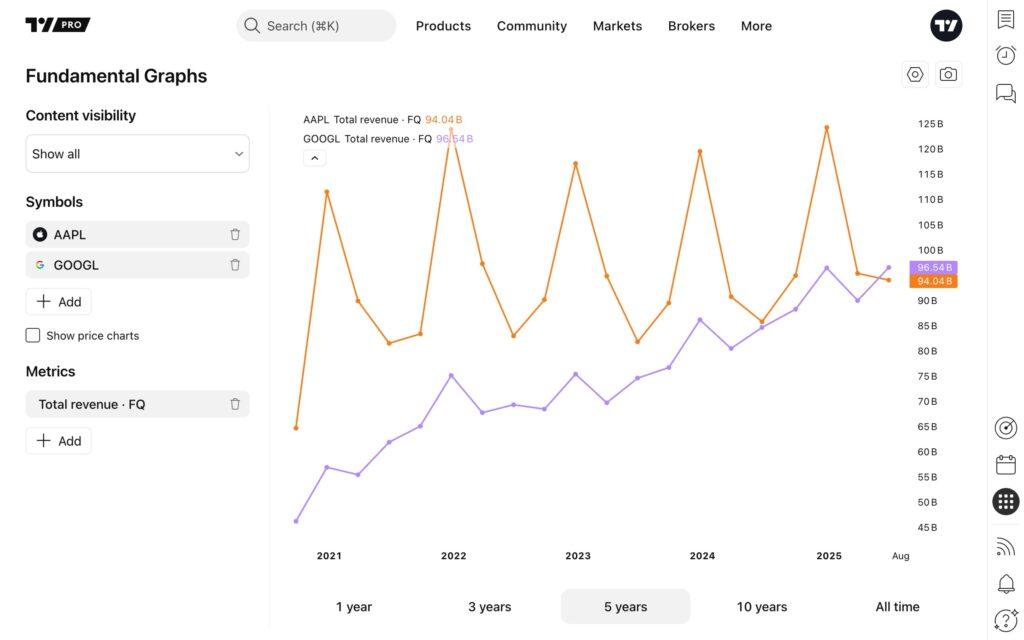

TradingView has expanded the range of tools available to its users through the addition of fundamental graphs.

Created to enhance the fundamental analysis, this feature allows for a smooth comparison of basic financial measurements in many companies – all in a single diagram that users can customize their needs.

With fundamental graphs, TradingView users can now make more up -to -date decisions, visually comparing the company’s critical data in a handy interface. Whether you analyze EPS, revenue or other basics, this tool enables you to find information you need and create a more reliable real -based investment strategy.

To get started, just go to the product menu and select fundamental graphs.

The graph interface is designed for maximum flexibility and clarity. You will set your chart from the left tool panel.

Add or remove to nine symbols and nine different measurements at the same time to compare performance between companies and time frames.

You can activate or disable the price diagrams to better isolate and examine the underlying fundamental data.

You can also explore different ways of visibility by allowing you to adjust the graph to your analysis style:

- Obviously: Displays each measurement for each selected symbol

- Measurements with a symbol: Focus on all measurements for an active symbol you selected in the left frame

- Symbols with metric: Compare how each symbol performs for a single selected measurement

The diagram also allows you to select the preferred dates range and the type of scale – including normal, logarithmic, percentage or 100 – to fit your analysis.

The date can be adjusted with the buttons under the diagram.

Each diagram configuration is automatically stored in a unique URL, making it easy to share with colleagues or customers. You can also get snapshots and save them or share them right away – just find the snapshot button over the chart.

This tool provides new opportunities for analysis for traders and investors based on basic business data ratification or long -term strategies. By offering a visual, comparative look at financial performance, these graphs help you save time and browse world stock markets with more confidence.

For example, if you want to evaluate various technological reserves, you can quickly compare the revenue, profits and trends of R&D spending over time – all in a graph – to see which companies are efficiently escalating and whose finances are stagnant. In this way, you can make a decision supported by data, not only in prices.