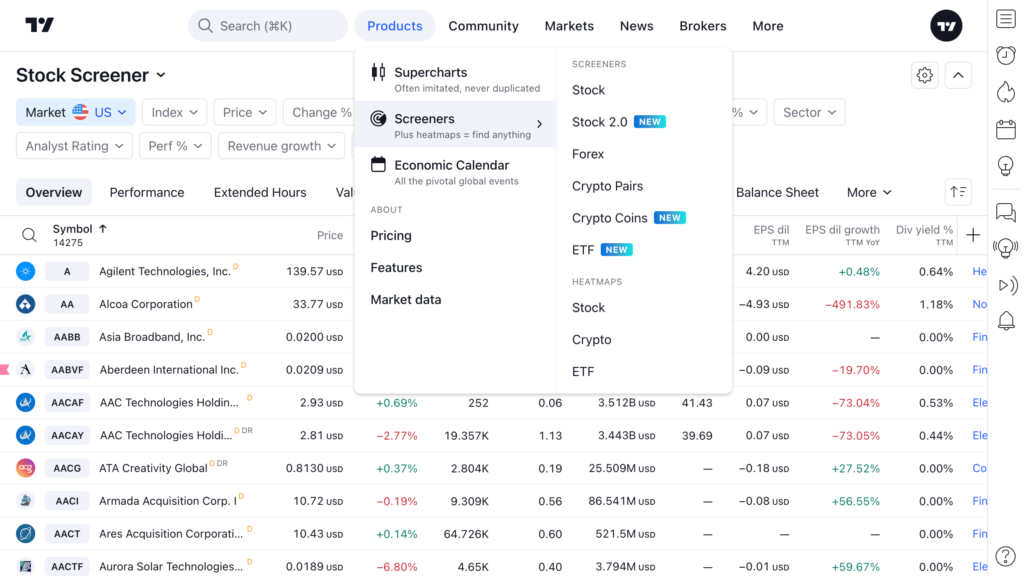

TradingView introduces its new products: Stop screener, Crypto coins screener and ETF screener. They’re built based on dealer feedback, so they offer unmatched speed, functionality and control. You can find them in the main menu: click Products and select Screeners.

TradingView has built-in screens to help you track different groups of stocks: for example, leaders by market capitalization or companies with the highest net income. You can find these screens in the screener’s main menu: click on Stock Screener and scroll down to the Popular Screens section.

Or add your own screens with a unique trading vision by clicking Create New Screen.

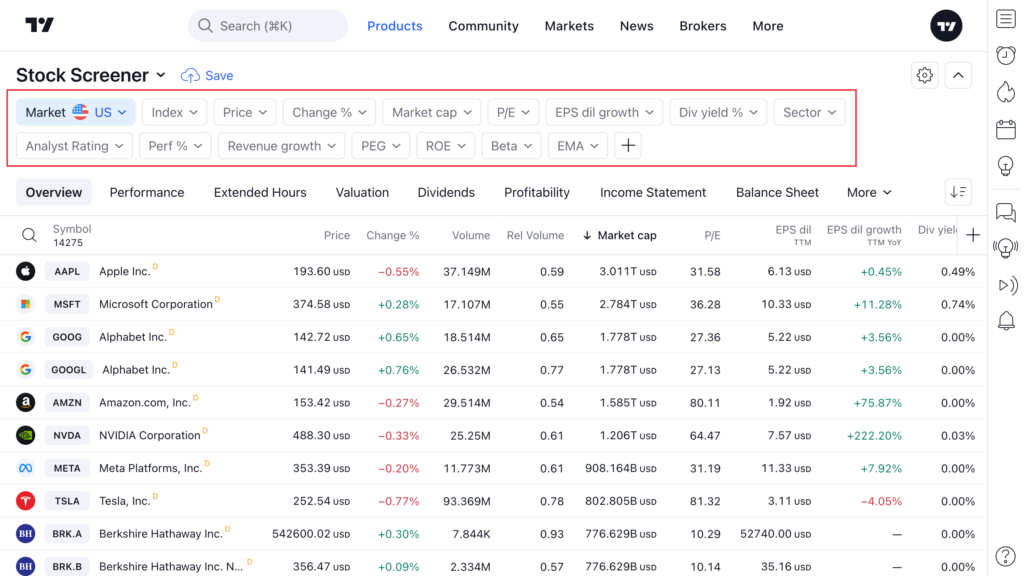

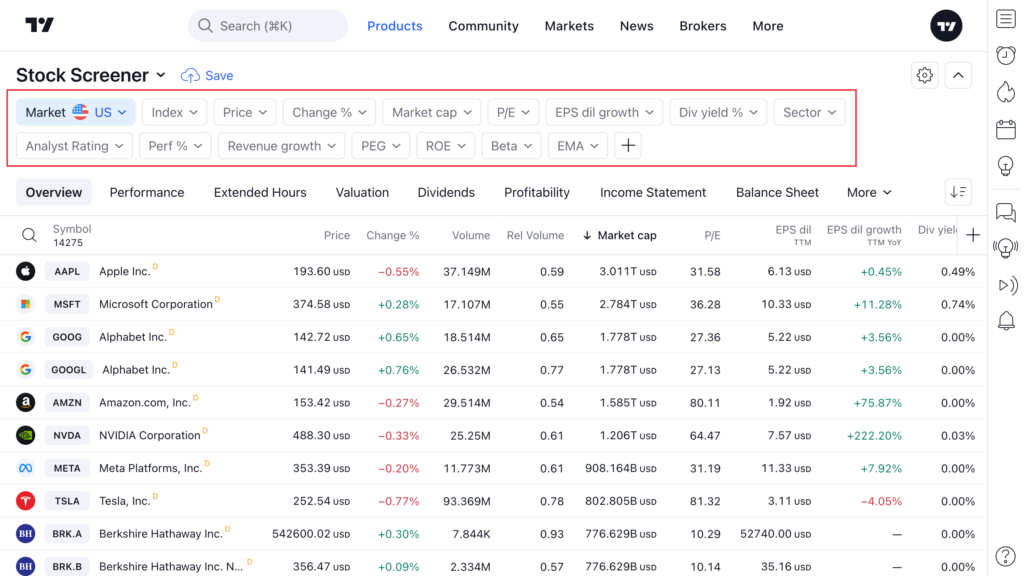

Any screen filters you are using will appear above the table.

TradingView has collected a whole range of financial data, technical indicators and everything you might find useful in your research. If you are not very familiar with a metric, you can read about it in the TradingView knowledge base. just click the question icon next to the filter name.

However, you don’t need to dive into articles for each financial indicator, as there is a new feature: presets and descriptions for filters.

If you need alternative filter values, just go to the Custom section. Here, you will have access to finer settings. Customize indicator lengths, timeframes and conditions.

If you want to find companies that have fallen slightly from their annual highs, but may still be attractive to investors looking to short assets, just set the necessary prices in the Price filter.

Now, after adjusting everything, you can see your search results in the table.

TradingView has also prepared thematic datasets for you — sets of columns that you can find just above the table. With them, for example, you can monitor the financial statements of the assets directly in the audit: just select the Income Statement, Balance Sheet or Cash Flow tabs.

In addition to the default columns, you can add and configure any additional column.